By Sara Sjolin, MarketWatch

Deutsche Bank rallies more than 10%

European stock markets rebounded from a two-year low on

Wednesday, as investors picked up stocks beaten down in a

seven-session selloff.

The Stoxx Europe 600 index jumped 2.2% to 316.25, after closing

at the lowest level since Oct. 2013 on Tuesday. That capped a

losing streak fueled by concerns about oil prices and slowing

global growth.

"Major European markets are trying to rally once again, but with

previous rebounds having lacked conviction, falling sharply after

early gains, sentiment remains fragile," said Rebecca O'Keeffe,

head of investment at stockbroker Interactive Investor, in a

note.

"Any early movement in markets is, however, just a precursor to

this afternoon's main event, billed as possibly the most important

debate of the year so far, as [Federal Reserve Chairwoman] Janet

Yellen makes her first official public statement since raising

rates in December," she added.

Germany's DAX 30 index climbed 2.3% to 9,081.33, while France's

CAC 40 index gained 2.1% to 4,081.37. The U.K.'s FTSE 100 index

rose 1% to 5,691.60

(http://www.marketwatch.com/story/uk-stocks-wobble-after-sinking-to-three-year-low-2016-02-10).

Later in the day, attention turns to U.S. Federal Reserve

Chairwoman Janet Yellen as she testifies before the House Financial

Services Committee at 10 a.m. Eastern Time, or 3 p.m. London time.

Read: Five questions Janet Yellen must answer

(http://www.marketwatch.com/story/five-questions-janet-yellen-must-answer-2016-02-09)

Banking relief: Banks, which were sold off heavily in previous

sessions, led the charge higher in Wednesday's trade, with the

Stoxx Europe 600 Banks Index rallying 5.4%.

Shares of Deutsche Bank AG (DBK.XE) (DBK.XE) jumped 13% on news

the German bank is considering buying back

(http://www.marketwatch.com/story/deutsche-bank-shares-rally-on-debt-buyback-report-2016-02-10)

billions of euros of its own bonds.

Among other banking shares, Eurobank Ergasias SA (EUROB.AT)

climbed 7.9%, UniCredit SpA (UCG.MI) rose 11%, Commerzbank AG

(CBK.XE) added 8.8%, and UBS Group AG (UBS) gained 6.7%.

Oil rebound: Prices for both crude oil and Brent rose more than

1.5%

(http://www.marketwatch.com/story/oil-hovers-above-28-a-barrel-as-market-braces-for-more-supply-data-2016-02-10).

On Tuesday, they posted sharp losses on the back of a warning the

supply glut could get even worse

(http://www.marketwatch.com/story/iea-warns-oil-surplus-will-be-worse-than-expected-2016-02-09).

Read: Cheap oil may trigger a new era of OPEC dominance, warns

IEA

(http://www.marketwatch.com/story/cheap-oil-for-longer-may-trigger-a-new-era-of-opec-dominance-warns-iea-2016-02-09)

However, the rebound in oil prices wasn't enough to turn the

sentiment on energy-related stocks, leaving most of them trading in

negative territory. Shares of Tullow Oil PLC (TLW.LN) dropped 9.3%

after a financial update

(http://www.marketwatch.com/story/tullow-loss-narrows-for-2015-on-lower-write-offs-2016-02-10),

while Seadrill Ltd. (SDRL.OS) (SDRL.OS) fell 4.6% and Technip SA

(TEC.FR) lost 1.3%.

Other movers: Shares of A.P. Moeller-Maersk AS (MAERSK-B.KO)

slumped 4.1% after the world's largest container operator swung to

a loss in the fourth quarter

(http://www.marketwatch.com/story/moller-maersk-earnings-hit-by-oil-freight-slumps-2016-02-10).

Hikma Pharmaceuticals PLC (HIK.LN) sank 12% after the company

said it has lowered the bid price

(http://www.marketwatch.com/story/hikma-revises-terms-for-roxane-bid-lowers-price-2016-02-10)

for its previously announced acquisition of Roxane Laboratories

Inc. and Boehringer Ingelheim Roxane Inc. after getting new

information on Roxane's financial performance in 2015.

Smurfit Kappa Group PLC (SK3.DB) surged 15% after the packaging

company released fourth-quarter results

(http://www.marketwatch.com/story/smurfit-kappa-2015-profit-rises-cfo-to-step-down-2016-02-10).

Economic data: French industrial production fell 1.6%

(http://www.marketwatch.com/story/frances-industrial-production-falls-16-on-month-2016-02-10)

in December compared with the previous month, missing expectations

for a 0.2% increase. In Germany, business sentiment has reached a

record high

(http://www.marketwatch.com/story/german-businesses-more-optimistic-than-ever-dihk-2016-02-10),

according to a German Chambers of Commerce survey published

Wednesday.

U.K. industrial production for December missed estimates,

falling 1.1%

(http://www.marketwatch.com/story/uk-industrial-production-surprises-with-11-dip-2016-02-10)

on the month.

You're invited to Investing Insights: A global markets survival

guide

If you'll be in London on Tuesday, Feb. 23, you're invited to

join us for an evening of cocktails and conversation on the topics

of shifting monetary policy, growth, currencies, and the outlook

for investing opportunities and risks in European and global

markets.

Our panelists for the evening will include MarketWatch Personal

Finance and Investing Columnist Robert Powell; and Mark Hulbert,

Editor of the Hulbert Financial Digest.

The event is free and open to the public, but reservations are

required. For more information or to RSVP for the event, please

email (MarketWatchevent@wsj.com)

(END) Dow Jones Newswires

February 10, 2016 07:24 ET (12:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

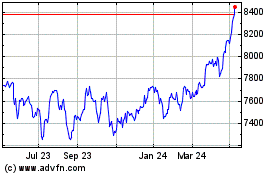

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

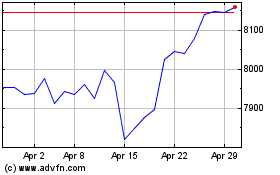

FTSE 100

Index Chart

From Apr 2023 to Apr 2024