Lower commodity prices pressured Asian resources shares this

week, while a weaker yen helped put Japanese shares on track for

their sixth week of gains.

The Nikkei Stock Average is on track to finish up 0.5% for the

week, and approaching the 20000 on Friday, a level it last closed

above on Aug. 20. It was last down 0.3% at 19891.66.

A weakening Korean won has led to standout weekly returns for

South Korea's Kospi, too, which is on track to post a 2.1% gain. On

Friday, the Kospi rose 0.1%.

Meanwhile, the materials sector pressured Hong Kong's Hang Seng

Index and Australia's S&P/ASX 200, which fell 1.2% and 3.7%,

respectively, this week.

Australian shares are up 0.3% on Friday. The Shanghai Composite

Index fell 0.5% and Hong Kong's Hang Seng Index fell 0.3%.

Rising expectations the Federal Reserve will raise interest

rates at its December meeting has pushed the dollar higher since

mid-October. That has pressured Asian currencies and commodities,

which become more expensive for other currency holders as the

dollar strengthens.

The Wall Street Journal Dollar Index, which gauges the U.S.

currency against a basket of 16 currencies, is hovering around its

highest level in more than a decade.

Asia's weaker currencies have been a boon to some of its stock

markets, particularly for exporters that repatriate profits from

abroad.

In Japan, the gains also reflect excessive optimism about how

aggressive the European Central Bank and Bank of Japan will be in

December, said Ilya Feygin, managing director at WallachBeth

Capital LLC.

The European Central Bank, which meets Dec. 3, has signaled that

it stands ready to expand its bond purchase program to combat weak

inflation. In Japan, investors are hopeful the central bank will

extend stimulus, after minutes show officials are open to further

action if inflation targets slip out of reach.

Meanwhile, "Fed rhetoric has signaled a slow pace of

tightening," even if the central bank raises interest rates, said

Mr. Feygin. "The Asian markets like that."

On Friday, data showed that consumer prices in Japan fell

slightly for the third month in a row in October. The figures

indicated that sustained inflation remains elusive despite the

central bank's efforts to spark price growth. Some economists have

forecast that flatlining inflation may force the bank and some of

its peers to ease again.

The Japanese yen was last at ¥ 122.59 to one U.S. dollar,

roughly flat from late Thursday in Asia. The currency has weakened

significantly since mid-October, when it reached as strong as ¥

118.04 to one U.S. dollar.

Earlier this week, metals including copper and nickel, which are

priced in dollars, dropped to multiyear lows. Miners BHP Billiton

Ltd. and Rio Tinto Ltd. are on track to lose 6.8% and 3.5%,

respectively, this week. On Friday, the stocks rose 1% and

0.9%.

Metals rebounded Thursday after reports that China will start

buying industrial metals to stock up its strategic reserves.

Analysts highlighted several media reports saying that the Chinese

government may buy large quantities of nickel, zinc and aluminum

for its own reserves and to alleviate a domestic oversupply.

Copper prices hit an eight-day high in London on Thursday, while

nickel pulled back from 12-and-a-half-year low to trade back above

$9,000 a ton on the news.

China is the biggest consumer of base metals, accounting for

about 48% of global copper demand, 50% of nickel demand and 54% of

aluminum demand in the first six months of this year, according to

World Bureau of Metal Statistics data.

In China, the Shanghai Composite Index is headed to finish the

week up 0.1%. Its gains come even as authorities in Beijing

escalate their crackdown in the financial sector, following the

summer's stock-market rout.

On Thursday, the country's largest stock broker, Citic

Securities Co., said it would cooperate with China's stock

regulator in an investigation of the firm for suspected violation

of securities rules. Guosen Securities, China's third-largest

broker by assets, is also under investigation for suspected

violations, according to the company's filing to the Shanghai Stock

Exchange.

Shares of Citic in Hong Kong and Guosen in Shenzhen fell more

than 4.5% on Friday. They are down 1.8% and 7.7%, respectively,

this week.

Markets in the U.S. were closed Thursday for the Thanksgiving

holiday.

Brent crude was last up 0.2% at $45.53 a barrel. U.S. oil prices

fell 0.4% on Thursday amid signs of robust U.S. production despite

data showing a lower-than-expected increase in U.S. oil inventories

and a decline in the number of working oil-rigs in the country.

Gold prices were flat at $1,070.80 a troy ounce.

Write to Chao Deng at Chao.Deng@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 26, 2015 22:05 ET (03:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

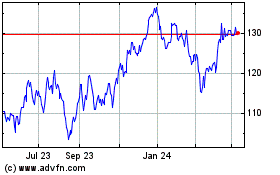

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

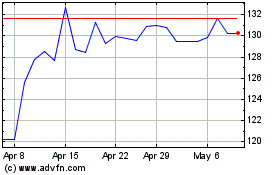

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024