U.S. Dollar Extends Decline Despite Positive U.S. Data

24 November 2015 - 9:05PM

RTTF2

The U.S. dollar extended its early slide against most major

rivals in early New York deals on Tuesday, despite the releases of

positive data on U.S. third quarter GDP and home price index in

September.

Data from the Commerce Department showed that economic activity

in the U.S. increased by more than previously estimated in the

third quarter, primarily reflecting an upward revision to private

inventory investment.

The report said real gross domestic product climbed by 2.1

percent in the third quarter compared to the previously reported

1.5 percent increase. The upward revision matched economist

estimates.

Home prices in major U.S. metropolitan areas rose by more than

expected in the month of September, according to a report released

by Standard & Poor's.

The report said the S&P/Case-Shiller 20-City Composite Home

Price Index increased by a seasonally adjusted 0.6 percent in

September after inching up by 0.1 percent in August. Economists had

expected the index to rise by 0.3 percent.

U.S. stocks opened lower amid geopolitical concerns after

Turkish fighter jets shot down a Russian warplane near the Syrian

border.

The Russian-made SU-24 was reportedly shot down after receiving

repeated warnings about entering Turkish air space, although Russia

claims the jet remained in Syria for the duration of its

flight.

Investors await U.S. consumer confidence index for November, due

at 10:00 am ET.

The greenback showed mixed performance in the European session,

after being lower in Asia. While the greenback declined against the

yen and the euro in European trades, it rose against the pound and

the franc.

In early New York trades, the greenback that ended yesterday's

trading at 1.0180 against the franc slipped to a 4-day low of

1.0157. The next possible support for the greenback is seen around

the 1.00 level.

The greenback fell to a weekly low of 122.36 against the yen,

compared to 122.84 hit late New York Monday. The greenback is

likely to find support around the 121.00 mark.

The latest flash survey from Markit Economics showed that

Japan's manufacturing activity expanded at the fastest pace in

twenty months in November, as output growth quickened.

The Markit/ Nikkei Manufacturing Purchasing Managers' Index, or

PMI, rose to 52.8 in November from 52.4 in October. A score above

50 indicates expansion in the sector.

Extended early fall, the greenback weakened to a 4-day low of

1.0673 against the euro. The pair was worth 1.0636 when it ended

Monday's trading. On the downside, 1.08 is possibly seen as the

next support level for the greenback.

Results of a survey by the Ifo Institute showed that German

business confidence strengthened unexpectedly in November.

The business climate index rose to 109 in November from 108.2 in

October. It was expected to remain unchanged at 108.2.

Reversing from an early high of 0.7185 against the aussie, the

greenback eased back to 0.7229. Further weakness may take the

greenback to a support around the 0.73 region.

On the flip side, the greenback climbed to a new 2-week high of

1.5066 against the Sterling, as the latter declined after the BoE

chief Mark Carney's Parliamentary testimony. The pound-greenback

pair finished Monday's trading at 1.5123. The greenback may locate

resistance around the 1.50 level.

U.K. interest rates are likely to remain low for some time, Bank

of England Governor Mark Carney said at the Treasury Committee

hearing.

"One of the concerns in a low prolonged interest rate

environment, which we clearly are in, and are likely to remain for

some time, even with limited and gradual rate increases - it still

will be a relatively low interest rate environment," Carney

said.

The U.S. Richmond Fed manufacturing index for November and U.S.

consumer confidence index for November are set to be announced

shortly.

At 3:30 pm ET, Bank of Canada Deputy Governor Lynn Patterson

will give a presentation as part of the bank's regional outreach

program at the University of Regina in Canada.

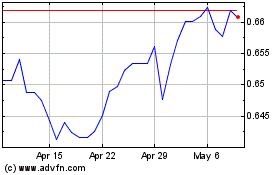

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024