U.S. Dollar Declines Amid Worries Over Fed Rate Hike Outlook

04 February 2016 - 5:27PM

RTTF2

The U.S. dollar fell against its major opponents in early

European trading on Thursday, amid expectations that the Federal

Reverse might raise interest rates at a slower pace this year, in

the light of slowing growth in the U.S., as well as deteriorating

prospectus over global growth outlook.

In an interview with MNI on Wednesday, Federal Reserve Bank of

New York President William Dudley warned that the deteriorating

outlook about the global growth and additional dollar strength

could have "significant consequences" for the health of the world's

largest economy.

Dudley stated that the Fed would consider persistent tightening

of financial conditions very seriously while pursuing its planned

interest rate hikes.

Weak service sector data released yesterday added to worries

about U.S. economic growth, with expectations for a rate hike in

March almost nil.

Data from the Institute for Supply Management showed that its

non-manufacturing index dropped to 53.5 in January from an upwardly

revised 55.8 in December. Economists had expected the index to inch

up to 55.5.

Investors await jobless claims and factory orders figures, due

later in the day, for fresh clues on the outlook for Fed

policy.

Attention also shift towards Friday's jobs data, which is

forecast to show that nonfarm payrolls may have risen 190,000 in

January, down from December's robust gain of 292,000.

The greenback showed mixed performance in Asian trading. While

the greenback held steady against the franc and the yen, it rose

slightly against the euro and the pound.

In European trading now, the greenback dropped to 1.1184 against

the euro for the first time since October 22, 2015. This marks

almost a 1 percent decline from a high of 1.1070 hit at 2:00 am ET.

Continuation of the greenback's downtrend may take it to a support

around the 1.13 zone.

The European Central Bank President Mario Draghi said that

adopting a wait-and-watch attitude and acting too late on prolonged

low inflation is riskier than taking early measures as the former

approach could erode confidence.

In a lecture delivered at the Bundesbank, Draghi said, "Adopting

a wait-and-see attitude and extending the policy horizon brings

with it risks: namely a lasting de-anchoring of expectations

leading to persistently weaker inflation."

Extending early slide, the greenback weakened to 1.3666 against

the loonie, its lowest since December 11, 2015. The greenback is

poised to test support around the 1.36 region.

The greenback fell to more than 4-week lows of 0.6721 against

the kiwi and 1.4665 against the pound, from its early highs of

1.6641 and 1.4563, respectively. On the downside, the greenback may

challenge support around 0.68 against the kiwi and 1.48 against the

pound.

The greenback edged down to 117.34 against the yen and 1.0008

against the franc, pulling away from its prior highs of 118.24 and

1.0074, respectively. The greenback is seen finding support around

116.00 against the yen and 0.99 against the franc.

Looking ahead, the Bank of England is due to announce its

interest rate decision, inflation report and the minutes of the

meeting at 7:00 am ET. Economists expect the bank to retain

interest rates unchanged at 0.50 percent and asset purchase target

at GBP 375 billion.

At 7:45 am ET, Bank of England Governor Mark Carney, along with

the other MPC members, will hold a press conference on the

Inflation Report in London.

Federal Reserve Bank of Dallas President Robert Kaplan is due to

participate in a discussion of Global Economic Conditions at an

event hosted by the Real Estate Council in Dallas at 8:30 am

ET.

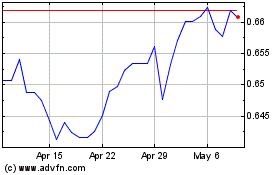

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024