Morgan Stanley Hit Hardest in Bank Selloff

09 February 2016 - 11:53AM

Dow Jones News

By Ben Eisen and Justin Baer

Morgan Stanley got hit hard Monday.

On a day when the six largest U.S. banks all dropped more than

the broader market, Morgan Stanley's shares took the worst beating.

The lender was down 6.9% as the S&P 500 dropped 1.4%. Since the

start of the year, Morgan Stanley shares are down 29%.

Here are a few factors that may have contributed to the

selloff:

-- Low returns. The Wall Street firm, which remains short of its goal of

producing a return on equity of at least 10%, is overhauling a

fixed-income trading business whose choppy results have frustrated

executives and investors alike. Morgan Stanley has installed new managers

and slashed its workforce.

On Tuesday, its head of trading will deliver what shareholders

hope will be a clear roadmap to higher returns at Credit Suisse

Group AG's financials conference.

Monday's sell-off, however, may mean those hopes have faded.

-- Globe trotting troubles. Monday's drop came as Deutsche Bank AG shares

fell 9.5% and other European banks declined sharply.

Morgan Stanley has long been considered by many as having more

international exposure than most of its U.S.-based peers, so shares

are affected by market action abroad. Its shares tended to react

sharply to both positive and negative news about the European debt

crisis in 2011 and 2012.

Though the perception that Morgan Stanley has disproportionate

overseas exposure isn't necessarily accurate, the market sentiment

has been, "the more international the name, the more the downside,"

said Jeffery Harte, an analyst at Sandler O'Neill + Partners.

Citigroup Inc., also seen as having a large exposure to global

markets, was down 5.1% Monday.

-- Small enough to stumble. The bank's market value of $44 billion makes it

the smallest of the six major banks. So it could be seen as having the

least resiliency to global economic turbulence, including concerns over

economic growth, interest rates and loan losses tied to an energy

industry pummeled by falling commodity prices.

Still, there is no perception that Morgan Stanley faces any

existential threat. "It's big enough not to have survivorship kind

of fears" Mr. Harte said.

-- The higher they fly, the harder they fall. Morgan SHItanley's stock had

a big run-up through the middle of last year as the bank was expected to

benefit from refocusing the business on its retail brokerage. Shares

climbed 58% during the two years through June, compared with 25% during

the same period for the KBW Nasdaq Bank Index. When bank stocks sold off,

Morgan Stanley's shares were hit more, sliding 42% since the beginning of

July, compared with the benchmark's 24%.

The financial sector sell-off has also hit bond investors. The

premium over U.S. Treasurys that investors demanded to be paid on

10-year Morgan Stanley bonds rose 0.15 percentage points on Monday

to 2.02 percentage points, according to MarketAxess.

Since the beginning of the year, the annual cost of insuring

debt for the six biggest U.S. banks using five-year credit default

swaps rose by about a third on average to 1%, according to Anthony

Valeri, investment strategist at LPL Financial. Even still, this is

far below levels seen in 2008 or 2012.

"It's built into a little bit of a frenzy here. It has knocked

down stock prices, but also more on the credit side," said Lon

Erickson, who manages $5.3 billion at Thornburg Investment

Management. "In general banks and financials have always been a

little bit more of a black box situation when you're trying to

analyze."

(END) Dow Jones Newswires

February 08, 2016 19:38 ET (00:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

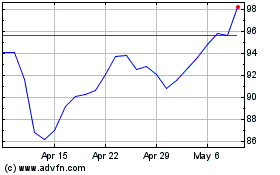

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

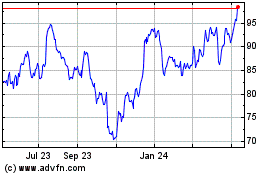

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024