U.S. Court Dismisses Rio Tinto Lawsuit Against Vale -- Update

21 November 2015 - 7:38AM

Dow Jones News

By Stephen Dockery

A U.S. District Court on Friday dismissed a lawsuit by Rio Tinto

PLC alleging that Vale SA conspired with an Israeli billionaire to

take Rio Tinto's mining concessions in West Africa, with the court

finding the events were outside the statute of limitations.

Rio's lawsuit pitted two of the world's largest mining companies

against each other in a fight over a vein of iron ore in the

Simandou range of Guinea, one of the richest veins ever discovered.

Rio Tinto, an Anglo-Australian company, alleged that Brazilian

mining company Vale worked with Israeli billionaire Benjamin

Steinmetz and his mining company, BSG Resources Ltd., starting in

December 2008 to illegally take Rio Tinto's mining rights in

Guinea.

Judge Richard Berman in the Southern District of New York

decided Rio Tinto's suit came too long after the alleged misconduct

occurred to seek damages. In his decision, he wrote that the "claim

is outside of the four-year civil RICO statute of limitations and

is, therefore, time-barred."

He also decided Rio Tinto had not alleged an lengthy enough

scheme to back up its claims of fraud and conspiracy under the

Racketeer Influenced and Corrupt Organizations Act.

Vale's lawyer, Jonathan Blackman of Cleary Gottlieb Steen &

Hamilton LLP, described the suit as "an effort by a competitor to

take advantage of the corruption scandal in Guinea." In a

statement, Vale said it was "pleased that the U.S. court saw that

Rio Tinto's allegations were baseless."

BSG Resources said the court found "Rio Tinto had failed even to

make coherent accusations of racketeering by BSGR and Mr. Steinmetz

in connection with the Simandou concession."

Rio Tinto wasn't immediately available for comment.

The case was one aspect of the contentious acquisitions of

iron-ore-mining concessions from the government of Guinea under the

last years of President Lansana Conté's rule.

Rio Tinto had held the whole block of iron-ore concessions and

was exploring them before half of those areas were redistributed to

BSG Resources in 2008. BSGR subsequently sold a 51% stake in its

Guinean assets to Vale for $2.5 billion.

An investigation carried out by the Guinean government found BSG

Resources obtained the rights through corruption, and stripped them

from the company while clearing Vale of wrongdoing. BSG Resources

denied there was any impropriety in its acquisition of the assets

and is trying to win compensation.

There is a continuing criminal corruption investigation into the

mining deal by the U.S., The Wall Street Journal reported

previously. People familiar with the matter said senior executives

of BSG Resources are among those being investigated. The company

has said previously there is no evidence linking its employees to

corruption in Guinea.

Write to Stephen Dockery at stephen.dockery@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 20, 2015 15:23 ET (20:23 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

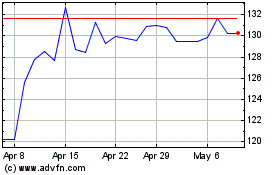

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

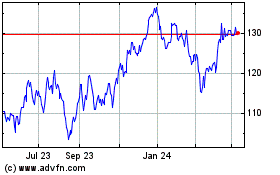

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024