Australian Dollar Falls On Disappointing Capex Data

26 November 2015 - 10:46AM

RTTF2

The Australian dollar weakened against the other major

currencies in the Asian session on Thursday, after the release of

the nation's weaker capital expenditure figures in the third

quarter of 2015.

Data from the Australian Bureau of Statistics showed that the

total value of private capital expenditure in Australia was down a

seasonally adjusted 9.2 percent on quarter in the third quarter of

2015, coming in at A$31.398 billion.

The headline figure was well shy of forecasts for a decline of

2.9 percent following the 4.0 percent contraction in the second

quarter.

On a yearly basis, capex tumbled 20.0 percent.

Wednesday, the Australian dollar rose to 0.35 percent against

the U.S. dollar, 0.22 percent against the yen, 0.10 percent against

the euro and 0.24 percent against the Canadian dollar.

In the Asian trading, the Australian dollar fell to a 6-day low

of 1.0979 against the NZ dollar, from yesterday's closing value of

1.1018. The aussie may test support near the 1.08 region.

The aussie dropped to 2-day lows of 1.4717 against the euro and

88.52 against the yen, from yesterday's closing quotes of 1.4648

and 88.97, respectively. If the aussie extends its downtrend, it is

likely to find support around 1.50 against the euro and 87.00

against the yen.

Against the U.S. and the Canadian dollars, the aussie slipped to

2-day lows of 0.7217 and 0.9600 from yesterday's closing quotes of

0.7250 and 0.9634, respectively. On the downside, 0.70 against the

greenback and 0.94 against the loonie are seen as the next support

levels for the aussie.

Looking ahead, Swiss industrial production for the third

quarter, Eurozone M3 money supply data for October and German Gfk

consumer confidence index for December are due later in the

day.

U.S. banks will be closed in observance of Thanksgiving Day

holiday.

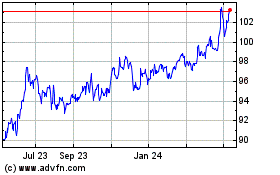

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

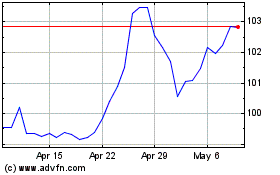

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024