UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2016

ACCO BRANDS CORPORATION

(Exact name of registrant as specified in its charter)

____________________________

|

| | |

Delaware | 001-08454 | 36-2704017 |

(State or other jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

Four Corporate Drive Lake Zurich, IL 60047 | | 60047 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (847) 541-9500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8‑K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] | Soliciting material pursuant to Rule 14a‑12 under the Exchange Act (17 CFR 240.14a‑12) |

| |

[ ] | Pre-commencement communications pursuant to Rule 14d‑2(b) under the Exchange Act (17 CFR 240.14d‑2(b)) |

| |

[ ] | Pre-commencement communications pursuant to Rule 13e‑4(c) under the Exchange Act (17 CFR 240.13e‑4(c)) |

Section 2 - Financial Information

Item 2.02 - Results of Operations and Financial Condition.

On February 10, 2016, ACCO Brands Corporation (the "Company") announced its results for the period ended December 31, 2015. Attached as Exhibit 99.1 is a copy of the press release relating to the Company's results, which is incorporated herein by reference.

The information included in this Current Report on Form 8-K under this Item 2.02 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report included under this Item 2.02 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 - Financial Statements and Exhibits.

| |

99.1 | Press Release of the Company, dated February 10, 2016. |

Certain statements made in this Current Report on Form 8-K are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of invoking these safe harbor provisions. These forward-looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words "will," "believe," "expect," "intend," "anticipate," "estimate," "forecast," "project," 'plan," or similar expressions. In particular, our business outlook is based on certain assumptions, which we believe to be reasonable under the circumstances. These include, without limitation, assumptions regarding changes in the macro environment, fluctuations in foreign currency rates, changes in the competitive landscape and consumer behavior and the effect of consolidation in the office products industry, as well as other factors described below.

Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Because actual results may differ from those predicted by such forward-looking statements, you should not place undue reliance on them when deciding whether to buy, sell or hold the Company’s securities. Our forward-looking statements are made as of the date hereof and we undertake no obligation to update these forward-looking statements in the future.

Among the factors that could affect our results or cause our plans, actions and results to differ materially from current expectations are: the concentration of our business with a relatively limited number of large and sophisticated customers; the consolidation of our customers, including the merger of Office Depot and OfficeMax in late 2013 and the proposed acquisition of Office Depot by Staples; shifts in the channels of distribution of our products; challenges related to the highly competitive business segments in which we operate, including, low barriers to entry, customers who have the ability to source their own private label products, limited retail space, competitors’ strong brands, competition from imports from a range of countries, including countries with lower production costs and from a wide range of products and services, including electronic, digital and web-based products that can render obsolete or less desirable some of our products; our ability to develop innovative products and expand our business into adjacent categories; our ability to meet the competitive challenges faced by our Computer Products business which is characterized by rapid technological change, short product life cycles and a dependency on the introduction by third party manufacturers of new equipment to drive demand for the accessories it sells; commercial and consumer spending decisions during periods of economic uncertainty or weakness; a failure of our information technology systems or supporting infrastructure or an information security breach; our ability to successfully expand our business in emerging markets which generally involve more financial, operational, legal and compliance risks and create exposure to unstable political conditions, civil unrest and economic volatility; our ability to grow profitably through acquisitions; our failure to comply with customer contracts; the impact of regulatory requirements, litigation, regulatory actions or other legal claims or proceedings; the risks associated with outsourcing production of certain of our products and information systems; the decline in the use of certain of our products, especially paper-based dated time management and productivity tools; risks associated with our substantial indebtedness, including our significant debt service obligations, limitations imposed by restrictive covenants and our ability to comply with financial ratios and tests; risks associated with seasonality, and foreign currency, interest rate and raw material and labor cost fluctuations; the impact of pension costs; any impairment of our goodwill or other intangible assets; the insolvency, bankruptcy or financial instability of our customers and suppliers; our ability to secure, protect and maintain our intellectual property rights; our ability to attract and retain key employees; the volatility of our stock price; material disruptions at one of our or our suppliers' major manufacturing or distribution facilities resulting from circumstances outside our control; and other risks and uncertainties described in "Part I, Item 1A. Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2014, in "Part II, Item 1A. Risk Factors" in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015 and in other reports we file with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | ACCO Brands Corporation (Registrant) |

Date: | February 10, 2016 | By: | /s/ Neal V. Fenwick |

| | | Name: Neal V. Fenwick |

| | | Title: Executive Vice President |

| | | and Chief Financial Officer |

INDEX TO EXHIBITS

Exhibit

Number Description of Exhibit

| |

99.1 | Press release, dated February 10, 2016. |

News Release

News Release

FOR IMMEDIATE RELEASE

ACCO BRANDS CORPORATION REPORTS

FOURTH QUARTER 2015 RESULTS

LAKE ZURICH, ILLINOIS, February 10, 2016 - ACCO Brands Corporation (NYSE: ACCO), a world leader in branded school, office and consumer products, today reported its fourth quarter results for the period ended December 31, 2015.

"I'm pleased with our overall operational performance in the fourth quarter, and especially pleased that we grew sales in the U.S.," said Boris Elisman, president and chief executive officer, ACCO Brands. "For the year, we grew market share in the mass and e-tail channels, increased our operating margins, grew underlying EPS before currency, generated $147 million in free cash flow, continued our share repurchase program and further reduced our leverage. For 2016, we are well positioned to again generate strong free cash flow supported by sustained market share gains and productivity improvements despite ongoing foreign currency headwinds."

Fourth Quarter Results

Net sales decreased 10% to $412.1 million from $459.9 million in the prior-year quarter. On a constant currency basis, sales decreased 2%, driven primarily by the International segment. Operating income decreased to $56.9 million from $68.5 million in the prior year, primarily due to a $6.1 million impact from foreign currency translation. Net income was $31.4 million, or $0.29 per share, compared to net income of $43.9 million, or $0.38 per share, in the prior-year quarter. Adjusted net income was $32.5 million, or $0.30 per share, compared to $41.5 million, or $0.36 per share, in the prior-year quarter. Cost savings and productivity improvements were offset by the negative impact of foreign currency translation of $0.04 per share, and lower sales. During the quarter the company reduced its fully diluted shares by 1.6 million.

Business Segment Highlights

ACCO Brands North America - Sales decreased 2% to $248.2 million from $253.5 million in the prior-year quarter. On a constant currency basis, sales decreased only slightly as a modest increase in the U.S. was more than offset by a decline in Canada. Operating income increased to $43.5 million from $42.7 million in the prior-year quarter. Adjusted operating income decreased to $43.4 million from $46.0 million in the prior-year quarter, due to lower sales, and foreign currency translation, which reduced operating income by $0.4 million.

ACCO Brands International - Sales decreased 23% to $131.3 million from $170.6 million in the prior-year quarter. On a constant currency basis, sales decreased 5% due to lower sales volume,

most significantly in Brazil, which was partially offset by price increases. Operating income decreased to $20.0 million from $31.0 million in the prior-year quarter primarily due to foreign currency translation, which reduced operating income by $5.1 million, as well as lower sales.

Computer Products - Sales decreased 9% to $32.6 million from $35.8 million in the prior-year quarter. On a constant currency basis, sales declined 1% due to lower sales of tablet accessory products. Operating income increased to $3.4 million from $3.2 million in the prior-year quarter. Adjusted operating income increased to $3.4 million from $3.1 million driven by favorable product mix. Foreign currency translation reduced adjusted operating income by $0.6 million.

Twelve Month Results

Net sales decreased 11% to $1.51 billion compared to $1.69 billion in the prior-year period. On a constant currency basis, sales decreased 3% due to declines with one consolidating customer and lower sales, primarily in Brazil. Operating income decreased 6% to $163.5 million but operating margins increased to 10.8% from 10.3% due to productivity improvements, price increases and lower selling, general and administrative expenses. Net income was $85.9 million, or $0.78 per share, compared to net income of $91.6 million, or $0.79 per share, in the prior-year period. Adjusted net income decreased 7% to $86.4 million, or $0.78 per share, from $93.1 million, or $0.80 per share, in the prior-year period. The negative effects of foreign currency translation of $0.12 per share were only partially offset by productivity improvements, price increases and lower selling, general and administrative expenses. During the twelve-month period the company reduced its fully diluted shares by 8.4 million, or 7% of total diluted shares, a benefit of $0.04 per share.

Business Outlook

The company expects 2016 sales to decline in the mid-to-high single digits, inclusive of a negative 4% impact from foreign currency translation. The company expects 2016 adjusted earnings per share of $0.73-$0.77, inclusive of a $0.03 negative impact from foreign currency translation. The company expects full-year free cash flow of approximately $135 million.

Webcast

At 8:30 a.m. Eastern Time today, ACCO Brands Corporation will host a conference call to discuss the company's results. The call will be broadcast live via webcast. The webcast can be accessed through the Investor Relations section of www.accobrands.com. The webcast will be in listen-only mode and will be available for replay for one month following the event.

Non-GAAP Financial Measures

To supplement our consolidated financial statements presented on a GAAP basis in this earnings release, we provide investors with certain non-GAAP financial measures, including "adjusted" financial measures, earnings before interest, taxes and depreciation ("EBITDA"), free cash flow and net sales at constant currency. See our Reconciliation of GAAP to Adjusted Non-GAAP Information (Unaudited), Reconciliation of Net Income to Adjusted EBITDA (Unaudited), Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow (Unaudited), Supplemental Business Segment Information and Reconciliation (Unaudited) and our Supplemental Net Sales Change Analysis (Unaudited), for a description of each of these non-GAAP financial measures and a reconciliation to the most directly comparable GAAP financial measure for each of the periods

presented herein. We believe these non-GAAP financial measures are appropriate to enhance an overall understanding of our past financial performance and also our prospects for the future, as well as to facilitate comparisons with our historical operating results. Adjustments to our GAAP results are made with the intent of providing both management and investors a more complete understanding of our underlying operational results and trends. For example, the non-GAAP results are an indication of our baseline performance before gains, losses or other charges that are considered by management to be outside our core operating results. In addition, these non-GAAP financial measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods and senior management’s incentive compensation is derived, in part, using certain of these non-GAAP financial measures.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The non-GAAP financial measures are limited in value because they exclude certain items that may have a material impact upon our reported financial results such as unusual income tax items, restructuring and integration charges, goodwill or other impairment charges, foreign currency fluctuation, and other one-time or non-recurring items. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the directly comparable financial measures prepared in accordance with generally accepted accounting principles in the United States. Investors should review the reconciliation of the non-GAAP financial measures to their most directly comparable GAAP financial measures as provided in the tables accompanying this press release.

About ACCO Brands Corporation

ACCO Brands Corporation is one of the world's largest suppliers of branded school, office and consumer products and print finishing solutions. Our widely recognized brands include AT-A-GLANCE®, Day-Timer®, Five Star®, GBC®, Hilroy®, Kensington®, Marbig, Mead®, NOBO, Quartet®, Rexel, Swingline®, Tilibra®, Wilson Jones® and many others. We design, market and sell products in more than 100 countries around the world. More information about ACCO Brands can be found at www.accobrands.com.

Forward-Looking Statements

This press release contains statements, which may be "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are subject to certain risks and uncertainties, are made as of the date hereof and we undertake no obligation to update them. In particular, our business outlook is based on certain assumptions, which we believe to be reasonable under the circumstances. These include, without limitation, assumptions regarding changes in the macro environment, fluctuations in foreign currency rates, changes in the competitive landscape and consumer behavior and the effect of consolidation in the office products industry, as well as other factors described below.

Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Because actual results may differ from those predicted by such forward-looking statements, you should not place undue reliance on them when deciding whether to buy, sell or hold the Company’s securities.

Among the factors that could affect our results or cause our plans, actions and results to differ materially from current expectations are: the concentration of our business with a relatively limited number of large and sophisticated customers; the consolidation of our customers, including the merger of Office Depot and OfficeMax in late 2013 and the proposed acquisition of Office Depot by Staples; shifts in the channels of distribution of our products; challenges related to the highly competitive business segments in which we operate, including, low barriers to entry, customers who have the ability to source their own private label products, limited retail space, competitors’ strong brands, competition from imports from a range of countries, including countries with lower production costs and from a wide range of products and services, including electronic, digital and web-based products that can render obsolete or less desirable some of our products; our ability to develop innovative products and expand our business into adjacent categories; our ability to meet the competitive challenges faced by our Computer Products business which is characterized by rapid technological change, short product life cycles and a dependency on the introduction by third party manufacturers of new equipment to drive demand for the accessories it sells; commercial and consumer spending decisions during periods of economic uncertainty or weakness; a failure of our information technology systems or supporting infrastructure or an information security breach; our ability to successfully expand our business in emerging markets which generally involve more financial, operational, legal and compliance risks and create exposure to unstable political conditions, civil unrest and economic volatility; our ability to grow profitably through acquisitions; our failure to comply with customer contracts; the impact of regulatory requirements, litigation, regulatory actions or other legal claims or proceedings; the risks associated with outsourcing production of certain of our products and information systems; the decline in the use of certain of our products, especially paper-based dated time management and productivity tools; risks associated with our substantial indebtedness, including our significant debt service obligations, limitations imposed by restrictive covenants and our ability to comply with financial ratios and tests; risks associated with seasonality, and foreign currency, interest rate and raw material and labor cost fluctuations; the impact of pension costs; any impairment of our goodwill or other intangible assets; the insolvency, bankruptcy or financial instability of our customers and suppliers; our ability to secure, protect and maintain our intellectual property rights; our ability to attract and retain key employees; the volatility of our stock price; material disruptions at one of our or our suppliers' major manufacturing or distribution facilities resulting from circumstances outside our control; and other risks and uncertainties described in "Part I, Item 1A. Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2014, in "Part II, Item 1A. Risk Factors" in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2015 and in other reports we file with the SEC.

For further information:

Rich Nelson Jennifer Rice

Media Relations Investor Relations

(847) 796-4059 (847) 796-4320

ACCO Brands Corporation and Subsidiaries

Condensed Consolidated Balance Sheets

|

| | | | | | | |

| (unaudited) | | |

(in millions of dollars) | December 31,

2015 | | December 31,

2014 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 55.4 |

| | $ | 53.2 |

|

Accounts receivable, net | 369.3 |

| | 420.5 |

|

Inventories | 203.6 |

| | 229.9 |

|

Deferred income taxes | — |

| | 39.4 |

|

Other current assets | 25.3 |

| | 35.8 |

|

Total current assets | 653.6 |

| | 778.8 |

|

Total property, plant and equipment | 526.1 |

| | 547.7 |

|

Less accumulated depreciation | (317.0 | ) | | (312.2 | ) |

Property, plant and equipment, net | 209.1 |

| | 235.5 |

|

Deferred income taxes | 25.1 |

| | 31.7 |

|

Goodwill | 496.9 |

| | 544.9 |

|

Identifiable intangibles, net | 520.9 |

| | 571.4 |

|

Other non-current assets | 47.8 |

| | 52.8 |

|

Total assets | $ | 1,953.4 |

| | $ | 2,215.1 |

|

Liabilities and Stockholders' Equity | | | |

Current liabilities: | | | |

Notes payable | $ | — |

| | $ | 0.8 |

|

Current portion of long-term debt | — |

| | 0.8 |

|

Accounts payable | 147.6 |

| | 159.1 |

|

Accrued compensation | 34.0 |

| | 36.6 |

|

Accrued customer program liabilities | 108.7 |

| | 111.8 |

|

Accrued interest | 6.3 |

| | 6.5 |

|

Other current liabilities | 58.7 |

| | 79.8 |

|

Total current liabilities | 355.3 |

| | 395.4 |

|

Long-term debt, net | 720.5 |

| | 787.7 |

|

Deferred income taxes | 142.3 |

| | 172.2 |

|

Pension and post-retirement benefit obligations | 89.1 |

| | 100.5 |

|

Other non-current liabilities | 65.0 |

| | 78.3 |

|

Total liabilities | 1,372.2 |

| | 1,534.1 |

|

Stockholders' equity: | | | |

Common stock | 1.1 |

| | 1.1 |

|

Treasury stock | (11.8 | ) | | (5.9 | ) |

Paid-in capital | 1,988.3 |

| | 2,031.5 |

|

Accumulated other comprehensive loss | (429.2 | ) | | (292.6 | ) |

Accumulated deficit | (967.2 | ) | | (1,053.1 | ) |

Total stockholders' equity | 581.2 |

| | 681.0 |

|

Total liabilities and stockholders' equity | $ | 1,953.4 |

| | $ | 2,215.1 |

|

ACCO Brands Corporation and Subsidiaries

Consolidated Statements of Income (Unaudited)

(In millions of dollars, except per share data)

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Twelve Months Ended December 31, | | |

| 2015 | | 2014 | | % Change | | 2015 | | 2014 | | % Change |

Net sales | $ | 412.1 |

| | $ | 459.9 |

| | (10)% | | $ | 1,510.4 |

| | $ | 1,689.2 |

| | (11)% |

Cost of products sold | 274.3 |

| | 303.0 |

|

| (9)% | | 1,032.0 |

| | 1,159.3 |

| | (11)% |

Gross profit | 137.8 |

| | 156.9 |

| | (12)% | | 478.4 |

| | 529.9 |

| | (10)% |

| | | | | | | | | | | |

Operating costs and expenses: | | | | | | | | | | | |

Advertising, selling, general and administrative expenses | 76.3 |

| | 79.2 |

| | (4)% | | 295.7 |

| | 328.6 |

| | (10)% |

Amortization of intangibles | 4.7 |

| | 5.3 |

| | (11)% | | 19.6 |

| | 22.2 |

| | (12)% |

Restructuring (credits) charges | (0.1 | ) | | 3.9 |

| | NM | | (0.4 | ) | | 5.5 |

| | NM |

Total operating costs and expenses | 80.9 |

| | 88.4 |

| | (8)% | | 314.9 |

| | 356.3 |

| | (12)% |

| | | | | | | | | | | |

Operating income | 56.9 |

| | 68.5 |

| | (17)% | | 163.5 |

| | 173.6 |

| | (6)% |

| | | | | | | | | | | |

Non-operating expense (income): | | | | | | | | | | | |

Interest expense | 11.0 |

| | 12.5 |

| | (12)% | | 44.5 |

| | 49.5 |

| | (10)% |

Interest income | (1.3 | ) | | (0.9 | ) | | 44% | | (6.6 | ) | | (5.6 | ) | | 18% |

Equity in earnings of joint ventures | (2.8 | ) | | (2.8 | ) | | —% | | (7.9 | ) | | (8.1 | ) | | (2)% |

Other (income) expense, net | (0.1 | ) | | 0.5 |

| | NM | | 2.1 |

| | 0.8 |

| | 163% |

| | | | | | | | | | | |

Income before income tax | 50.1 |

| | 59.2 |

| | (15)% | | 131.4 |

| | 137.0 |

| | (4)% |

Income tax expense | 18.7 |

| | 15.3 |

| | 22% | | 45.5 |

| | 45.4 |

| | —% |

Net income | $ | 31.4 |

| | $ | 43.9 |

| | (28)% | | $ | 85.9 |

| | $ | 91.6 |

| | (6)% |

| | | | | | | | | | | |

Per share: | | | | | | | | | | | |

Basic income per share | $ | 0.30 |

| | $ | 0.39 |

| | (23)% | | $ | 0.79 |

| | $ | 0.81 |

| | (2)% |

Diluted income per share | $ | 0.29 |

| | $ | 0.38 |

| | (24)% | | $ | 0.78 |

| | $ | 0.79 |

| | (1)% |

| | | | | | | | | | | |

Weighted average number of shares outstanding: | | | | | | | | | | | |

Basic | 106.0 |

| | 112.2 |

| | | | 108.8 |

| | 113.7 |

| | |

Diluted | 107.9 |

| | 115.1 |

| | | | 110.6 |

| | 116.3 |

| | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Statistics (as a % of Net sales, except Income tax rate) | | | | | | | | | |

| Three Months Ended December 31, | | | | Twelve Months Ended December 31, | | |

| 2015 | | 2014 | | | | 2015 | | 2014 | | |

Gross profit (Net sales, less Cost of products sold) | 33.4 | % | | 34.1 | % | | | | 31.7 | % | | 31.4 | % | | |

Advertising, selling, general and administrative | 18.5 | % | | 17.2 | % | | | | 19.6 | % | | 19.5 | % | | |

Operating income | 13.8 | % | | 14.9 | % | | | | 10.8 | % | | 10.3 | % | | |

Income before income tax | 12.2 | % | | 12.9 | % | | | | 8.7 | % | | 8.1 | % | | |

Net income | 7.6 | % | | 9.5 | % | | | | 5.7 | % | | 5.4 | % | | |

Income tax rate | 37.3 | % | | 25.8 | % | | | | 34.6 | % | | 33.1 | % | | |

ACCO Brands Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

| | | | | | | |

| Twelve Months Ended December 31, |

(in millions of dollars) | 2015 | | 2014 |

Operating activities | | | |

Net income | $ | 85.9 |

| | $ | 91.6 |

|

Loss on disposal of assets | 0.1 |

| | 0.8 |

|

Deferred income tax provision | 27.4 |

| | 20.6 |

|

Depreciation | 32.4 |

| | 35.3 |

|

Other non-cash charges | — |

| | 0.7 |

|

Amortization of debt issuance costs | 3.5 |

| | 4.6 |

|

Amortization of intangibles | 19.6 |

| | 22.2 |

|

Stock-based compensation | 16.0 |

| | 15.7 |

|

Loss on debt extinguishment | 1.9 |

| | — |

|

Equity in earnings of joint ventures, net of dividends received | (3.8 | ) | | (2.4 | ) |

Changes in balance sheet items: | | | |

Accounts receivable | (3.9 | ) | | 20.4 |

|

Inventories | 9.8 |

| | 11.6 |

|

Other assets | 1.2 |

| | (6.1 | ) |

Accounts payable | (2.6 | ) | | (10.1 | ) |

Accrued expenses and other liabilities | (19.2 | ) | | (28.9 | ) |

Accrued income taxes | 2.9 |

| | (4.3 | ) |

Net cash provided by operating activities | 171.2 |

| | 171.7 |

|

Investing activities | | | |

Additions to property, plant and equipment | (27.6 | ) | | (29.6 | ) |

Proceeds from the disposition of assets | 2.8 |

| | 3.8 |

|

Other | 0.2 |

| | — |

|

Net cash used by investing activities | (24.6 | ) | | (25.8 | ) |

Financing activities | | | |

Proceeds from long-term borrowings | 300.0 |

| | — |

|

Repayments of long-term debt | (370.1 | ) | | (121.1 | ) |

Repayments (borrowings) of notes payable, net | (0.8 | ) | | 1.0 |

|

Payments for debt issuance costs | (1.7 | ) | | (0.3 | ) |

Repurchases of common stock | (60.0 | ) | | (19.4 | ) |

Payments related to tax withholding for share-based compensation | (5.9 | ) | | (2.5 | ) |

Proceeds from the exercise of stock options | 0.7 |

| | 0.3 |

|

Net cash used by financing activities | (137.8 | ) | | (142.0 | ) |

Effect of foreign exchange rate changes on cash and cash equivalents | (6.6 | ) | | (4.2 | ) |

Net increase (decrease) in cash and cash equivalents | 2.2 |

| | (0.3 | ) |

Cash and cash equivalents | | | |

Beginning of the period | 53.2 |

| | 53.5 |

|

End of the period | $ | 55.4 |

| | $ | 53.2 |

|

ACCO Brands Corporation and Subsidiaries

Reconciliation of GAAP to Adjusted Non-GAAP Information (Unaudited)

(In millions of dollars, except per share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2015 | | Three Months Ended December 31, 2014 | | |

| Reported | | % of | | Adjusted | | Adjusted | | % of | | Reported | | % of | | Adjusted | | Adjusted | | % of | | % Change |

| GAAP | | Sales | | Items | | Non-GAAP | | Sales | | GAAP | | Sales | | Items | | Non-GAAP | | Sales | | Adjusted |

Restructuring (credits) charges | $ | (0.1 | ) | | | | $ | 0.1 |

| (A.1) | $ | — |

| | | | $ | 3.9 |

| | | | $ | (3.9 | ) | (A.1) | $ | — |

| | | | NM |

|

Operating income | 56.9 |

| | 13.8 | % | | (0.1 | ) | | 56.8 |

| | 13.8 | % | | 68.5 |

| | 14.9 | % | | 3.9 |

| | 72.4 |

| | 15.7 | % | | (22 | )% |

Interest expense | 11.0 |

| | | | — |

| | 11.0 |

| | | | 12.5 |

| | | | (0.8 | ) | (A.2) | 11.7 |

| | | | (6 | )% |

Other (income) expense, net | (0.1 | ) | | | | — |

| | (0.1 | ) | | | | 0.5 |

| | | | — |

| | 0.5 |

| | | | NM |

|

Income before income tax | 50.1 |

| | 12.2 | % | | (0.1 | ) | | 50.0 |

| | 12.1 | % | | 59.2 |

| | 12.9 | % | | 4.7 |

| | 63.9 |

| | 13.9 | % | | (22 | )% |

Income tax expense | 18.7 |

| | | | (1.2 | ) | (A.3) | 17.5 |

| | | | 15.3 |

| | | | 7.1 |

| (A.3) | 22.4 |

| | | | (22 | )% |

Income tax rate | 37.3 | % | | | | | | 35.0 | % | | | | 25.8 | % | | | | | | 35.0 | % | | | | |

Net income | $ | 31.4 |

| | 7.6 | % | | $ | 1.1 |

| | $ | 32.5 |

| | 7.9 | % | | $ | 43.9 |

| | 9.5 | % | | $ | (2.4 | ) | | $ | 41.5 |

| | 9.0 | % | | (22 | )% |

Diluted income per share | $ | 0.29 |

| | | | $ | 0.01 |

| | $ | 0.30 |

| | | | $ | 0.38 |

| | | | $ | (0.02 | ) | | $ | 0.36 |

| | | | (17 | )% |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, 2015 | | Twelve Months Ended December 31, 2014 | | |

| Reported | | % of | | Adjusted | | Adjusted | | % of | | Reported | | % of | | Adjusted | | Adjusted | | % of | | % Change |

| GAAP | | Sales | | Items | | Non-GAAP | | Sales | | GAAP | | Sales | | Items | | Non-GAAP | | Sales | | Adjusted |

Restructuring (credits) charges | $ | (0.4 | ) | | | | 0.4 |

| (A.1) | — |

| | | | $ | 5.5 |

| | | | (5.5 | ) | (A.1) | $ | — |

| | | | NM |

|

Operating income | $ | 163.5 |

| | 10.8 | % | | (0.4 | ) | | 163.1 |

| | 10.8 | % | | $ | 173.6 |

| | 10.3 | % | | 5.5 |

| | 179.1 |

| | 10.6 | % | | (9 | )% |

Interest expense | $ | 44.5 |

| | | | (0.1 | ) | (A.2) | 44.4 |

| | | | $ | 49.5 |

| | | | (0.7 | ) | (A.2) | 48.8 |

| | | | (9 | )% |

Other expense, net | $ | 2.1 |

| | | | (1.9 | ) | (A.2) | 0.2 |

| | | | $ | 0.8 |

| | | | — |

| | 0.8 |

| | | | (75 | )% |

Income before income tax | $ | 131.4 |

| | 8.7 | % | | 1.6 |

| | 133.0 |

| | 8.8 | % | | $ | 137.0 |

| | 8.1 | % | | 6.2 |

| | 143.2 |

| | 8.5 | % | | (7 | )% |

Income tax expense | $ | 45.5 |

| | | | 1.1 |

| (A.3) | 46.6 |

| | | | $ | 45.4 |

| | | | 4.7 |

| (A.3) | 50.1 |

| | | | (7 | )% |

Income tax rate | 34.6 | % | | | | | | 35.0 | % | | | | 33.1 | % | | | | | | 35.0 | % | | | | |

Net income | $ | 85.9 |

| | 5.7 | % | | 0.5 |

| | 86.4 |

| | 5.7 | % | | $ | 91.6 |

| | 5.4 | % | | $ | 1.5 |

| | $ | 93.1 |

| | 5.5 | % | | (7 | )% |

Diluted income per share | $ | 0.78 |

| | | | $ | — |

| | $ | 0.78 |

| | | | $ | 0.79 |

| | | | $ | 0.01 |

| | $ | 0.80 |

| | | | (3 | )% |

Notes for Reconciliation of GAAP to Adjusted Non-GAAP Information (Unaudited)

| |

A. | “Adjusted” results exclude restructuring (credits) charges, costs associated with refinancing of the Company's debt and all unusual income tax items, including income taxes related to the aforementioned items, in order to provide a comparison of underlying results of operations; in addition, income taxes have been recalculated at a normalized tax rate. |

| |

1. | Represents restructuring (credits) charges. |

| |

2. | In 2015 represents the reversal of the write-off of debt issuance costs and other costs associated with the Company's refinancing in the second quarter of 2015. In 2014 primarily represents the adjustments related to accelerated amortization of debt origination costs resulting from accelerated bank debt repayments in the fourth quarter of 2014. |

| |

3. | Adjustment primarily reflects the tax effect of the adjustments outlined in items A.1-2 above and adjusts the company's effective tax rate to a normalized rate of 35%. The Company's estimated long-term rate remains subject to variations from the mix of earnings across the Company's operating jurisdictions. |

ACCO Brands Corporation and Subsidiaries

Reconciliation of Net Income to Adjusted EBITDA (Unaudited)

(In millions of dollars)

The following table sets forth a reconciliation of reported net income in accordance with GAAP to Adjusted EBITDA.

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | | | Twelve Months Ended December 31, | | |

| | 2015 | | 2014 | | % Change | | 2015 | | 2014 | | % Change |

Net income | $ | 31.4 |

| | $ | 43.9 |

| | (28 | )% | | $ | 85.9 |

| | $ | 91.6 |

| | (6 | )% |

| Restructuring (credits) charges | (0.1 | ) | | 3.9 |

| | NM |

| | (0.4 | ) | | 5.5 |

| | NM |

|

| Depreciation | 7.7 |

| | 8.5 |

| | (9 | )% | | 32.4 |

| | 35.3 |

| | (8 | )% |

| Stock-based compensation | 5.5 |

| | 4.1 |

| | 34 | % | | 16.0 |

| | 15.7 |

| | 2 | % |

| Amortization of intangibles | 4.7 |

| | 5.3 |

| | (11 | )% | | 19.6 |

| | 22.2 |

| | (12 | )% |

| Interest expense (income) | 9.7 |

| | 11.6 |

| | (16 | )% | | 37.9 |

| | 43.9 |

| | (14 | )% |

| Other (income) expense, net | (0.1 | ) | | 0.5 |

| | NM |

| | 2.1 |

| | 0.8 |

| | 163 | % |

| Income tax expense | 18.7 |

| | 15.3 |

| | 22 | % | | 45.5 |

| | 45.4 |

| | — | % |

Adjusted EBITDA (non-GAAP) | $ | 77.5 |

| | $ | 93.1 |

| | (17 | )% | | $ | 239.0 |

| | $ | 260.4 |

| | (8 | )% |

| | | | | | | | | | | | |

Adjusted EBITDA as a % of Net Sales | 18.8 | % | | 20.2 | % | | | | 15.8 | % | | 15.4 | % | | |

Notes for Reconciliation of Net Income to Adjusted EBITDA

“Adjusted EBITDA” represents net income after adding back depreciation, stock-based compensation expense, amortization of intangibles, interest expense (income) and other (income) expense, net and income tax expense and excludes restructuring (credits) charges.

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow (Unaudited)

(In millions of dollars)

“Free Cash Flow” represents cash flow from operating activities less cash flow from investing activities. The following table sets forth a reconciliation of reported net cash provided by operating activities in accordance with GAAP to Free Cash Flow.

|

| | | |

| Twelve Months Ended December 31, 2015 |

Net cash provided by operating activities | $ | 171.2 |

|

| |

Net cash (used) provided by: | |

Additions to property, plant and equipment | (27.6 | ) |

Proceeds from the disposition of assets | 2.8 |

|

Other | $ | 0.2 |

|

Free cash flow (non-GAAP) | $ | 146.6 |

|

ACCO Brands Corporation and Subsidiaries

Supplemental Business Segment Information and Reconciliation (Unaudited)

(In millions of dollars)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2015 | | 2014 | | Changes |

| | | | | | |

| | Adjusted | | | | | | | | | | Adjusted | | | |

|

| |

| | | Reported | | | | Adjusted | | Operating | | | | Reported | | | | Adjusted | | Operating | | | | Adjusted | Adjusted | |

| | | Operating | | | | Operating | | Income | | | | Operating | | | | Operating | | Income | |

|

| Operating | Operating |

|

| Reported | | Income | | Adjusted | | Income | | (Loss) | | Reported | | Income | | Adjusted | | Income | | (Loss) | | Net Sales | Net Sales | Income | Income | Margin |

| Net Sales | | (Loss) | | Items | | (Loss) (A) | | Margin (A) | | Net Sales | | (Loss) | | Items | | (Loss) (A) | | Margin (A) | | $ | % | (Loss) $ | (Loss) % | Points |

Q1: | | | | | | | | | | | | | | | | | | | | | | | | | |

ACCO Brands North America | $ | 166.7 |

| | $ | 5.6 |

| | $ | (0.5 | ) | | $ | 5.1 |

| | 3.1% | | $ | 171.4 |

| | $ | (1.5 | ) | | $ | 0.3 |

| | $ | (1.2 | ) | | (0.7)% | | $ | (4.7 | ) | (3)% | $ | 6.3 |

| NM | 380 |

ACCO Brands International | 94.6 |

| | 3.3 |

| | — |

| | 3.3 |

| | 3.5% | | 124.3 |

| | 7.6 |

| | 0.5 |

| | 8.1 |

| | 6.5% | | (29.7 | ) | (24)% | (4.8 | ) | (59)% | (300) |

Computer Products | 28.7 |

| | 2.0 |

| | — |

| | 2.0 |

| | 7.0% | | 33.7 |

| | 1.9 |

| | 0.3 |

| | 2.2 |

| | 6.5% | | (5.0 | ) | (15)% | (0.2 | ) | (9)% | 50 |

Corporate | — |

| | (8.3 | ) | | — |

| | (8.3 | ) | | | | — |

| | (8.6 | ) | | — |

| | (8.6 | ) | | | | — |

| | 0.3 |

| | |

Total | $ | 290.0 |

| | $ | 2.6 |

| | $ | (0.5 | ) | | $ | 2.1 |

| | 0.7% | | $ | 329.4 |

| | $ | (0.6 | ) | | $ | 1.1 |

| | $ | 0.5 |

| | 0.2% | | $ | (39.4 | ) | (12)% | $ | 1.6 |

| 320% | 50 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Q2: | | | | | | | | | | | | | | | | | | | | | | | | | |

ACCO Brands North America | $ | 268.6 |

| | $ | 50.1 |

| | $ | — |

| | $ | 50.1 |

| | 18.7% | | $ | 283.7 |

| | $ | 49.0 |

| | $ | 0.2 |

| | $ | 49.2 |

| | 17.3% | | $ | (15.1 | ) | (5)% | $ | 0.9 |

| 2% | 140 |

ACCO Brands International | 96.7 |

| | 6.2 |

| | — |

| | 6.2 |

| | 6.4% | | 111.3 |

| | 5.2 |

| | — |

| | 5.2 |

| | 4.7% | | (14.6 | ) | (13)% | 1.0 |

| 19% | 170 |

Computer Products | 29.4 |

| | 2.2 |

| | 0.2 |

| | 2.4 |

| | 8.2% | | 32.7 |

| | 0.4 |

| | — |

| | 0.4 |

| | 1.2% | | (3.3 | ) | (10)% | 2.0 |

| 500% | 700 |

Corporate | — |

| | (9.3 | ) | | — |

| | (9.3 | ) | | | | — |

| | (10.7 | ) | | (0.2 | ) | | (10.9 | ) | | | | — |

| | 1.6 |

| | |

Total | $ | 394.7 |

| | $ | 49.2 |

| | $ | 0.2 |

| | $ | 49.4 |

| | 12.5% | | $ | 427.7 |

| | $ | 43.9 |

| | $ | — |

| | $ | 43.9 |

| | 10.3% | | $ | (33.0 | ) | (8)% | $ | 5.5 |

| 13% | 220 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Q3: | | | | | | | | | | | | | | | | | | | | | | | | | |

ACCO Brands North America | $ | 279.8 |

| | $ | 48.4 |

| | $ | — |

| | $ | 48.4 |

| | 17.3% | | $ | 297.4 |

| | $ | 50.5 |

| | $ | (0.5 | ) | | $ | 50.0 |

| | 16.8% | | $ | (17.6 | ) | (6)% | $ | (1.6 | ) | (3)% | 50 |

ACCO Brands International | 104.3 |

| | 11.3 |

| | (0.1 | ) | | 11.2 |

| | 10.7% | | 140.7 |

| | 19.1 |

| | 0.1 |

| | 19.2 |

| | 13.6% | | $ | (36.4 | ) | (26)% | (8.0 | ) | (42)% | (290) |

Computer Products | 29.5 |

| | 2.7 |

| | 0.1 |

| | 2.8 |

| | 9.5% | | 34.1 |

| | 2.7 |

| | 0.9 |

| | 3.6 |

| | 10.6% | | $ | (4.6 | ) | (13)% | (0.8 | ) | (22)% | (110) |

Corporate | — |

| | (7.6 | ) | | — |

| | (7.6 | ) | | | | — |

| | (10.5 | ) | | — |

| | (10.5 | ) | | | | — |

| | 2.9 |

| | |

Total | $ | 413.6 |

| | $ | 54.8 |

| | $ | — |

| | $ | 54.8 |

| | 13.2% | | $ | 472.2 |

| | $ | 61.8 |

| | $ | 0.5 |

| | $ | 62.3 |

| | 13.2% | | $ | (58.6 | ) | (12)% | $ | (7.5 | ) | (12)% | — |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Q4: | | | | | | | | | | | | | | | | | | | | | | | | | |

ACCO Brands North America | $ | 248.2 |

| | $ | 43.5 |

| | $ | (0.1 | ) | | $ | 43.4 |

| | 17.5% | | $ | 253.5 |

| | $ | 42.7 |

| | $ | 3.3 |

| | $ | 46.0 |

| | 18.1% | | $ | (5.3 | ) | (2)% | $ | (2.6 | ) | (6)% | (60) |

ACCO Brands International | 131.3 |

| | 20.0 |

| | — |

| | 20.0 |

| | 15.2% | | 170.6 |

| | 31.0 |

| | 0.5 |

| | 31.5 |

| | 18.5% | | $ | (39.3 | ) | (23)% | (11.5 | ) | (37)% | (330) |

Computer Products | 32.6 |

| | 3.4 |

| | — |

| | 3.4 |

| | 10.4% | | 35.8 |

| | 3.2 |

| | (0.1 | ) | | 3.1 |

| | 8.7% | | $ | (3.2 | ) | (9)% | 0.3 |

| 10% | 170 |

Corporate | — |

| | (10.0 | ) | | — |

| | (10.0 | ) | | | | — |

| | (8.4 | ) | | 0.2 |

| | (8.2 | ) | | | | — |

| | (1.8 | ) | | |

Total | $ | 412.1 |

| | $ | 56.9 |

| | $ | (0.1 | ) | | $ | 56.8 |

| | 13.8% | | $ | 459.9 |

| | $ | 68.5 |

| | $ | 3.9 |

| | $ | 72.4 |

| | 15.7% | | $ | (47.8 | ) | (10)% | $ | (15.6 | ) | (22)% | (190) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Full Year: | | | | | | | | | | | | | | | | | | | | | | | | | |

ACCO Brands North America | $ | 963.3 |

| | $ | 147.6 |

| | $ | (0.6 | ) | | $ | 147.0 |

| | 15.3% | | $ | 1,006.0 |

| | $ | 140.7 |

| | $ | 3.3 |

| | $ | 144.0 |

| | 14.3% | | $ | (42.7 | ) | (4)% | $ | 3.0 |

| 2% | 100 |

ACCO Brands International | 426.9 |

| | 40.8 |

| | (0.1 | ) | | 40.7 |

| | 9.5% | | 546.9 |

| | 62.9 |

| | 1.1 |

| | 64.0 |

| | 11.7% | | $ | (120.0 | ) | (22)% | (23.3 | ) | (36)% | (220) |

Computer Products | 120.2 |

| | 10.3 |

| | 0.3 |

| | 10.6 |

| | 8.8% | | 136.3 |

| | 8.2 |

| | 1.1 |

| | 9.3 |

| | 6.8% | | $ | (16.1 | ) | (12)% | 1.3 |

| 14% | 200 |

Corporate | — |

| | (35.2 | ) | | — |

| | (35.2 | ) | | | | — |

| | (38.2 | ) | | — |

| | (38.2 | ) | | | | — |

| | 3.0 |

| | |

Total | $ | 1,510.4 |

| | $ | 163.5 |

| | $ | (0.4 | ) | | $ | 163.1 |

| | 10.8% | | $ | 1,689.2 |

| | $ | 173.6 |

| | $ | 5.5 |

| | $ | 179.1 |

| | 10.6% | | $ | (178.8 | ) | (11)% | $ | (16.0 | ) | (9)% | 20 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

(A) See "Notes for Reconciliation of GAAP to Adjusted Non-GAAP Information (Unaudited)" for a description of adjusted items on page 8. |

ACCO Brands Corporation and Subsidiaries

Supplemental Net Sales Change Analysis (Unaudited)

|

| | | | | | | | | | |

| | Percent Change - Sales |

| | GAAP | Non-GAAP |

| | | | | | Constant | | | | |

| | | | | | Currency | | | | |

| | Net Sales | | Currency | | Net Sales | | | | |

| | Change | | Translation | | Change (A) | | Price | | $ Volume/Mix |

Q1 2015: | | | | | | | | | | |

ACCO Brands North America | | (2.7)% | | (1.5)% | | (1.2)% | | 1.6% | | (2.8)% |

ACCO Brands International | | (23.9)% | | (11.6)% | | (12.3)% | | 4.3% | | (16.6)% |

Computer Products | | (14.8)% | | (8.9)% | | (5.9)% | | (0.3)% | | (5.6)% |

Total | | (12.0)% | | (6.1)% | | (5.9)% | | 2.4% | | (8.3)% |

| | | | | | | | | | |

Q2 2015: | | | | | | | | | | |

ACCO Brands North America | | (5.3)% | | (1.7)% | | (3.6)% | | 1.1% | | (4.7)% |

ACCO Brands International | | (13.1)% | | (18.0)% | | 4.9% | | 4.1% | | 0.8% |

Computer Products | | (10.1)% | | (8.9)% | | (1.2)% | | 3.1% | | (4.3)% |

Total | | (7.7)% | | (6.5)% | | (1.2)% | | 2.0% | | (3.2)% |

| | | | | | | | | | |

Q3 2015: | | | | | | | | | | |

ACCO Brands North America | | (5.9)% | | (2.3)% | | (3.6)% | | 0.6% | | (4.2)% |

ACCO Brands International | | (25.9)% | | (21.0)% | | (4.9)% | | 8.0% | | (12.9)% |

Computer Products | | (13.5)% | | (7.9)% | | (5.6)% | | 4.4% | | (10.0)% |

Total | | (12.4)% | | (8.2)% | | (4.2)% | | 3.1% | | (7.3)% |

| | | | | | | | | | |

Q4 2015: | | | | | | | | | | |

ACCO Brands North America | | (2.1)% | | (1.7)% | | (0.4)% | | 0.9% | | (1.3)% |

ACCO Brands International | | (23.0)% | | (17.8)% | | (5.2)% | | 10.3% | | (15.5)% |

Computer Products | | (8.9)% | | (7.5)% | | (1.4)% | | 7.3% | | (8.7)% |

Total | | (10.4)% | | (8.1)% | | (2.3)% | | 4.9% | | (7.2)% |

| | | | | | | | | | |

2015 YTD: | | | | | | | | | | |

ACCO Brands North America | | (4.2)% | | (1.8)% | | (2.4)% | | 1.0% | | (3.4)% |

ACCO Brands International | | (21.9)% | | (17.2)% | | (4.7)% | | 7.1% | | (11.8)% |

Computer Products | | (11.8)% | | (8.3)% | | (3.5)% | | 3.7% | | (7.2)% |

Total | | (10.6)% | | (7.3)% | | (3.3)% | | 3.2% | | (6.5)% |

(A) Current period foreign operation sales translated at prior year currency rates. | | |

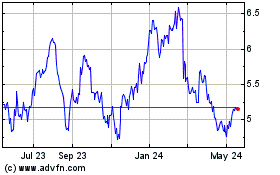

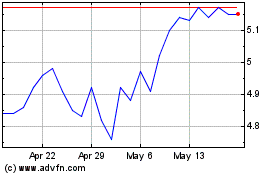

Acco Brands (NYSE:ACCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acco Brands (NYSE:ACCO)

Historical Stock Chart

From Apr 2023 to Apr 2024