Australia Shares Climb to Two-Month High

30 December 2015 - 5:06PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--An end-of-year rally by Australian shares

continued for a ninth straight session Wednesday, lifting the

market to a two-month high as investor confidence was buoyed by a

recovery in oil prices.

The market opened strongly in the wake of overnight strength on

Wall Street on Tuesday, as investors there bought some of the

year's biggest decliners, and as crude-oil and natural-gas prices

rallied.

In the last full trading day of the year, the S&P/ASX 200

finished 52.6 points, or 1%, higher at 5319.9. The index has now

climbed 6.9% from a year-low that it hit mid-December, narrowing

the drop in 2015 to 1.7%, after gains the previous three years.

"The stock market continues to push higher on thin volume and

with no need for a macro catalyst," said Ric Spooner, chief market

strategist at CMC Markets. "At the moment, the market is all about

sentiment and perceived value."

Still, he cautioned the value that investors were hunting in the

market was becoming less obvious after recent gains.

The basket of energy shares helped drive the day's push higher,

rising 1.4%, supported by gains in the heavily-weighted financial

sector. The mining-heavy materials subindex lagged, edging up 0.2%

amid broad gains.

Still, the energy sector remains down 30% this year, while the

materials segment is 19% lower.

For the day, Woodside Petroleum rose 1.4%, Oil Search added 1.8%

and Origin Energy advanced 1.7%. Smaller Beach Energy and

Drillsearch Energy were up 5.2% and 5.9%, respectively.

The four largest banks, sought for their relatively strong

dividend yield, were all more than 1% higher, led by a 1.9% rise in

Westpac.

Among mining stocks, BHP Billiton slipped 0.1% to find itself

down 32% in 2015. Rio Tinto was little changed Wednesday but is

down 23% this year, while South32 shed 0.5% and gold producer

Newcrest Mining fell 1.5% for the day.

Angus Nicholson, a market analyst at IG, said that while some in

the market were looking for the ASX 200 to end the year above 5411,

the level where it began 2015, that appeared to be a stretch.

"However, a close above 5350 would be very respectable and see the

index end the year at its highest level since Aug. 19, hopefully

putting the sub-5000 performances well behind it," Mr. Nicholson

said.

The ASX 200 will close early ahead of the New Year's public

holiday Friday.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 30, 2015 00:51 ET (05:51 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

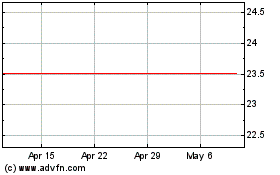

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

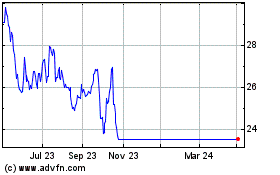

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Apr 2023 to Apr 2024