Intesa Sanpaolo Sees Benefit From Low Interest Rates

11 February 2016 - 2:00AM

Dow Jones News

The chief executive of Italian lender Intesa Sanpaolo said there

is "a lot of concern" about low and negative interest rates among

European banks, but that the environment has helped Intesa lower

its own cost of funding.

The bank, Italy's second-biggest by assets, said last week its

net interest income—a measure of the profit earned on the

difference between what a bank charges for loans and pays for

deposits—rose slightly in the fourth quarter of last year from the

third quarter.

Carlo Messina, the CEO, said in an interview that Intesa could

see savings of between around €200 million ($226 million) and €300

million a year on the cost of its own borrowing over the medium

term.

Low and negative rates are generally tough for banks, because

they reduce the spread between loans and deposits—typically, banks

have a hard time imposing negative rates on their own depositors.

Intesa said its net interest income for all of 2015 fell 6.5% from

the year before.

Nonetheless, it reported that net income more than doubled in

2015, thanks to higher fee income in its asset-management business

and an improvement in the quality of its loans: It said its total

nonperforming loans fell in the fourth quarter.

European bank shares have been battered this year by a welter of

concerns, among them the pressure induced by near-zero rates. A

European bank-stock index is off nearly a quarter in 2016, even

after a 5% rise in midday trading Wednesday.

Intesa shares were up nearly 13%. It is Italy's largest bank by

market value. Shares of the largest bank by assets, UniCredit SpA,

were up 11%.

In the interview, Mr. Messina said concerns about bad loans and

liquidity in the Italian banking system were overwrought.

Investors have pummeled a regional lender, Banca Monte dei

Paschi di Siena SpA, which has long been troubled by concerns about

its capital position and by bad loans. It is at the center of

worries over how Italy will consolidate and clean up its banking

sector, which is peppered with small and weak regional banks. Monte

dei Paschi has been for sale for more than a year.

Although Intesa's own deposits from its banking business have

risen (up €13 billion in the fourth quarter from the third), Mr.

Messina said he saw no signs of a sustained flight from other

banks. "There is not clear evidence of a problem with liquidity in

the country," he said.

He said Intesa's stock of bad loans had improved thanks in part

to higher household consumption in Italy, which gave firms more

cash and increased their ability to pay.

Italian households are "coming back to consumption," he

said.

Write to Charles Forelle at charles.forelle@wsj.com

(END) Dow Jones Newswires

February 10, 2016 09:45 ET (14:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

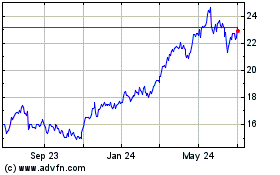

Intesa Sanpaolo (PK) (USOTC:ISNPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

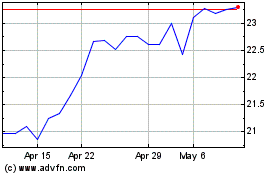

Intesa Sanpaolo (PK) (USOTC:ISNPY)

Historical Stock Chart

From Apr 2023 to Apr 2024