BlueScope to Buy Cargill Stake in North Star

26 October 2015 - 2:40PM

Dow Jones News

SYDNEY—BlueScope Steel Ltd. has agreed to buy Cargill Inc.'s

stake in their U.S. joint venture North Star for US$720 million,

and will keep making steel at its struggling flagship Australian

mill after reaching cost-saving deals with unions and the

government.

In a statement Monday, BlueScope said it had exercised its right

of last refusal under the North Star shareholders' agreement,

matching an offer received by Cargill from a third party. Delta,

Ohio-based North Star produces 2.0 million tons of hot rolled coil

a year and employs 380 people.

In a separate statement, Cargill said that with the deal it will

exit its last remaining steel-production investment. However, the

Minneapolis company will continue to trade, distribute and process

steel products such as iron ore, hot rolled steel coils, and

reinforcing bar steel.

A global glut has sapped steel prices over the past year, while

a surge in cheaper Chinese exports is making life difficult for

Australian, Korean and Japanese producers in particular.

Producers everywhere are being squeezed by oversupply as China's

demand for steel—used in everything from skyscrapers to

bridges—slows. China produces roughly half of the world's

steel.

"We have chosen to sell our interest in the joint venture to

redeploy this capital elsewhere in Cargill's portfolio, and are

confident in the team's continued success under new ownership,"

said Peter Hawthorne, Cargill's vice president of strategy and

business development.

Founded 150 years ago, Cargill is shaking up its portfolio to

keep up with shifting consumer tastes and to strengthen

profitability. In August, it reported its third annual earnings

decline in four years.

Black River Asset Management LLC, a hedge fund unit owned by

Cargill, announced plans in September to spin out of Cargill and

split into three separate firms after closing four funds in recent

months.

In July, Cargill agreed to sell its U.S. pork business to

Brazil-based JBS SA for $1.45 billion.

Cargill said in August it would pay US$1.49 billion to acquire a

Norwegian producer of salmon and trout feed, part of a bet on the

rapidly growing fish-farming industry.

BlueScope also said Monday it had decided to continue producing

steel at its flagship Port Kembla operation, south of Sydney, after

the New South Wales state government committed to defer 60 million

Australian dollars (US$43 million) of payroll tax payments over the

next three years.

Collapsing steel prices had prompted BlueScope to review its

Port Kembla steelworks, which support some 5,000 workers and have

been struggling to compete with the surge in cheap steel in global

markets. Several analysts had predicted the operation would close.

As well as tax breaks, the mill was saved by a deal struck earlier

in October with unions and workers that will result in 500 job

losses and other cost savings.

BlueScope also upgraded its earnings guidance Monday. It now

expects about 40% growth in underlying earnings before interest and

tax in the first half of fiscal 2016 from the second half of fiscal

2015. That is about A$50 million greater than in its previous

outlook due to earlier-than-planned cost savings in the company's

Australian Steel Products division, strong domestic demand, and the

benefits of a weaker Australian dollar.

Write to Rebecca Thurlow at rebecca.thurlow@wsj.com and Jacob

Bunge at jacob.bunge@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 25, 2015 23:25 ET (03:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

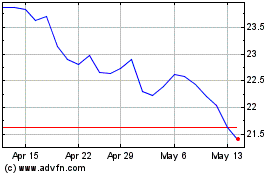

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

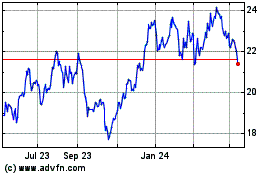

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Apr 2023 to Apr 2024