Sanofi Profit Hit By Falling Diabetes Revenue -- Update

09 February 2016 - 8:10PM

Dow Jones News

By Noemie Bisserbe

PARIS--French drugmaker Sanofi SA reported sharply lower

fourth-quarter earnings on Tuesday as it continues to face growing

pricing pressure in the U.S. diabetes market, and said profit won't

show much change this year.

Business net income, the company's term for adjusted income

excluding the impact of acquisitions and divestments, declined 6.5%

to EUR1.71 billion ($1.92 billion) from EUR1.83 billion a year ago.

Sanofi's total sales rose 2.3% to EUR9.28 billion.

Sanofi said it expected its business earnings per share to

remain "broadly stable" in 2016 at constant exchange rates "barring

unforeseen major adverse events."

Sanofi's earnings for the quarter highlight the continuing

deterioration of the drugmaker's diabetes business in the U.S.,

where it is forced to offer larger discounts to the government,

insurers and health-care providers to push its products to the

market.

Diabetes drug sales, which account for about 20% of the

company's revenue, fell 13% to EUR1.9 billion in the fourth

quarter, hurt by lower sales of its insulin drug Lantus, which lost

patent protection in the U.S. last year. However, Genzyme, Sanofi's

biotech unit, posted a 28% increase in revenue to EUR1.01 billion,

boosted by sales of multiple sclerosis treatment Aubagio. Sales of

consumer health-care products rose 1% to EUR809 million, while

vaccines sales increased 15% to EUR1.44 billion.

Chief Executive Olivier Brandicourt, who took over in April

after the abrupt dismissal of Christopher Viehbacher, has pledged

to revive profit growth by focusing on fewer markets where it has,

or can build, a competitive position--and by slashing costs.

Sanofi said earlier in February that it planned to cut about 600

jobs in France over the next three years as part of its

restructuring plans. On Tuesday, Mr. Brandicourt said he would

detail global job cuts this summer.

The company continues to look for acquisitions as it positions

itself for stronger growth.

"We want to be vigilant, agile on M&A opportunities," Mr.

Brandicourt told reporters in a conference call. "We should be able

to act swiftly if an attractive opportunity arises," he added.

In December, the company said it had entered exclusive

negotiations with Boehringer Ingelheim GmbH on a possible exchange

of its animal-health business for most of the German group's

consumer-health-care unit.

Boehringer would pay Sanofi EUR4.7 billion as part of the deal.

Sanofi's animal-health business has an enterprise value of EUR11.4

billion and Boehringer's consumer-health-care business has an

enterprise value of EUR6.7 billion. The deal would make Sanofi the

global revenue leader in over-the-counter medicines, just ahead of

Bayer AG and GlaxoSmithKline PLC, and would make closely held

Boehringer No. 2 in animal health after Zoetis Inc.

Last year, the company said it was also considering selling its

European generics business as part of its new strategic plan. Mr.

Brandicourt said Tuesday that the company was "still exploring its

options."

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

February 09, 2016 03:55 ET (08:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

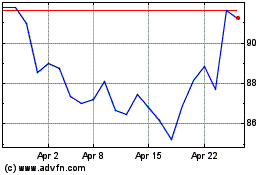

Sanofi (EU:SAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sanofi (EU:SAN)

Historical Stock Chart

From Apr 2023 to Apr 2024