BHP Slips As Brazil Troubles Mount

01 December 2015 - 7:02PM

Dow Jones News

(FROM THE WALL STREET JOURNAL 12/1/15)

By Rhiannon Hoyle and Alex MacDonald

Shares in BHP Billiton Ltd. fell to a more-than-10-year low on

Monday in expectation of the Brazilian government suing the

Anglo-Australian miner, its Brazilian partner Vale SA and their

joint venture over a deadly dam failure in November.

The lawsuit, which was filed on Monday, demands damages of

roughly 20.2 billion Brazilian reais ($5.25 billion) over 10 years,

the Attorney General's office said, for a fund to help recovery

efforts in the Rio Doce, a major river contaminated when a dam

holding mine waste broke on Nov. 5 at an iron-ore operation in

Brazil's Minas Gerais state.

At least 13 people were killed and six remain missing, BHP said.

The dam burst unleashed a torrent of waste that the United Nations

called "toxic," turning the Rio Doce orange in recent weeks and

sending a plume of material into the Atlantic Ocean.

Hundreds of people were displaced and entire villages were

destroyed.

BHP's shares in London fell 1.3% on Monday, after hitting a

seven-year low of 778.9 pence during the session, while its shares

in Sydney closed at a more-than-10-year low of 18.09 Australian

dollars ($13.01), down 3.6% on the day.

This compares with a 0.5% drop in the U.K.'s FTSE 350 mining

index and 0.4% drop in the London shares of Anglo-Australian mining

peer Rio Tinto PLC.

BHP and Vale have said their equally owned joint venture,

Samarco Mineracao SA, was legally responsible for the incident.

BHP said it was committed "to supporting Samarco to rebuild the

community and restore the environment affected by the breach of the

dams." Samarco operates the mine.

On Friday, Vale and BHP said they would establish a voluntary

fund for efforts to rehabilitate the Rio Doce river system,

although the mining giants didn't say how much money would be

available.

The dam incident has put new financial pressure on BHP at a time

when it was already challenged by falling prices for the

commodities it sells, especially iron ore.

That steelmaking ingredient hit a more-than-decade low of $42.80

a metric ton on Monday, down 78% from its 2011 peak of $191.90 a

ton, according to data provider The Steel Index.

The travails are also weighing on Vale and its executive team.

The mining giant's CEO, Murilo Ferreira, has stepped down from his

chairman position at Brazil's state-run oil company, Petroleo

Brasileiro SA, as he deals with the implications of the dam

break.

Mr. Ferreira had already been on temporary leave from Petrobras

since Sept. 14, though he had only been at the company since an

April shake-up.

The dam incident and falling commodity prices have prompted BHP

Billiton's shareholders to query whether the company can sustain

its dividend payout, among the highest in the industry.

BHP Chairman Jacques Nasser told investors last week that the

miner won't change its dividend policy until February at the

earliest, despite shareholder concerns.

Analysts at Investec Securities and J.P. Morgan Cazenove have

since issued notes recommending that BHP cut its dividend.

"Given the risk of ongoing commodity price volatility, we

believe it would be prudent for the company to rebase its

[progressive] dividend," Investec Securities said in a note.

Meanwhile in Brazil, BHP said Samarco is working with government

authorities to relocate displaced people to rented housing from

temporary accommodation, which it expects to happen by

February.

Samarco and local authorities are also continuing to assess

water quality in the Rio Doce, it said, adding that the plume of

so-called tailings had reached the Atlantic Ocean and was

dispersing.

Last week, a U.N. report said "high levels of toxic heavy metals

and other toxic chemicals" had been detected in the river

system.

Vale later confirmed materials such as arsenic were found in the

water.

In its news release Sunday evening, BHP said the material

released into the Rio Doce was "not hazardous to human health,

based on the hazard classification of the material under Brazilian

standards."

The company called the materials "nonreactive" and

"geochemically stable."

The company said a large number of fish had suffocated in the

river "as a result of the high volume of sand and clay tailings

material that moved through the river system."

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 02:47 ET (07:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

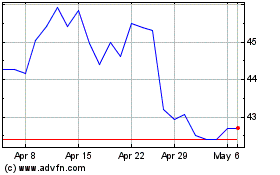

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

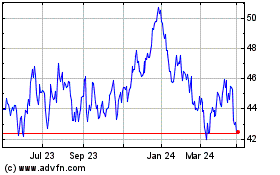

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024