Gap Offers Upbeat Guidance For Full Year -- Update

09 February 2016 - 10:34AM

Dow Jones News

By Josh Beckerman

Gap Inc. gave rosy guidance for the fiscal year ended Jan. 30

even though sales declined overall in the fourth quarter and

comparable-store sales at the retailer's three major brands dropped

in January.

Shares, up 4.7% in the past month, rose 3.1% to $24.74 in

after-hours trading.

Gap said it projects full-year earnings per share, excluding

items, to come in at $2.41 to $2.42. That is at the high end of

earlier guidance.

The San Francisco company said overall sales for the fourth

quarter totaled $4.39 billion, down 7% from $4.71 billion in the

year-earlier period. Analysts polled by Thomson Reuters had

forecast sales of $4.46 billion. Gap said the decline was 5% when

the impacts of currency fluctuations were stripped out.

Retailers have faced challenges recently including unusually

warm weather that has damped demand for coats, sweaters and other

winter gear. In addition, tourists visiting the U.S. are spending

less due to a stronger dollar. These issues have prompted some

retailers to cut prices to attract shoppers.

Gap has been struggling to revamp its namesake brand. The

company brought on new leadership, including former Banana Republic

veteran Wendi Goldman, who had led the Pink line at Victoria's

Secret. It has also been working through cost-cutting measures.

In January, comparable-store sales declined 6% at Gap, 17% at

Banana Republic and 6% at Old Navy. According to Gap's recorded

sales call, Old Navy sales were hurt by the shift of three "Super

Cash" redemption days to February this year from January of last

year.

Sales at Gap's three main brands also declined in December.

Gap is slated to release full fourth-quarter results Feb.

25.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

February 08, 2016 18:19 ET (23:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

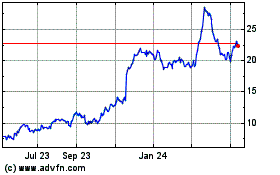

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

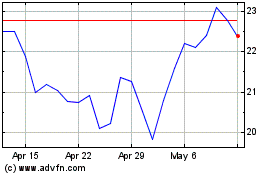

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024