SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) February 4, 2016

PERMA-FIX ENVIRONMENTAL SERVICES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

1-11596 |

58-1954497 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| |

|

|

| |

|

|

| 8302 Dunwoody Place, Suite 250, Atlanta, Georgia |

30350 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code: (770) 587-9898

|

Not applicable |

|

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| __ | |

Written communications pursuant to Rule 425 under the Securities Act |

|

| __ | |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

|

| __ | |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

|

| __ | |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Section 5 – Corporate Governance and Management

Item 5.02 – Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Management Incentive Plans (“MIP”)

On February 4, 2016, the Company’s Compensation and Stock Option Committee (“Compensation Committee”) approved individual management incentive plans (“MIPs”) for Dr. Louis F. Centofanti, our Chief Executive Officer (“CEO”), John Lash, our Chief Operating Officer (“COO”), and Ben Naccarato, our Chief Financial Officer (“CFO”). The MIPs are effective as of January 1, 2016. Each MIP provides guidelines for the calculation of annual cash incentive based compensation, subject to Compensation Committee oversight and modification. Each MIP awards cash compensation based on achievement of performance thresholds, with the amount of such compensation established as a percentage of base salary. The potential target performance compensation ranges from 5% to 100% or $13,962 to $279,248 of the 2016 base salary for the CEO, 5% to 100% or $10,750 to $215,000 of the 2016 base salary for the COO, and 5% to 100% or $11,033 to $220,667 of the 2016 base salary for the CFO.

The performance compensation payable under each MIP is based upon meeting corporate revenue, earnings before interest, taxes, depreciation and amortization (“EBITDA”), health and safety, and environmental compliance (permit and license violations) targets and objectives during fiscal year 2016 from our continuing operations, with such targets and objectives approved by the Company’s Board of Directors (“Board”). The EBITDA target excludes the financial results of the Company’s majority-owned Polish subsidiary, Perma-Fix Medical S.A. (“PF Medical”). The Compensation Committee believe performance compensation payable under each of the MIPs should be based on achievement of EBITDA, a non-GAAP (Generally Accepted Accounting Principles) financial measurement, as this target provides a better indicator of operating performance as it excludes certain non-cash items. EBITDA has certain limitations as it does not reflect all items of income or cash flows that affect the Company’s financial performance under GAAP.

Performance compensation is paid on or about 90 days after year-end, or sooner, based on finalization of our audited financial statements for 2016. If the MIP participant’s employment with the Company is voluntarily or involuntarily terminated prior to a regularly scheduled MIP compensation payment date, no MIP payment will be payable for and after such period.

The Compensation Committee retains the right to modify, change or terminate each MIP and may adjust the various target amounts described below, at any time and for any reason.

The total paid to the CEO, COO, and CFO will not exceed 50% of the Company’s pre-tax net income prior to the calculation of performance compensation.

Each MIP is briefly described below, and the descriptions are qualified by reference to the respective MIPs attached as exhibits 99.1 to 99.3 to this Report.

CEO MIP:

2016 CEO performance compensation is based upon meeting corporate revenue, EBITDA, health and safety, and environmental compliance (permit and license violations) objectives during fiscal year 2016 from our continuing operations (excluding PF Medical). At achievement of 70% to 119% of the Revenue and EBITDA targets, the potential performance compensation is payable at 5% to 50% of the total salary, of which 60% is based on EBITDA goal, 10% on revenue goal, 15% on the number of health and safety claim incidents that occur during fiscal year 2016, and the remaining 15% on the number of notices alleging environmental, health or safety violations under our permits or licenses that occur during the fiscal year 2016. Upon achievement of over 119% of the Revenue and EBITDA targets, with potential performance compensation payable at over 50% to 100% of the total salary, the amount of total performance compensation payable is based on the four objectives noted above, with the payment of such performance compensation being weighted more heavily toward the EBITDA objective. No performance incentive compensation will be payable to the CEO for achieving the health and safety, permit and license violation, and revenue targets unless a minimum of 70% of the EBITDA target is achieved. Each of the revenue and EBITDA components is based on our board approved revenue target and EBITDA target. The 2016 target performance incentive compensation for our CEO is as follows:

|

Annualized Base Pay: |

|

$ |

279,248 |

|

|

Performance Incentive Compensation Target (at 100% of MIP): |

|

$ |

139,624 |

|

|

Total Annual Target Compensation (at 100% of MIP): |

|

$ |

418,872 |

|

COO MIP:

2016 COO performance compensation is based upon meeting corporate revenue, EBITDA, health and safety, and environmental compliance (permit and license violations) objectives during fiscal year 2016 from our continuing operations (excluding PF Medical). At achievement of 70% to 119% of the Revenue and EBITDA targets, the potential performance compensation is payable at 5% to 50% of the total salary, of which 60% is based on EBITDA goal, 10% on revenue goal, 15% on the number of health and safety claim incidents that occur during fiscal year 2016, and the remaining 15% on the number of notices alleging environmental, health or safety violations under our permits or licenses that occur during the fiscal year 2016. Upon achievement of over 119% of the Revenue and EBITDA targets, with potential performance compensation payable at over 50% to 100% of the total salary, the amount of performance compensation payable is based on the four objectives noted above, with the payment of such performance compensation being weighted more heavily toward the EBITDA objective. No performance incentive compensation will be payable to the COO for achieving the health and safety, permit and license violation, and revenue targets unless a minimum of 70% of the EBITDA target is achieved. Each of the revenue and EBITDA components is based on our board approved revenue target and EBITDA target. The 2016 target performance incentive compensation for our COO is as follows:

|

Annualized Base Pay: |

|

$ |

215,000 |

|

|

Performance Incentive Compensation Target (at 100% of Plan): |

|

$ |

107,500 |

|

|

Total Annual Target Compensation (at 100% of Plan): |

|

$ |

322,500 |

|

CFO MIP:

2016 CFO performance compensation is based upon meeting corporate revenue, EBITDA, health and safety, and environmental compliance (permit and license violations) objectives during fiscal year 2016 from our continuing operations (excluding PF Medical). At achievement of 70% to 119% of the Revenue and EBITDA targets, the potential performance compensation is payable at 5% to 50% of the total salary, of which 60% is based on EBITDA goal, 10% on revenue goal, 15% on the number of health and safety claim incidents that occur during fiscal year 2016, and the remaining 15% on the number of notices alleging environmental, health or safety violations under our permits or licenses that occur during the fiscal year 2015. Upon achievement of over 119% of the Revenue and EBITDA targets, with potential performance compensation payable at over 50% to 100% of the total salary, the amount of performance compensation payable is based on the four objectives noted above, with the payment of such performance compensation being weighted more heavily toward the EBITDA objective. No performance incentive compensation will be payable to the CFO for achieving the health and safety, permit and license violation, and revenue targets unless a minimum of 70% of the EBITDA target is achieved. Each of the revenue and EBITDA components is based on our board approved revenue target and EBITDA target. The 2016 target performance incentive compensation for our CFO is as follows:

|

Annualized Base Pay: |

|

$ |

220,667 |

|

|

Performance Incentive Compensation Target (at 100% of Plan): |

|

$ |

110,334 |

|

|

Total Annual Target Compensation (at 100% of Plan): |

|

$ |

331,001 |

|

Section 9 – Financial Statements and Exhibits

Item 9.01 – Financial Statements and Exhibits

(d) Exhibits

Exhibit Number Description

| |

99.1 |

2016 Management Incentive Plan for Chief Executive Officer, approved February 4, 2016 but effective January 1, 2016. |

| |

99.2 |

2016 Management Incentive Plan for Chief Operating Officer, approved February 4, 2016 but effective January 1, 2016. |

| |

99.3 |

2016 Management Incentive Plan for Chief Financial Officer, approved February 4, 2016 but effective January 1, 2016. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 10, 2016

|

|

PERMA-FIX ENVIRONMENTAL SERVICES, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Ben Naccarato |

|

|

|

|

Ben Naccarato |

|

|

|

|

Vice President and |

|

| |

|

Chief Financial Officer |

|

4

Exhibit 99.1

CHIEF EXECUTIVE OFFICER AND PRESIDENT

Effective: January 1, 2016

CHIEF EXECUTIVE OFFICER AND PRESIDENT

PURPOSE: To define the compensation plan for the Chief Executive Officer and President.

SCOPE: Perma-Fix Environmental Services, Inc.

POLICY: The Compensation Plan is designed to retain, motivate and reward the incumbent to support and achieve the business, operating and financial objectives of Perma-Fix Environmental Services, Inc. (the “Company”).

BASE SALARY: The Base Salary indicated below is paid in equal periodic installments per the regularly scheduled payroll.

PERFORMANCE INCENTIVE COMPENSATION: Performance Incentive Compensation is available based on the Company’s financial results noted in the CEO MIP Matrix below. Effective date of plan is January 1, 2016 and incentive will be for entire year of 2016. Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based on final Form 10-K financial statement.

SEPARATION: If employment is separated prior to the annual incentive compensation payment date as noted above, no incentive compensation is due to the incumbent.

ACKNOWLEDGEMENT: Payment of Performance Incentive Compensation of any type will be forfeited, unless the Human Resources Department has received a signed acknowledgement of receipt of the Compensation Plan prior to the applicable payment date.

INTERPRETATIONS: The Compensation Committee of the Board of Directors retains the right to modify, change or terminate the Compensation Plan at any time and for any reason. It also reserves the right to determine the final interpretation of any provision contained in the Compensation Plan and it reserves the right to modify or change the Revenue and EBITDA Targets as defined herein in the event of the sale or disposition of any of the assets of the Company. While the plan is intended to represent all situations and circumstances, some issues may not easily be addressed. The Compensation Committee will endeavor to review all standard and non-standard issues related to the Compensation Plan and will provide quick interpretations that are in the best interest of the Company, its shareholders and the incumbent.

CHIEF EXECUTIVE OFFICER AND PRESIDENT

Base Pay and Performance Incentive Compensation Targets

|

The compensation for the below named individual as follows: |

|

|

|

|

| |

|

|

|

|

|

Annualized Base Pay: |

|

$ |

279,248 |

|

|

Performance Incentive Compensation Target (at 100% of Plan): |

|

$ |

139,624 |

|

| Total Annual Target Compensation (at 100% of Plan): |

|

$ |

418,872 |

|

The Performance Incentive Compensation Target is based on the CEO MIP Matrix below.

CEO MIP MATRIX

2016

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

TARGET |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue Target |

|

<$56,000,000 |

|

|

$ |

56,000,000 |

|

|

$ |

68,000,000 |

|

|

$ |

80,000,000 |

|

|

$ |

96,000,000 |

|

|

$ |

112,000,000 |

|

|

$ |

128,000,000 |

|

|

EBITDA Target |

|

<$6,370,000 |

|

|

$ |

6,370,000 |

|

|

$ |

7,735,000 |

|

|

$ |

9,100,000 |

|

|

$ |

10,920,000 |

|

|

$ |

12,740,000 |

|

|

$ |

14,560,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Performance Incentive Target |

|

|

0 |

% |

|

|

10 |

% |

|

|

50 |

% |

|

|

100 |

% |

|

|

130 |

% |

|

|

170 |

% |

|

|

200 |

% |

|

% of Target Achieved |

|

<70 |

% |

|

|

70%-84 |

% |

|

|

85%-99 |

% |

|

|

100%-119 |

% |

|

|

120%-139 |

% |

|

|

140%-159 |

% |

|

160% |

+ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

- |

|

|

$ |

1,397 |

|

|

$ |

6,981 |

|

|

$ |

13,962 |

|

|

$ |

19,945 |

|

|

$ |

27,924 |

|

|

$ |

33,908 |

|

|

EBITDA |

|

|

- |

|

|

|

8,377 |

|

|

|

41,887 |

|

|

|

83,774 |

|

|

|

119,678 |

|

|

|

167,549 |

|

|

|

203,452 |

|

|

Health and Safety |

|

|

- |

|

|

|

2,094 |

|

|

|

10,472 |

|

|

|

20,944 |

|

|

|

20,944 |

|

|

|

20,944 |

|

|

|

20,944 |

|

|

Permit & License Violations |

|

|

- |

|

|

|

2,094 |

|

|

|

10,472 |

|

|

|

20,944 |

|

|

|

20,944 |

|

|

|

20,944 |

|

|

|

20,944 |

|

| |

|

$ |

- |

|

|

$ |

13,962 |

|

|

$ |

69,812 |

|

|

$ |

139,624 |

|

|

$ |

181,511 |

|

|

$ |

237,361 |

|

|

$ |

279,248 |

|

|

1) |

Revenue is defined as the total consolidated third party top line revenue from continuing operations (excluding Perma-Fix Medical S.A. (“PF Medical”) for 2016) as publicly reported in the Company’s 2016 financial statements. The percentage achieved is determined by comparing the actual consolidated revenue from continuing operations to the Board approved Revenue Target from continuing operations, which is $80,000,000. The Board reserves the right to modify or change the Revenue Targets as defined herein in the event of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

|

2) |

EBITDA is defined as earnings before interest, taxes, depreciation, and amortization from continuing operations, excluding PF Medical. The percentage achieved is determined by comparing the actual EBITDA to the Board approved EBITDA Target for 2016, which is $9,100,000. The Board reserves the right to modify or change the EBITDA Targets as defined herein in the event of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

|

3) |

The Health and Safety Incentive Target is based upon the actual number of Worker’s Compensation Lost Time Accidents, as provided by the Company’s Worker’s Compensation carrier. The Corporate Controller will submit a report on a quarterly basis documenting and confirming the number of Worker’s Compensation Lost Time Accidents, supported by the Worker’s Compensation Loss Report provided by the company’s carrier or broker. Such claims will be identified on the loss report as “indemnity claims.” The following number of Worker’s Compensation Lost Time Accidents and corresponding Performance Target Thresholds has been established for the annual Incentive Compensation Plan calculation for 2016. |

|

Work Comp.

Claim Number |

|

Performance

Target |

|

6 |

|

70%-84% |

|

5 |

|

85%-99% |

|

4 |

|

100%-119% |

|

3 |

|

120%-139% |

|

2 |

|

140%-159% |

|

1 |

|

160%+ |

| |

4) |

Permits or License Violations incentive is earned/determined according to the scale set forth below: An “official notice of non-compliance” is defined as an official communication during 2016 from a local, state, or federal regulatory authority alleging one or more violations of an otherwise applicable Environmental, Health or Safety requirement or permit provision, which results in a facility’s implementation of corrective action(s). |

|

Permit and

License Violations |

|

Performance

Target |

|

6 |

|

70%-84% |

|

5 |

|

85%-99% |

|

4 |

|

100%-119% |

|

3 |

|

120%-139% |

|

2 |

|

140%-159% |

|

1 |

|

160%+ |

| |

5) |

No performance incentive compensation will be payable for achieving the health and safety, permit and license violation, and revenue targets unless a minimum of 70% of the EBITDA Target is achieved. |

Performance Incentive Compensation Payment

Effective date of plan is January 1, 2016 and incentive will be for entire year. Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based on final Form 10-K financial statement.

In no event will Performance Incentive Compensation paid to all Executive Officers as a group exceed 50% of Pretax Net Income exclusive of PF Medical computed prior to the calculation of bonus expense. If applicable, Incentive Compensation payments will be reduced on a pro-rata basis, so not to exceed 50% of Pretax Net Income.

ACKNOWLEDGMENT:

I acknowledge receipt of the aforementioned Chief Executive Officer and President 2016 - Compensation Plan. I have read and understand and accept employment under the terms and conditions set forth therein.

|

/s/ Dr. Louis Centofanti |

|

2/9/16 |

|

|

|

/S/ Dr. Louis Centofanti |

|

Date |

|

|

| |

|

|

|

|

|

/s/Dr. Gary Kugler |

|

2/9/16 |

|

|

|

/S/ Board of Directors |

|

Date |

|

|

Exhibit 99.2

CHIEF OPERATING OFFICER

Effective: January 1, 2016

CHIEF OPERATING OFFICER

PURPOSE: To define the compensation plan for the CHIEF OPERATING OFFICER.

SCOPE: Perma-Fix Environmental Services, Inc.

POLICY: The Compensation Plan is designed to retain, motivate and reward the incumbent to support and achieve the business, operating and financial objectives of Perma-Fix Environmental Services, Inc. (the “Company”).

BASE SALARY: The Base Salary indicated below is paid in equal periodic installments per the regularly scheduled payroll.

PERFORMANCE INCENTIVE COMPENSATION: Performance Incentive Compensation is available based on the Company’s financial results noted in the COO MIP Matrix below. Effective date of plan is January 1, 2016 and incentive will be for entire year of 2016. Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based on final Form 10-K financial statement.

SEPARATION: If employment is separated prior to the annual incentive compensation payment date as noted above, no incentive compensation is due to the incumbent.

ACKNOWLEDGEMENT: Payment of Performance Incentive Compensation of any type will be forfeited, unless the Human Resources Department has received a signed acknowledgement of receipt of the Compensation Plan prior to the applicable payment date.

INTERPRETATIONS: The Compensation Committee of the Board of Directors retains the right to modify, change or terminate the Compensation Plan at any time and for any reason. It also reserves the right to determine the final interpretation of any provision contained in the Compensation Plan and it reserves the right to modify or change the Revenue and EBITDA Targets as defined herein in the event of the sale or disposition of any of the assets of the Company. While the plan is intended to represent all situations and circumstances, some issues may not easily be addressed. The Compensation Committee will endeavor to review all standard and non-standard issues related to the Compensation Plan and will provide quick interpretations that are in the best interest of the Company, its shareholders and the incumbent.

CHIEF OPERATING OFFICER

Base Pay and Performance Incentive Compensation Targets

The compensation for the below named individual as follows:

|

Annualized Base Pay: |

|

$ |

215,000 |

|

|

Performance Incentive Compensation Target (at 100% of Plan): |

|

$ |

107,500 |

|

|

Total Annual Target Compensation (at 100% of Plan): |

|

$ |

322,500 |

|

The Performance Incentive Compensation Target is based on the COO MIP Matrix below.

COO MIP MATRIX

2016

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

TARGET |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue Target |

|

<$56,000,000 |

|

|

$ |

56,000,000 |

|

|

$ |

68,000,000 |

|

|

$ |

80,000,000 |

|

|

$ |

96,000,000 |

|

|

$ |

112,000,000 |

|

|

$ |

128,000,000 |

|

|

EBITDA Target |

|

<$6,370,000 |

|

|

$ |

6,370,000 |

|

|

$ |

7,735,000 |

|

|

$ |

9,100,000 |

|

|

$ |

10,920,000 |

|

|

$ |

12,740,000 |

|

|

$ |

14,560,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Performance Incentive Target |

|

|

0 |

% |

|

|

10 |

% |

|

|

50 |

% |

|

|

100 |

% |

|

|

130 |

% |

|

|

170 |

% |

|

|

200 |

% |

|

% of Target Achieved |

|

<70 |

% |

|

|

70%-84 |

% |

|

|

85%-99 |

% |

|

|

100%-119 |

% |

|

|

120%-139 |

% |

|

|

140%-159 |

% |

|

160% |

+ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

- |

|

|

$ |

1,074 |

|

|

$ |

5,374 |

|

|

$ |

10,750 |

|

|

$ |

15,357 |

|

|

$ |

21,500 |

|

|

$ |

26,107 |

|

|

EBITDA |

|

|

- |

|

|

|

6,450 |

|

|

|

32,250 |

|

|

|

64,500 |

|

|

|

92,143 |

|

|

|

129,000 |

|

|

|

156,643 |

|

|

Health and Safety |

|

|

- |

|

|

|

1,613 |

|

|

|

8,063 |

|

|

|

16,125 |

|

|

|

16,125 |

|

|

|

16,125 |

|

|

|

16,125 |

|

|

Permit & License Violations |

|

|

- |

|

|

|

1,613 |

|

|

|

8,063 |

|

|

|

16,125 |

|

|

|

16,125 |

|

|

|

16,125 |

|

|

|

16,125 |

|

| |

|

$ |

- |

|

|

$ |

10,750 |

|

|

$ |

53,750 |

|

|

$ |

107,500 |

|

|

$ |

139,750 |

|

|

$ |

182,750 |

|

|

$ |

215,000 |

|

| |

|

|

1) |

Revenue is defined as the total consolidated third party top line revenue from continuing operations (excluding Perma-Fix Medical S.A. (“PF Medical”) for 2016) as publicly reported in the Company’s 2016 financial statements. The percentage achieved is determined by comparing the actual consolidated revenue from continuing operations to the Board approved Revenue Target from continuing operations, which is $80,000,000. The Board reserves the right to modify or change the Revenue Targets as defined herein in the event of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

|

2) |

EBITDA is defined as earnings before interest, taxes, depreciation, and amortization from continuing operations, excluding PF Medical. The percentage achieved is determined by comparing the actual EBITDA to the Board approved EBITDA Target for 2016, which is $9,100,000. The Board reserves the right to modify or change the EBITDA Targets as defined herein in the event of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

|

3) |

The Health and Safety Incentive target is based upon the actual number of Worker’s Compensation Lost Time Accidents, as provided by the Company’s Worker’s Compensation carrier. The Corporate Controller will submit a report on a quarterly basis documenting and confirming the number of Worker’s Compensation Lost Time Accidents, supported by the Worker’s Compensation Loss Report provided by the company’s carrier or broker. Such claims will be identified on the loss report as “indemnity claims.” The following number of Worker’s Compensation Lost Time Accidents and corresponding Performance Target Thresholds has been established for the annual Incentive Compensation Plan calculation for 2016. |

|

Work Comp.

Claim Number |

|

Performance

Target |

|

6 |

|

70%-84% |

|

5 |

|

85%-99% |

|

4 |

|

100%-119% |

|

3 |

|

120%-139% |

|

2 |

|

140%-159% |

|

1 |

|

160%+ |

|

4) |

Permits or License Violations incentive is earned/determined according to the scale set forth below: An “official notice of non-compliance” is defined as an official communication during 2016 from a local, state, or federal regulatory authority alleging one or more violations of an otherwise applicable Environmental, Health or Safety requirement or permit provision, which results in a facility’s implementation of corrective action(s). |

|

Permit and

License Violations |

|

Performance

Target |

|

6 |

|

70%-84% |

|

5 |

|

85%-99% |

|

4 |

|

100%-119% |

|

3 |

|

120%-139% |

|

2 |

|

140%-159% |

|

1 |

|

160%+ |

| |

|

|

|

5) |

No performance incentive compensation will be payable for achieving the health and safety, permit and license violation, and revenue targets unless a minimum of 70% of the EBITDA Target is achieved. |

Performance Incentive Compensation Payment

Effective date of plan is January 1, 2016. Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based on final Form 10-K financial statement.

In no event will Performance Incentive Compensation paid to all Executive Officers as a group exceed 50% of Pretax Net Income exclusive of PF Medical computed prior to the calculation of bonus expense. If applicable, Incentive Compensation payments will be reduced on a pro-rata basis, so not to exceed 50% of Pretax Net Income.

ACKNOWLEDGMENT:

I acknowledge receipt of the aforementioned Chief Operating Officer 2016 - Compensation Plan. I have read and understand and accept employment under the terms and conditions set forth therein.

|

/s/John Lash |

|

2/9/16 |

|

|

|

/S/ John Lash |

|

Date |

|

|

| |

|

|

|

|

|

/s/Dr. Gary Kugler |

|

2/9/16 |

|

|

|

/S/ Board of Directors |

|

Date |

|

|

Exhibit 99.3

CHIEF FINANCIAL OFFICER

Effective: January 1, 2016

CHIEF FINANCIAL OFFICER

PURPOSE: To define the compensation plan for the Chief Financial Officer.

SCOPE: Perma-Fix Environmental Services, Inc.

POLICY: The Compensation Plan is designed to retain, motivate and reward the incumbent to support and achieve the business, operating and financial objectives of Perma-Fix Environmental Services, Inc. (the “Company”).

BASE SALARY: The Base Salary indicated below is paid in equal periodic installments per the regularly scheduled payroll.

PERFORMANCE INCENTIVE COMPENSATION: Performance Incentive Compensation is available based on the Company’s financial results noted in the CFO MIP Matrix below. Effective date of plan is January 1, 2016 and incentive will be for entire year of 2016. Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based on final 10-K financial statement.

SEPARATION: If employment is separated prior to the annual incentive compensation payment date as noted above, no incentive compensation is due to the incumbent.

ACKNOWLEDGEMENT: Payment of Performance Incentive Compensation of any type will be forfeited, unless the Human Resources Department has received a signed acknowledgement of receipt of the Compensation Plan prior to the applicable payment date.

INTERPRETATIONS: The Compensation Committee of the Board of Directors retains the right to modify, change or terminate the Compensation Plan at any time and for any reason. It also reserves the right to determine the final interpretation of any provision contained in the Compensation Plan and it reserves the right to modify or change the Revenue and EBITDA Targets as defined herein in the event of the sale or disposition of any of the assets of the Company. While the plan is intended to represent all situations and circumstances, some issues may not easily be addressed. The Compensation Committee will endeavor to review all standard and non-standard issues related to the Compensation Plan and will provide quick interpretations that are in the best interest of the Company, its shareholders and the incumbent.

CHIEF FINANCIAL OFFICER

Base Pay and Performance Incentive Compensation Targets

The compensation for the below named individual as follows:

|

Annualized Base Pay: |

|

$ |

220,667 |

|

|

Performance Incentive Compensation Target (at 100% of Plan): |

|

$ |

110,334 |

|

|

Total Annual Target Compensation (at 100% of Plan): |

|

$ |

331,001 |

|

The Performance Incentive Compensation Target is based on the CFO MIP Matrix below.

CFO MIP Matrix

2016

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

TARGET |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue Target |

|

<$56,000,000 |

|

|

$ |

56,000,000 |

|

|

$ |

68,000,000 |

|

|

$ |

80,000,000 |

|

|

$ |

96,000,000 |

|

|

$ |

112,000,000 |

|

|

$ |

128,000,000 |

|

|

EBITDA Target |

|

<$6,370,000 |

|

|

$ |

6,370,000 |

|

|

$ |

7,735,000 |

|

|

$ |

9,100,000 |

|

|

$ |

10,920,000 |

|

|

$ |

12,740,000 |

|

|

$ |

14,560,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Performance Incentive Target |

|

|

0 |

% |

|

|

10 |

% |

|

|

50 |

% |

|

|

100 |

% |

|

|

130 |

% |

|

|

170 |

% |

|

|

200 |

% |

|

% of Target Achieved |

|

<70 |

% |

|

|

70%-84 |

% |

|

|

85%-99 |

% |

|

|

100%-119 |

% |

|

|

120%-139 |

% |

|

|

140%-159 |

% |

|

160% |

+ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

- |

|

|

$ |

1,103 |

|

|

$ |

5,517 |

|

|

$ |

11,034 |

|

|

$ |

15,762 |

|

|

$ |

22,067 |

|

|

$ |

26,795 |

|

|

EBITDA |

|

|

- |

|

|

|

6,620 |

|

|

|

33,100 |

|

|

|

66,200 |

|

|

|

94,572 |

|

|

|

132,400 |

|

|

|

160,772 |

|

|

Health and Safety |

|

|

- |

|

|

|

1,655 |

|

|

|

8,275 |

|

|

|

16,550 |

|

|

|

16,550 |

|

|

|

16,550 |

|

|

|

16,550 |

|

|

Permit & License Violations |

|

|

- |

|

|

|

1,655 |

|

|

|

8,275 |

|

|

|

16,550 |

|

|

|

16,550 |

|

|

|

16,550 |

|

|

|

16,550 |

|

| |

|

$ |

- |

|

|

$ |

11,033 |

|

|

$ |

55,167 |

|

|

$ |

110,334 |

|

|

$ |

143,434 |

|

|

$ |

187,567 |

|

|

$ |

220,667 |

|

|

1) |

Revenue is defined as the total consolidated third party top line revenue from continuing operations (excluding Perma-Fix Medical S.A. (“PF Medical”) for 2016) as publicly reported in the Company’s 2016 financial statements. The percentage achieved is determined by comparing the actual consolidated revenue from continuing operations to the Board approved Revenue Target from continuing operations, which is $80,000,000. The Board reserves the right to modify or change the Revenue Targets as defined herein in the event of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

|

2) |

EBITDA is defined as earnings before interest, taxes, depreciation, and amortization from continuing operations, excluding PF Medical. The percentage achieved is determined by comparing the actual EBITDA to the Board approved EBITDA Target for 2016, which is $9,100,000. The Board reserves the right to modify or change the EBITDA Targets as defined herein in the event of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

|

3) |

The Health and Safety Incentive Target is based upon the actual number of Worker’s Compensation Lost Time Accidents, as provided by the Company’s Worker’s Compensation carrier. The Corporate Controller will submit a report on a quarterly basis documenting and confirming the number of Worker’s Compensation Lost Time Accidents, supported by the Worker’s Compensation Loss Report provided by the company’s carrier or broker. Such claims will be identified on the loss report as “indemnity claims.” The following number of Worker’s Compensation Lost Time Accidents and corresponding Performance Target Thresholds has been established for the annual Incentive Compensation Plan calculation for 2016. |

|

Work Comp.

Claim Number |

|

Performance

Target |

|

6 |

|

70%-84% |

|

5 |

|

85%-99% |

|

4 |

|

100%-119% |

|

3 |

|

120%-139% |

|

2 |

|

140%-159% |

|

1 |

|

160%+ |

|

4) |

Permits or License Violations incentive is earned/determined according to the scale set forth below: An “official notice of non-compliance” is defined as an official communication during 2016 from a local, state, or federal regulatory authority alleging one or more violations of an otherwise applicable Environmental, Health or Safety requirement or permit provision, which results in a facility’s implementation of corrective action(s). |

|

Permit and

License Violations |

|

Performance

Target |

|

6 |

|

70%-84% |

|

5 |

|

85%-99% |

|

4 |

|

100%-119% |

|

3 |

|

120%-139% |

|

2 |

|

140%-159% |

|

1 |

|

160%+ |

|

5) |

No performance incentive compensation will be payable for achieving the health and safety, permit and license violation, and revenue targets unless a minimum of 70% of the EBITDA Target is achieved. |

Performance Incentive Compensation Payment

Effective date of plan is January 1, 2016 and incentive will be for entire year. Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based on final Form 10-K financial statement.

In no event will Performance Incentive Compensation paid to all Executive Officers as a group exceed 50% of Pretax Net Income exclusive of PF Medical computed prior to the calculation of bonus expense. If applicable, Incentive Compensation payments will be reduced on a pro-rata basis, so not to exceed 50% of Pretax Net Income.

ACKNOWLEDGMENT:

I acknowledge receipt of the aforementioned Chief Financial Officer 2016 - Compensation Plan. I have read and understand and accept employment under the terms and conditions set forth therein.

|

/s/ Ben Naccarato |

|

|

2/9/16 |

|

|

|

/s/Ben Naccarato |

|

|

Date |

|

|

| |

|

|

|

|

|

|

/s/Dr. Gary Kugler |

|

|

2/9/16 |

|

|

|

/s/ Board of Director |

|

|

Date |

|

|

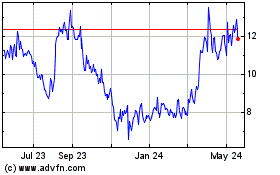

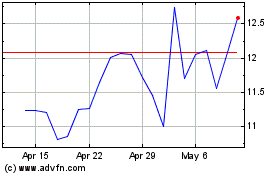

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Mar 2024 to Apr 2024

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Apr 2023 to Apr 2024