Anadarko Slashes Dividend by 81%

10 February 2016 - 9:20AM

Dow Jones News

Anadarko Petroleum Corp., hit hard by sharply lower energy

prices, slashed its quarterly dividend by 81% to five cents a

share.

The move will save the company about $450 million a year,

Anadarko Chief Executive Al Walker said.

The company's stock, down more than half over the past 12

months, fell nearly 6% Tuesday to $37.65.

While executives at some major oil companies such as Exxon Mobil

Corp., Royal Dutch Shell PLC and BP PLC have defended their

payouts, vowing to take on new debt, others are cutting

dividends.

Last week, ConocoPhillips chopped its dividend from 74 cents to

25 cents, saying the 66% reduction was necessary to protect the

company's financial health as oil prices hovered near 12-year lows.

The Houston company booked $2.7 billion in charges in the fourth

quarter that pushed it to a $3.45 billion loss.

In December, Kinder Morgan Inc. slashed its dividend by 75% to

12.5 cents a share, an unprecedented move for a company that had

held dividends as sacrosanct.

Anadarko, one of the largest independent oil and gas producers

in the U.S., reported a wider fourth-quarter loss as revenue

dropped 35%.

And last week, Standard & Poor's Ratings Services changed

its outlook on Anadarko's ratings to negative, indicating a

possible downgrade.

Anadarko's first reduced dividend will be made on March 23 to

stockholders of record at the close of business on March 9.

The Woodlands, Texas, company had raised its dividend to 27

cents, the level in place before Tuesday's announcement comes into

effect, in 2014, just before oil prices began their downward

spiral.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 09, 2016 17:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

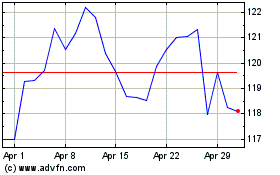

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

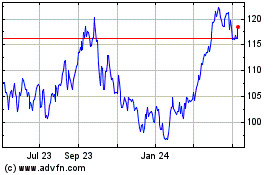

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024