UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): February 11, 2016

PBF ENERGY INC.

PBF ENERGY COMPANY LLC

PBF HOLDING COMPANY LLC

(Exact Name of Registrant as Specified in its Charter)

|

| | |

Delaware | 001-35764 | 45-3763855 |

Delaware | 333-206728-02 | 61-1622166 |

Delaware | 333-186007 | 27-2198168 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

_____________________________________________

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

(Address of the Principal Executive Offices) (Zip Code)

(973) 455-7500

(Registrant’s Telephone Number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

⃞ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⃞ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

⃞ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

⃞ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 - Results of Operations and Financial Condition.

On February 11, 2016, PBF Energy Inc. (the “Company”) issued a press release announcing the Company's financial and operating results for the fourth quarter and year ended December 31, 2015, which include the operating results of its consolidated subsidiaries, PBF Energy Company LLC and PBF Holding Company LLC. A copy of the press release is furnished with this Current Report as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report is being “furnished” pursuant to Item 2.02 of Form 8-K, and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Accordingly, the information in Item 2.02 of this Current Report, including the press release (Exhibit 99.1), will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits

|

| |

Exhibit No. | Description |

| |

99.1 | Press release announcing fourth quarter and full year results, dated February 11, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

| | | | |

Dated: | February 11, 2016 | | |

| | | |

| | PBF Energy Inc. |

| | (Registrant) |

| | | | |

| | By: | /s/ Erik Young | |

| | Name: | Erik Young |

| | Title: | Senior Vice President, Chief Financial |

| | | Officer |

|

| | | | |

Dated: | February 11, 2016 | | |

| | | |

| | PBF Energy Company LLC |

| | (Registrant) |

| | | | |

| | By: | /s/ Erik Young | |

| | Name: | Erik Young |

| | Title: | Senior Vice President, Chief Financial |

| | | Officer |

|

| | | | |

Dated: | February 11, 2016 | | |

| | | |

| | PBF Holding Company LLC |

| | (Registrant) |

| | | | |

| | By: | /s/ Erik Young | |

| | Name: | Erik Young |

| | Title: | Senior Vice President, Chief Financial |

| | | Officer |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

| |

99.1 | Press release announcing fourth quarter and full year results, dated February 11, 2016 |

PBF Energy Reports Fourth Quarter and Full Year 2015 Results,

Declares Dividend of $0.30 Per Share

| |

• | 2015 EBITDA of $1.0 billion, fourth quarter EBITDA of $221.9 million, excluding special items |

| |

• | Fourth quarter adjusted fully-converted EPS of $0.70, based on adjusted fully-converted net income of $71.0 million, excluding special items (GAAP loss per share of $1.24, based on a GAAP net loss of $119.5 million) |

| |

• | Closed the Chalmette refinery acquisition and announced the pending Torrance refinery acquisition |

| |

• | Successfully raised $850 million of equity and debt financing |

| |

• | Declares quarterly dividend of $0.30 per share |

PARSIPPANY, NJ - February 11, 2016 - PBF Energy Inc. (NYSE:PBF) today reported fourth quarter 2015 operating income, excluding special items, of $167.7 million versus operating income of $208.6 million for the fourth quarter of 2014. Special items in the fourth quarter 2015 results include two notable non-cash, after-tax items, a $209.0 million lower-of-cost-or-market ("LCM") inventory charge and a $12.3 million benefit related to a change in a tax receivable agreement liability.

Adjusted fully-converted net income for the fourth quarter 2015, excluding special items, was $71.0 million, or $0.70 per share on a fully-exchanged, fully-diluted basis, as described below, compared to adjusted fully-converted net income of $104.8 million, or $1.13 per share, for the fourth quarter 2014. On a GAAP basis, the company reported a fourth quarter 2015 net loss of $121.5 million, and net loss attributable to PBF Energy Inc. of $119.5 million or $1.24 per share. This compares to a GAAP net loss of $320.8 million, and net loss attributable to PBF Energy Inc. of $277.6 million or $3.34 per share for the fourth quarter 2014. PBF Energy's financial results reflect the consolidation of the financial results of PBF Logistics LP (NYSE: PBFX), a master limited partnership of which PBF indirectly owns the general partner and approximately 53.7% of the limited partner interests as of quarter-end.

For the year-ended December 31, 2015, operating income, excluding special items, was $787.3 million, compared to $837.8 million for the corresponding period in 2014. Adjusted fully-converted net income for the year, excluding special items, was $402.1 million, or $4.27 per share on a fully-exchanged, fully-diluted basis, as compared to $433.5 million, or $4.50 per share, on a fully-exchanged, fully-diluted basis, for the corresponding period in 2014. Net income attributable to PBF Energy Inc. for the year was $146.4 million, or $1.66 per share as compared to a net loss of $38.2 million, or $0.51 per share, for the year-ended December 31, 2014.

Tom Nimbley, PBF Energy's CEO, said, “2015 was a transformational year for PBF. Our strong operating results, particularly those from our East Coast assets, and our recently integrated Chalmette refinery, reflect the benefits of the optionality that we have built into our refining system. This optionality provides us with the flexibility to pursue the most economic barrels for our system and maximize the profitability of our assets by operating them as an integrated system.” Mr. Nimbley continued, “We have added meaningful scale to the company by closing on the Chalmette acquisition and announcing the Torrance refinery transaction. With these two acquisitions, upon closing of Torrance, we will have solidified PBF's position as the fourth largest independent refiner in North America and added meaningful diversification to our refining system with the addition of Gulf Coast and West Coast assets. Looking ahead, our focus remains on delivering safe and strong operational performance and on fully integrating and optimizing our newest assets.”

Total throughput for the fourth quarter averaged approximately 629,900 barrels per day, which was at the top end of our guidance and includes two months of operations from the Chalmette refinery. Throughput in the Mid-Continent averaged approximately 156,900 barrels per day, throughput on the East Coast averaged approximately 346,600 barrels per day and throughput on the Gulf Coast averaged approximately 190,800 barrels per day for the two months of operations under PBF's ownership.

Successfully raised $850.0 million of equity and debt financing through two capital markets transactions

October 13, 2015, PBF announced that it had closed its underwritten public offering of shares of its Class A common stock. Gross proceeds of the offering were approximately $350.0 million.

On November 24, 2015, PBF's indirect subsidiary, PBF Holding Company LLC (“PBF Holding”), closed its senior secured notes offering of $500.0 million in aggregate principal amount of 7.0% senior secured notes due 2023.

Previously announced Chalmette Refining LLC and pending Torrance refinery acquisitions

On November 1, 2015, PBF's subsidiary, PBF Holding, successfully closed its previously announced transaction to purchase Chalmette Refining, LLC, through which it acquired the 189,000 barrel per day Chalmette refinery and related logistics assets, from ExxonMobil and PDV Chalmette, LLC.

On September 30, 2015, PBF announced that its indirect subsidiary, PBF Holding, signed a definitive agreement to purchase the 155,000 barrel per day Torrance refinery, and related logistics assets, from ExxonMobil. The purchase price for the assets is $537.5 million, plus working capital to be valued at closing. The Torrance transaction is expected to close in the second quarter of 2016, subject to customary closing conditions and regulatory approvals. The refinery will be restored to full working order prior to close.

PBF Energy Inc. Declares Dividend

The company announced today that it will pay a quarterly dividend of $0.30 per share of Class A common stock on March 8, 2016 to holders of record as of February 22, 2016.

PBF Energy Inc. Share Repurchase Program

On August 19, 2014, PBF announced that its board of directors authorized the repurchase of up to $200 million of PBF Class A common stock. On October 29, 2014, the board of directors approved a $100 million increase to the existing authorization, for a total repurchase authorization of $300 million. The repurchase authorization expires on September 30, 2016.

These repurchases may be made from time to time through various methods, including open market transactions, block trades, accelerated share repurchases, privately negotiated transactions or otherwise, certain of which may be effected through Rule 10b5-1 and Rule 10b-18 plans. The timing and number of shares repurchased will depend on a variety of factors, including price, capital availability, legal requirements and economic and market conditions. PBF is not obligated to purchase any shares under the repurchase program, and repurchases may be suspended or discontinued at any time without prior notice.

There were no repurchases made during the fourth quarter of 2015. As of the end the fourth quarter, 6,050,717 shares of Class A common stock have been repurchased at an average price of approximately $24.90 per share, excluding broker fees. After giving effect to shares already purchased under the program, the company has approximately $149 million of available repurchasing authorization under the program going forward. At the end of the quarter, there were an aggregate of 102,767,291 shares of Class A common stock and PBF Energy Company LLC Series A Units outstanding.

Adjusted Fully-Converted Results

Adjusted fully-converted results assume the exchange of all PBF Energy Company LLC Series A Units and dilutive securities into shares of PBF Energy Inc. Class A common stock on a one-for-one basis, resulting in the elimination of the noncontrolling interest and a corresponding adjustment to the company's tax provision.

Non-GAAP Measures

This earnings release, and the discussion during the management conference call, may include references to non-GAAP (Generally Accepted Accounting Principles) measures including Adjusted Fully-Converted Net Income, Adjusted Fully-Converted Net Income per fully-exchanged, fully-diluted share, gross refining margin, gross refining margin per barrel of throughput, EBITDA (Earnings before Interest, Income Taxes, Depreciation and Amortization) and Adjusted EBITDA, as well as such measures excluding the impact of non-cash special items. PBF Energy Inc. believes that non-GAAP financial measures provide useful information about its operating performance and financial results. However, these measures have important limitations as analytical tools and should not be viewed in isolation or considered as alternatives for, or superior to, comparable GAAP financial measures. PBF Energy Inc.'s non-GAAP financial measures may also differ from similarly

named measures used by other companies. See the accompanying tables and footnotes in this release for additional information on the non-GAAP measures used in this release and reconciliations to the most directly comparable GAAP measures.

Conference Call Information

PBF Energy's senior management will host a conference call regarding earnings results and other business matters on Thursday, February 11, 2016, at 8:30 a.m. ET. The call can be heard by dialing (877) 876-9177 or (785) 424-1666, conference ID: PBFQ415. The audio replay will be available approximately two hours after the end of the call through February 27, 2016, by dialing (800) 388-6509 or (402) 220-1111. The call will also be webcast and can be accessed at PBF Energy's website, http://www.pbfenergy.com.

Forward-Looking Statements

Statements in this press release relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which may be beyond the company's control, that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors and uncertainties that may cause actual results to differ include but are not limited to the risks disclosed in the company's filings with the SEC, as well as the risks disclosed in PBF Logistics LP's SEC filings and any impact PBF Logistics LP may have on the company's credit rating, cost of funds, employees, customers and vendors; risks relating to the securities markets generally; satisfaction of the conditions to the closing of the Torrance acquisition and the possibility that the Torrance acquisition will not close; timing of the completion of the Torrance acquisition; the company's plans for financing the Torrance acquisition; and the impact of adverse market conditions affecting the company, unanticipated developments, regulatory approvals, changes in laws and other events that negatively impact the company. All forward-looking statements speak only as of the date hereof. The company undertakes no obligation to revise or update any forward-looking statements except as may be required by applicable law.

About PBF Energy Inc.

PBF Energy Inc. (NYSE:PBF) is one of the largest independent refiners in North America, operating, through its subsidiaries, oil refineries and related facilities in Delaware, New Jersey, Ohio and Louisiana. Our mission is to operate our facilities in a safe, reliable and environmentally responsible manner, provide employees with a safe and rewarding workplace, become a positive influence in the communities where we do business, and provide superior returns to our investors.

PBF Energy Inc. also currently indirectly owns the general partner and approximately 53.7% of the limited partnership interest of PBF Logistics LP (NYSE: PBFX).

Contacts:

Colin Murray (investors)

ir@pbfenergy.com

Tel: 973.455.7578

Michael C. Karlovich (media)

mediarelations@pbfenergy.com

Tel: 973.455.8994

|

| | | | | | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

EARNINGS RELEASE TABLES |

CONSOLIDATED STATEMENTS OF OPERATIONS |

(Unaudited, in thousands, except share and per share data) |

| | | | | | | | | | | | |

| | | | | | Three Months Ended | | Year Ended |

| | | | | | December 31, | | December 31, |

| | | | | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | | | | | |

Revenues | | $ | 3,360,489 |

| | $ | 4,520,000 |

| | $ | 13,123,929 |

| | $ | 19,828,155 |

|

| | | | | | | | | | | | |

Costs and expenses: | | | | | | | | | |

| Cost of sales, excluding depreciation | | 3,162,210 |

| | 4,717,155 |

| | 11,481,614 |

| | 18,471,203 |

|

| Operating expenses, excluding depreciation | | 268,577 |

| | 200,894 |

| | 904,525 |

| | 883,140 |

|

| General and administrative expenses | | 54,919 |

| | 39,695 |

| | 181,266 |

| | 146,661 |

|

| Loss (gain) loss on sale of assets | | 129 |

| | (733 | ) | | (1,004 | ) | | (895 | ) |

| Depreciation and amortization expense | | 53,016 |

| | 44,495 |

| | 197,417 |

| | 180,382 |

|

| | | | | | 3,538,851 |

| | 5,001,506 |

| | 12,763,818 |

| | 19,680,491 |

|

| | | | | | | | | | | | |

(Loss) income from operations | | (178,362 | ) | | (481,506 | ) | | 360,111 |

| | 147,664 |

|

| | | | | | | | | | | | |

Other income (expense) | | | | | | | | | |

| Change in tax receivable agreement liability | | 20,365 |

| | — |

| | 18,150 |

| | 2,990 |

|

| Change in fair value of catalyst lease | | 1,202 |

| | 2,765 |

| | 10,184 |

| | 3,969 |

|

| Interest expense, net | | (29,093 | ) | | (22,933 | ) | | (106,187 | ) | | (98,764 | ) |

(Loss) income before income taxes | | (185,888 | ) | | (501,674 | ) | | 282,258 |

| | 55,859 |

|

Income tax (benefit) expense | | (64,347 | ) | | (180,825 | ) | | 86,725 |

| | (22,412 | ) |

Net (loss) income | | (121,541 | ) | | (320,849 | ) | | 195,533 |

| | 78,271 |

|

| Less: net (loss) income attributable to noncontrolling interest | | (2,012 | ) | | (43,238 | ) | | 49,132 |

| | 116,508 |

|

Net (loss) income attributable to PBF Energy Inc. | | $ | (119,529 | ) | | $ | (277,611 | ) | | $ | 146,401 |

| | $ | (38,237 | ) |

| | | | | | | | | | | | |

Net (loss) income available to Class A common stock per share: | | | | | | | | |

| | Basic | | $ | (1.24 | ) | | $ | (3.34 | ) | | $ | 1.66 |

| | $ | (0.51 | ) |

| | Diluted | | $ | (1.24 | ) | | $ | (3.34 | ) | | $ | 1.65 |

| | $ | (0.51 | ) |

| | Weighted-average shares outstanding-basic | | 96,135,314 |

| | 83,130,507 |

| | 88,106,999 |

| | 74,464,494 |

|

| | Weighted-average shares outstanding-diluted | | 96,135,314 |

| | 83,130,507 |

| | 94,138,850 |

| | 74,464,494 |

|

| | | | | | | | | | | | |

Dividends per common share | | $ | 0.30 |

| | $ | 0.30 |

| | $ | 1.20 |

| | $ | 1.20 |

|

| | | | | | | | | | | | |

Adjusted fully-converted net (loss) income and adjusted fully-converted net (loss) income per fully exchanged, fully diluted shares outstanding (Note 1): | | | | | | | | |

| | Adjusted fully-converted net (loss) income | | $ | (125,738 | ) | | $ | (307,899 | ) | | $ | 155,012 |

| | $ | 22,620 |

|

| | Adjusted fully-converted net (loss) income per fully exchanged, fully diluted share | | $ | (1.23 | ) | | $ | (3.32 | ) | | $ | 1.65 |

| | $ | 0.24 |

|

| | Adjusted fully-converted shares outstanding - diluted | | 102,010,309 |

| | 92,806,491 |

| | 94,138,850 |

| | 96,231,446 |

|

| | | | | | | | | | | | |

| | | | | | | | | | | | |

See Footnotes to Earnings Release Tables |

|

| | | | | | | | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

RECONCILIATION OF AMOUNTS REPORTED UNDER U.S. GAAP |

(Unaudited, in thousands, except share and per share data) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | Three Months Ended | | Year Ended | |

RECONCILIATION OF NET INCOME TO | December 31, | | December 31, | |

ADJUSTED FULLY-CONVERTED NET INCOME (Note 1) | 2015 | | 2014 | | 2015 | | 2014 | |

| | | | | | | | |

Net (loss) income attributable to PBF Energy Inc. | $ | (119,529 | ) | | $ | (277,611 | ) | | $ | 146,401 |

| | $ | (38,237 | ) | |

| Add: | Net (loss) income attributable to the noncontrolling interest (Note 2) | (10,279 | ) | | (50,648 | ) | | 14,257 |

| | 101,768 |

| |

| Less: | Income tax expense (benefit) (Note 3) | 4,070 |

| | 20,360 |

| | (5,646 | ) | | (40,911 | ) | |

Adjusted fully-converted net (loss) income | $ | (125,738 | ) | | $ | (307,899 | ) | | $ | 155,012 |

| | $ | 22,620 |

| |

Special Items (Note 4): | | | | | | | | |

| Add: | Non-cash LCM inventory adjustment (Note 5) | 346,079 |

| | 690,110 |

| | 427,226 |

| | 690,110 |

| |

| Add: | Change in tax receivable agreement liability (Note 15) | (20,365 | ) | | — |

| | (18,150 | ) | | (2,990 | ) | |

| Less: | Recomputed income taxes on special items (Note 5, Note 15) | (128,983 | ) | | (277,424 | ) | | (161,994 | ) | | (276,222 | ) | |

Adjusted fully-converted net income (loss) excluding special items (Note 4) | $ | 70,993 |

| | $ | 104,787 |

| | $ | 402,094 |

| | $ | 433,518 |

| |

| | | | | | | | | | | | | | |

Diluted weighted-average shares outstanding of PBF Energy Inc. (Note 6) | 96,135,314 |

| | 83,130,507 |

| | 88,106,999 |

| | 74,464,494 |

| |

| Conversion of PBF LLC Series A Units (Note 7) | 5,046,988 |

| | 9,170,696 |

| | 5,530,568 |

| | 21,249,314 |

| |

| Common stock equivalents (Note 6) | 828,007 |

| | 505,288 |

| | 501,283 |

| | 517,638 |

| |

Fully-converted shares outstanding - diluted | 102,010,309 |

| | 92,806,491 |

| | 94,138,850 |

| | 96,231,446 |

| |

| | | | | | | | | | | | | | |

Adjusted fully-converted net (loss) income (per fully exchanged, fully diluted shares outstanding) | $ | (1.23 | ) | | $ | (3.32 | ) | | $ | 1.65 |

| | $ | 0.24 |

| |

| | | | | | | | | | | | | | |

Adjusted fully-converted net income excluding special items (per fully exchanged, fully diluted shares outstanding) (Note 4) | $ | 0.70 |

| | $ | 1.13 |

| | $ | 4.27 |

| | $ | 4.50 |

| |

| | | | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| Three Months Ended | | Year Ended | |

RECONCILIATION OF INCOME (LOSS) FROM OPERATIONS TO | December 31, | | December 31, | |

INCOME FROM OPERATIONS EXCLUDING SPECIAL ITEMS | 2015 | | 2014 | | 2015 | | 2014 | |

| | | | | | | | | | |

Income (Loss) from operations | $ | (178,362 | ) | | $ | (481,506 | ) | | $ | 360,111 |

| | $ | 147,664 |

| |

Special Items (Note 4): | | | | | | | | |

| Add: | Non-cash LCM inventory adjustment (Note 5) | 346,079 |

| | 690,110 |

| | 427,226 |

| | 690,110 |

| |

Income from operations excluding special items (Note 4) | $ | 167,717 |

| | $ | 208,604 |

| | $ | 787,337 |

| | $ | 837,774 |

| |

| | | | | | | | | | | | | | |

| | | | | | | | |

See Footnotes to Earnings Release Tables |

|

| | | | | | | | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

RECONCILIATION OF AMOUNTS REPORTED UNDER U.S. GAAP |

EBITDA RECONCILIATIONS (Note 8) |

(Unaudited, in thousands, except share and per share data) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | Three Months Ended | | Year Ended | |

RECONCILIATION OF NET INCOME (LOSS) TO EBITDA | December 31, | | December 31, | |

| 2015 | | 2014 | | 2015 | | 2014 | |

| | | | | | | | | | | | | | |

Net (loss) income | $ | (121,541 | ) | | $ | (320,849 | ) | | $ | 195,533 |

| | $ | 78,271 |

| |

| Add: | Depreciation and amortization expense | 53,016 |

| | 44,495 |

| | 197,417 |

| | 180,382 |

| |

| Add: | Interest expense, net | 29,093 |

| | 22,933 |

| | 106,187 |

| | 98,764 |

| |

| Add: | Income tax (benefit) expense | (64,347 | ) | | (180,825 | ) | | 86,725 |

| | (22,412 | ) | |

EBITDA | $ | (103,779 | ) | | $ | (434,246 | ) | | $ | 585,862 |

| | $ | 335,005 |

| |

Special Items (Note 4): | | | | | | | | |

| Add: | Non-cash LCM inventory adjustment (Note 5) | 346,079 |

| | 690,110 |

| | 427,226 |

| | 690,110 |

| |

| Add: | Change in tax receivable agreement liability (Note 15) | (20,365 | ) | | — |

| | (18,150 | ) | | (2,990 | ) | |

EBITDA excluding special items (Note 4) | $ | 221,935 |

| | $ | 255,864 |

| | $ | 994,938 |

| | $ | 1,022,125 |

| |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | Three Months Ended | | Year Ended | |

RECONCILIATION OF EBITDA TO ADJUSTED EBITDA | December 31, | | December 31, | |

| 2015 | | 2014 | | 2015 | | 2014 | |

EBITDA | $ | (103,779 | ) | | $ | (434,246 | ) | | $ | 585,862 |

| | $ | 335,005 |

| |

| Add: | Non-cash LCM inventory adjustment (Note 5) | 346,079 |

| | 690,110 |

| | 427,226 |

| | 690,110 |

| |

| Add: | Stock based compensation | 4,741 |

| | 1,804 |

| | 13,497 |

| | 7,181 |

| |

| Add: | Change in tax receivable agreement liability (Note 15) | (20,365 | ) | | — |

| | (18,150 | ) | | (2,990 | ) | |

| Add: | Non-cash change in fair value of catalyst lease obligations | (1,202 | ) | | (2,765 | ) | | (10,184 | ) | | (3,969 | ) | |

Adjusted EBITDA | $ | 225,474 |

| | $ | 254,903 |

| | $ | 998,251 |

| | $ | 1,025,337 |

| |

|

See Footnotes to Earnings Release Tables |

|

| | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

EARNINGS RELEASE TABLES |

CONSOLIDATED BALANCE SHEET DATA |

(Unaudited, in thousands) |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | December 31, | | December 31, | |

| | | | | 2015 | | 2014 | |

Balance Sheet Data: | | | | | |

| Cash, cash equivalents and marketable securities | $ | 1,178,578 |

| | $ | 632,803 |

| |

| Inventories | 1,174,272 |

| | 1,102,261 |

| |

| Total assets | 6,105,124 |

| | 5,164,008 |

| |

| Total long-term debt | 1,840,355 |

| | 1,228,069 |

| |

| | | | | |

| Total equity | $ | 2,095,857 |

| | $ | 1,693,316 |

| |

| Special Items (Note 4): | | | | |

| Add: Non-cash LCM inventory adjustment (Note 5) | 427,226 |

| | 690,110 |

| |

| Add: Change in tax receivable agreement liability (Note 4)

| (18,150 | ) | | (2,990 | ) | |

| Less: Recomputed income taxes on special items (Note 5, Note 15) | (161,994 | ) | | (276,222 | ) | |

| Net impact of special items to equity | $ | 247,082 |

| | $ | 410,898 |

| |

| Total equity excluding special items (Note 4) | $ | 2,342,939 |

| | $ | 2,104,214 |

| |

| | | | | |

| Net debt to capitalization ratio | 24 | % | | 26 | % | |

| Net debt to capitalization ratio, excluding special items | 22 | % | | 22 | % | |

| Total debt to capitalization ratio | 47 | % | | 42 | % | |

| Total debt to capitalization ratio, excluding special items | 44 | % | | 37 | % | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

SUMMARIZED STATEMENT OF CASH FLOW DATA |

(Unaudited, in thousands) |

| | | | | | | | |

| | | | | Year Ended December 31, | |

| | | | | 2015 | | 2014 | |

Cash flows provided by operations | $ | 560,424 |

| | $ | 456,325 |

| |

Cash flows used in investing activities | (812,113 | ) | | (663,607 | ) | |

Cash flows provided by in financing activities | 798,136 |

| | 528,185 |

| |

Net increase in cash and cash equivalents | 546,447 |

| | 320,903 |

| |

Cash and cash equivalents, beginning of period | 397,873 |

| | 76,970 |

| |

Cash and cash equivalents, end of period | $ | 944,320 |

| | $ | 397,873 |

| |

| Marketable securities | 234,258 |

| | 234,930 |

| |

Net cash, cash equivalent and marketable securities | $ | 1,178,578 |

| | $ | 632,803 |

| |

| | | | | | | | |

See Footnotes to Earnings Release Tables

|

|

| | | | | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

EARNINGS RELEASE TABLES |

SEGMENT FINANCIAL INFORMATION (Note 9) |

(Unaudited, in thousands) |

| | | | | | | | | |

| Three Months Ended December 31, 2015 |

| Refining | | Logistics | | Corporate | | Eliminations | | Consolidated Total |

Revenues | $ | 3,360,489 |

| | $ | 37,306 |

| | $ | — |

| | $ | (37,306 | ) | | $ | 3,360,489 |

|

Depreciation and amortization | 49,330 |

| | 1,663 |

| | 2,023 |

| | — |

| | 53,016 |

|

Income (loss) from operations | (152,187 | ) | | 24,462 |

| | (50,637 | ) | | — |

| | (178,362 | ) |

Interest expense, net | 3,674 |

| | 7,189 |

| | 18,230 |

| | — |

| | 29,093 |

|

Capital expenditures (Note 16) | $ | 637,351 |

| | $ | 864 |

| | $ | 6,956 |

| | $ | — |

| | $ | 645,171 |

|

| | | | | | | | | |

| Three Months Ended December 31, 2014 |

| Refining | | Logistics | | Corporate | | Eliminations | | Consolidated Total |

Revenues | $ | 4,520,000 |

| | $ | 29,994 |

| | $ | — |

| | $ | (29,994 | ) | | $ | 4,520,000 |

|

Depreciation and amortization | 39,468 |

| | 1,567 |

| | 3,460 |

| | — |

| | 44,495 |

|

Income (loss) from operations | (457,837 | ) | | 16,023 |

| | (39,692 | ) | | — |

| | (481,506 | ) |

Interest expense, net | 3,214 |

| | 1,489 |

| | 18,230 |

| | — |

| | 22,933 |

|

Capital expenditures | $ | 292,234 |

| | $ | 6,812 |

| | $ | 1,542 |

| | $ | — |

| | $ | 300,588 |

|

| | | | | | | | | |

| Year Ended December 31, 2015 |

| Refining | | Logistics | | Corporate | | Eliminations | | Consolidated Total |

Revenues | $ | 13,123,929 |

| | $ | 142,102 |

| | $ | — |

| | $ | (142,102 | ) | | $ | 13,123,929 |

|

Depreciation and amortization | 181,147 |

| | 6,582 |

| | 9,688 |

| | — |

| | 197,417 |

|

Income (loss) from operations | 441,033 |

| | 96,376 |

| | (177,298 | ) | | — |

| | 360,111 |

|

Interest expense, net | 17,061 |

| | 21,254 |

| | 67,872 |

| | — |

| | 106,187 |

|

Capital expenditures (Note 16) | $ | 969,895 |

| | $ | 2,046 |

| | $ | 9,139 |

| | $ | — |

| | $ | 981,080 |

|

| | | | | | | | | |

| Year Ended December 31, 2014 |

| Refining | | Logistics | | Corporate | | Eliminations | | Consolidated Total |

Revenues | $ | 19,828,155 |

| | $ | 59,403 |

| | $ | — |

| | $ | (59,403 | ) | | $ | 19,828,155 |

|

Depreciation and amortization | 162,326 |

| | 4,473 |

| | 13,583 |

| | — |

| | 180,382 |

|

Income (loss) from operations

| 283,646 |

| | 20,514 |

| | (156,496 | ) | | — |

| | 147,664 |

|

Interest expense, net

| 23,618 |

| | 2,672 |

| | 72,474 |

| | — |

| | 98,764 |

|

Capital expenditures

| $ | 577,896 |

| | $ | 47,805 |

| | $ | 5,631 |

| | $ | — |

| | $ | 631,332 |

|

| | | | | | | | | |

| Balance at December 31, 2015 |

| Refining | | Logistics | | Corporate | | Eliminations | | Consolidated Total |

| | | | | | | | | |

Total Assets | $ | 5,087,554 |

| | $ | 422,902 |

| | $ | 618,617 |

| | $ | (23,949 | ) | | $ | 6,105,124 |

|

| | | | | | | | | |

| | | | | | | | | |

| Balance at December 31, 2014 |

| Refining | | Logistics | | Corporate | | Eliminations | | Consolidated Total |

| | | | | | | | | |

Total Assets | $ | 4,312,618 |

| | $ | 407,989 |

| | $ | 455,031 |

| | $ | (11,630 | ) | | $ | 5,164,008 |

|

| | | | | | | | | |

See Footnotes to Earnings Release Tables

|

|

| | | | | | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

EARNINGS RELEASE TABLES |

MARKET INDICATORS AND KEY OPERATING INFORMATION |

(Unaudited, amounts in thousands except as indicated) |

| | | | | | | | | | | | |

| | | | | | Three Months Ended | | Year Ended |

| | | | | | December 31, | | December 31, |

Market Indicators (dollars per barrel) (Note 10) | 2015 | | 2014 | | 2015 | | 2014 |

Dated Brent Crude | $ | 43.68 |

| | $ | 76.58 |

| | $ | 52.56 |

| | $ | 98.95 |

|

West Texas Intermediate (WTI) crude oil | $ | 42.07 |

| | $ | 73.62 |

| | $ | 48.71 |

| | $ | 93.28 |

|

Light Louisiana Sweet (LLS) crude oil | $ | 43.53 |

| | $ | 76.58 |

| | $ | 52.36 |

| | $ | 96.92 |

|

Crack Spreads | | | | | | | |

| Dated Brent (NYH) 2-1-1 | $ | 12.16 |

| | $ | 11.87 |

| | $ | 16.35 |

| | $ | 12.92 |

|

| WTI (Chicago) 4-3-1 | $ | 13.06 |

| | $ | 11.44 |

| | $ | 17.91 |

| | $ | 15.92 |

|

| LLS (Gulf Coast) 2-1-1 | $ | 9.62 |

| | $ | 11.46 |

| | $ | 14.39 |

| | $ | 16.95 |

|

Crude Oil Differentials | | | | | | | |

| Dated Brent (foreign) less WTI | $ | 1.61 |

| | $ | 2.96 |

| | $ | 3.85 |

| | $ | 5.66 |

|

| Dated Brent less Maya (heavy, sour) | $ | 9.35 |

| | $ | 9.24 |

| | $ | 8.45 |

| | $ | 13.08 |

|

| Dated Brent less WTS (sour) | $ | 1.95 |

| | $ | 5.14 |

| | $ | 3.59 |

| | $ | 11.62 |

|

| Dated Brent less ASCI (sour) | $ | 4.97 |

| | $ | 4.37 |

| | $ | 4.57 |

| | $ | 6.49 |

|

| WTI less WCS (heavy, sour) | $ | 12.96 |

| | $ | 15.84 |

| | $ | 11.87 |

| | $ | 19.45 |

|

| WTI less Bakken (light, sweet) | $ | 1.03 |

| | $ | 6.28 |

| | $ | 2.89 |

| | $ | 5.47 |

|

| WTI less Syncrude (light, sweet) | $ | (2.07 | ) | | $ | 3.35 |

| | $ | (1.45 | ) | | $ | 2.25 |

|

Natural gas (dollars per MMBTU) | | | $ | 2.23 |

| | $ | 3.85 |

| | $ | 2.63 |

| | $ | 4.26 |

|

| | | | | | | | | | | | |

Key Operating Information | | | | | | | |

Production (barrels per day ("bpd") in thousands) | 636.6 |

| | 415.4 |

| | 511.9 |

| | 452.1 |

|

Crude oil and feedstocks throughput (bpd in thousands) | 629.9 |

| | 415.3 |

| | 516.4 |

| | 453.1 |

|

Total crude oil and feedstocks throughput (millions of barrels) | 57.9 |

| | 38.2 |

| | 188.4 |

| | 165.4 |

|

Gross refining margin, excluding special items, per barrel of throughput (Note 4, Note 11) | $ | 8.79 |

| | $ | 12.37 |

| | $ | 10.29 |

| | $ | 12.11 |

|

Operating expense per barrel of throughput (Note 12) | $ | 4.55 |

| | $ | 5.26 |

| | $ | 4.72 |

| | $ | 5.34 |

|

Crude and feedstocks (% of total throughput) (Note 13) | | | | | | | |

| Heavy | 17 | % | | 15 | % | | 14 | % | | 14 | % |

| Medium | 47 | % | | 46 | % | | 49 | % | | 44 | % |

| Light | 22 | % | | 28 | % | | 26 | % | | 33 | % |

| Other feedstocks and blends | | | 14 | % | | 11 | % | | 11 | % | | 9 | % |

| | Total throughput | | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

Yield (% of total throughput): | | | | | | | |

| Gasoline and gasoline blendstocks | 50 | % | | 48 | % | | 49 | % | | 47 | % |

| Distillates and distillate blendstocks | 35 | % | | 35 | % | | 35 | % | | 36 | % |

| Lubes | 1 | % | | 2 | % | | 1 | % | | 2 | % |

| Chemicals | 3 | % | | 3 | % | | 3 | % | | 3 | % |

| Other | 11 | % | | 12 | % | | 12 | % | | 12 | % |

| | Total yield | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| | | | | | | | | | | | |

See Footnotes to Earnings Release Tables |

|

| | | | | | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

EARNINGS RELEASE TABLES

|

SUPPLEMENTAL OPERATING INFORMATION |

(Unaudited, amounts in thousands except as indicated) |

| | | | | | | | | | | | |

| | | | | | Three Months Ended | | Year Ended |

| | | | | | December 31, | | December 31, |

| | | | | | 2015 | | 2014 | | 2015 | | 2014 |

Supplemental Operating Information - East Coast (Delaware City and Paulsboro) | | | | | | | |

Production (barrels per day ("bpd") in thousands) | 345.6 |

| | 338.3 |

| | 322.9 |

| | 322.9 |

|

Crude oil and feedstocks throughput (bpd in thousands) | 346.6 |

| | 339.7 |

| | 330.7 |

| | 325.3 |

|

Total crude oil and feedstocks throughput (millions of barrels) | 31.9 |

| | 31.2 |

| | 120.7 |

| | 118.7 |

|

Gross refining margin, excluding special items, per barrel of throughput (Note 4, Note 11) | $ | 9.16 |

| | $ | 13.19 |

| | $ | 9.28 |

| | $ | 10.97 |

|

Operating expense per barrel of throughput (Note 12) | $ | 4.39 |

| | $ | 4.66 |

| | $ | 4.67 |

| | $ | 5.07 |

|

Crude and feedstocks (% of total throughput) (Note 13): | | | | | | | |

| Heavy | 18 | % | | 19 | % | | 18 | % | | 19 | % |

| Medium | 60 | % | | 46 | % | | 58 | % | | 48 | % |

| Light | 5 | % | | 21 | % | | 9 | % | | 21 | % |

| Other feedstocks and blends | 17 | % | | 14 | % | | 15 | % | | 12 | % |

| | Total throughput | 100 | % | | 100 | % | | 100 | % | | 100 | % |

Yield (% of total throughput): | | | | | | | |

| Gasoline and gasoline blendstocks | 49 | % | | 48 | % | | 47 | % | | 46 | % |

| Distillates and distillate blendstocks | 34 | % | | 35 | % | | 34 | % | | 36 | % |

| Lubes | 2 | % | | 2 | % | | 2 | % | | 2 | % |

| Chemicals | 2 | % | | 2 | % | | 2 | % | | 2 | % |

| Other | 13 | % | | 12 | % | | 14 | % | | 13 | % |

| | Total yield | 100 | % | | 99 | % | | 99 | % | | 99 | % |

| | | | | | | | | | | | |

Supplemental Operating Information - Mid-Continent (Toledo) | | | | | | | |

Production (bpd in thousands) | 159.1 |

| | 77.1 |

| | 155.8 |

| | 129.2 |

|

Crude oil and feedstocks throughput (bpd in thousands) | 156.9 |

| | 75.6 |

| | 153.8 |

| | 127.8 |

|

Total crude oil and feedstocks throughput (millions of barrels) | 14.4 |

| | 7.0 |

| | 56.1 |

| | 46.7 |

|

Gross refining margin, excluding special items, per barrel of throughput (Note 4, Note 11) | $ | 7.67 |

| | $ | 8.70 |

| | $ | 12.69 |

| | $ | 15.04 |

|

Operating expense per barrel of throughput (Note 12) | $ | 4.97 |

| | $ | 7.99 |

| | $ | 4.88 |

| | $ | 5.97 |

|

Crude and feedstocks (% of total throughput) (Note 13): | | | | | | | |

| Medium | 32 | % | | 45 | % | | 35 | % | | 37 | % |

| Light | 65 | % | | 53 | % | | 63 | % | | 61 | % |

| Other feedstocks and blends | 3 | % | | 2 | % | | 2 | % | | 2 | % |

| | Total throughput | 100 | % | | 100 | % | | 100 | % | | 100 | % |

Yield (% of total throughput): | | | | | | | |

| Gasoline and gasoline blendstocks | 55 | % | | 51 | % | | 52 | % | | 50 | % |

| Distillates and distillate blendstocks | 36 | % | | 38 | % | | 36 | % | | 37 | % |

| Chemicals | 5 | % | | 4 | % | | 5 | % | | 5 | % |

| Other | 5 | % | | 9 | % | | 8 | % | | 9 | % |

| | Total yield | 101 | % | | 102 | % | | 101 | % | | 101 | % |

See Footnotes to Earnings Release Tables |

|

| | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

EARNINGS RELEASE TABLES |

SUPPLEMENTAL OPERATING INFORMATION |

(Unaudited, amounts in thousands except as indicated) |

| | | | | | | | | | | | |

| | | | | | Three Months Ended | | Year Ended |

| | | | | | December 31, | | December 31, |

| | | | | | 2015 | | 2014 | | 2015 | | 2014 |

Supplemental Operating Information - Gulf Coast (Chalmette) (Note 14) | | | | | | | |

Production (barrels per day ("bpd") in thousands) | 199.0 |

| | N/A | | 199.0 |

| | N/A |

Crude oil and feedstocks throughput (bpd in thousands) | 190.8 |

| | N/A | | 190.8 |

| | N/A |

Total crude oil and feedstocks throughput (millions of barrels) | 11.6 |

| | N/A | | 11.6 |

| | N/A |

Gross refining margin, excluding special items, per barrel of throughput (Note 4, Note 11) | $ | 9.17 |

| | N/A | | $ | 9.17 |

| | N/A |

Operating expense per barrel of throughput (Note 12) | $ | 4.48 |

| | N/A | | $ | 4.48 |

| | N/A |

Crude and feedstocks (% of total throughput) (Note 13): | | | | | | | |

| Heavy | 35 | % | | N/A | | 35 | % | | N/A |

| Medium | 32 | % | | N/A | | 32 | % | | N/A |

| Light | 18 | % | | N/A | | 18 | % | | N/A |

| Other feedstocks and blends | 15 | % | | N/A | | 15 | % | | N/A |

| | Total throughput | 100 | % | | N/A | | 100 | % | | N/A |

Yield (% of total throughput): | | | | | | | |

| Gasoline and gasoline blendstocks | 49 | % | | N/A | | 49 | % | | N/A |

| Distillates and distillate blendstocks | 35 | % | | N/A | | 35 | % | | N/A |

| Chemicals | 5 | % | | N/A | | 5 | % | | N/A |

| Other | 12 | % | | N/A | | 12 | % | | N/A |

| | Total yield | 101 | % | | N/A | | 101 | % | | N/A |

See Footnotes to Earnings Release Tables |

|

| | | | | | | | | | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

RECONCILIATION OF AMOUNTS REPORTED UNDER U.S. GAAP |

GROSS REFINING MARGIN / GROSS REFINING MARGIN PER BARREL OF THROUGHPUT (Note 11) |

(Unaudited, in thousands, except per barrel amounts) |

| | | | | | | | | | | | | | |

| | | | | | | Three Months Ended | | Three Months Ended | |

| | | | | | | December 31, 2015 | | December 31, 2014 | |

| | | | | | | | | per barrel of | | | | per barrel of | |

| | | | | | | $ | | throughput | | $ | | throughput | |

Reconciliation of gross margin to gross refining margin: | | | | | | | | |

Gross margin | $ | (114,877 | ) | | $ | (1.98 | ) | | $ | (438,168 | ) | | $ | (11.47 | ) | |

| Less: Affiliate Revenues of PBFX | (37,306 | ) | | (0.64 | ) | | (27,304 | ) | | (0.71 | ) | |

| Add: Affiliate Cost of sales of PBFX | 2,340 |

| | 0.04 |

| | 6,979 |

| | 0.18 |

| |

| Add: Refinery operating expense | 263,826 |

| | 4.55 |

| | 200,894 |

| | 5.26 |

| |

| Add: Refinery depreciation | 49,330 |

| | 0.85 |

| | 40,119 |

| | 1.05 |

| |

Gross refining margin | $ | 163,313 |

| | $ | 2.82 |

| | $ | (217,480 | ) | | $ | (5.69 | ) | |

Special Items (Note 4): | | | | | | | | |

| Add: Non-cash LCM inventory adjustment (Note 5) | 346,079 |

| | 5.97 |

| | 690,110 |

| | 18.06 |

| |

Gross refining margin excluding special items (Note 4) | $ | 509,392 |

| | $ | 8.79 |

| | $ | 472,630 |

| | $ | 12.37 |

| |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | Year Ended | | Year Ended | |

| | | | | | | December 31, 2015 | | December 31, 2014 | |

| | | | | | | | | per barrel of | | | | per barrel of | |

| | | | | | | $ | | throughput | | $ | | throughput | |

Reconciliation of gross margin to gross refining margin: | | | | | | | | |

Gross margin | $ | 571,524 |

| | $ | 3.03 |

| | $ | 308,399 |

| | $ | 1.86 |

| |

| Less: Affiliate Revenues of PBFX | (138,719 | ) | | (0.74 | ) | | (49,830 | ) | | (0.30 | ) | |

| Add: Affiliate Cost of sales of PBFX | 8,734 |

| | 0.05 |

| | 6,979 |

| | 0.04 |

| |

| Add: Refinery operating expense | 889,368 |

| | 4.72 |

| | 883,140 |

| | 5.34 |

| |

| Add: Refinery depreciation | 181,423 |

| | 0.96 |

| | 165,413 |

| | 1.00 |

| |

Gross refining margin | $ | 1,512,330 |

| | $ | 8.02 |

| | $ | 1,314,101 |

| | $ | 7.94 |

| |

Special Items (Note 4): | | | | | | | | |

| Add: Non-cash LCM inventory adjustment (Note 5) | 427,226 |

| | 2.27 |

| | 690,110 |

| | 4.17 |

| |

Gross refining margin excluding special items (Note 4) | $ | 1,939,556 |

| | $ | 10.29 |

| | $ | 2,004,211 |

| | $ | 12.11 |

| |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

See Footnotes to Earnings Release Tables

|

|

| | | | | | | | | | | | | | |

PBF ENERGY INC. AND SUBSIDIARIES |

EARNINGS RELEASE TABLES |

FOOTNOTES TO EARNINGS RELEASE TABLES |

|

(1) Adjusted fully-converted information is presented in this table as management believes that these Non-GAAP measures, when presented in conjunction with comparable U.S. GAAP measures, are useful to investors to compare the company’s results across the periods presented and facilitates an understanding of the company’s operating results. The company also uses this measure to evaluate its operating performance. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. The differences between adjusted fully-converted and U.S. GAAP results are explained in footnotes 2 through 7 and footnote 15. |

| | | | | | | | | | | | | | |

(2) Represents the elimination of the noncontrolling interest associated with the ownership by the members of PBF Energy Company LLC other than PBF Energy Inc., as if such members had fully exchanged their Series A Units for shares of the PBF Energy's Class A common stock. |

| | | | | | | | | | | | | | |

(3) Represents an adjustment to reflect the company's statutory corporate tax rate of approximately 39.6% and 40.2% for the 2015 and 2014 periods, respectively, applied to the net income attributable to the noncontrolling interest for all periods presented. The adjustment assumes the full exchange of existing PBF Energy Company LLC Series A Units as described in footnote 2. |

| | | | | | | | | | | | | | |

(4) The non-GAAP measures presented include adjusted fully-converted net income excluding special items, income from continuing operations excluding special items, EBITDA excluding special items, and gross refining margin excluding special items. The special items for the periods presented relate to a lower of cost or market adjustment (LCM) and changes in the tax receivable agreement liability. LCM is a GAAP guideline related to inventory valuation that requires inventory to be stated at the lower of cost or market. Our inventories are stated at the lower of cost or market. Cost is determined using last-in, first-out (LIFO) inventory valuation methodology, in which the most recently incurred costs are charged to cost of sales and inventories are valued at base layer acquisition costs. Market is determined based on an assessment of the current estimated replacement cost and net realizable selling price of the inventory. In periods where the market price of our inventory declines substantially, cost values of inventory may exceed market values. In such instances, we record an adjustment to write down the value of inventory to market value in accordance with GAAP. In subsequent periods, the value of inventory is reassessed and an LCM adjustment is recorded to reflect the net change in the LCM inventory reserve between the prior period and the current period. Changes in the tax receivable agreement liability reflect charges or benefits attributable to changes in our obligation under the tax receivable agreement due to factors out of our control such as changes in tax rates. Although we believe that non-GAAP financial measures excluding the impact of special items provide useful supplemental information to investors regarding the results and performance of our business and allow for more useful period-over-period comparisons, such non-GAAP measures should only be considered as a supplement to, and not as a substitute for, or superior to, the financial measures prepared in accordance with GAAP. |

| | | | | | | | | | | | | | |

(5) During the year ended December 31, 2015, the Company recorded an adjustment to value its inventories to the lower of cost or market which resulted in a net pre-tax impact of $427.2 million reflecting the change in the lower of cost or market inventory reserve from $690.1 million at December 31, 2014 to $1,117.3 million at December 31, 2015. During the three months ended December 31, 2015, the Company recorded an adjustment to the lower of cost or market which resulted in a net pre-tax impact of $346.1 million reflecting the change in the lower of cost or market inventory reserve from $771.3 million at September 30, 2015 to $1,117.3 million at December 31, 2015. During the year and three months December 31, 2014, the Company recorded an adjustment to value its inventory to the lower of cost or market which resulted in a net pre-tax impact of $690.1 million. The net impact of these LCM inventory adjustments are included in the Refining segment's operating income, but are excluded from the operating results presented in the table in order to make such information comparable between periods. Income taxes related to the net LCM adjustment were recalculated using the Company's statutory corporate tax rate of approximately 39.6% and 40.2%, respectively, for the 2015 and 2014 periods presented. |

| | | | | | | | | | | | | | |

(6) Represents weighted-average diluted shares outstanding assuming the full exchange of common stock equivalents, including options and warrants for PBF LLC Series A Units and options for shares of PBF Energy Class A common stock as calculated under the treasury stock method. Common stock equivalents excludes the effects of options to purchase 2,943,750 and 2,401,875 shares of PBF Energy Class A common stock because they are anti-dilutive for the years ended December 31, 2015 and 2014, respectively. Common stock equivalents excludes the effects of options to purchase 1,335,000 and 2,385,000 shares of PBF Energy Class A common stock because they are anti-dilutive for the three months ended December 31, 2015 and 2014, respectively. |

| | | | | | | | | | | | | | |

(7) Represents an adjustment to weighted-average diluted shares to assume the full exchange of existing PBF LLC Series A Units as described in footnote 2 above if not included in the diluted weighted-average shares outstanding as described in footnote 6 above. |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

(8) EBITDA (Earnings before Interest, Income Taxes, Depreciation and Amortization) and Adjusted EBITDA are supplemental measures of performance that are not required by, or presented in accordance with, GAAP. We use these non-GAAP financial measures as a supplement to our GAAP results in order to provide a more complete understanding of the factors and trends affecting our business. EBITDA and Adjusted EBITDA are measures of operating performance that are not defined by GAAP and should not be considered substitutes for net income as determined in accordance with GAAP. In addition, because EBITDA and Adjusted EBITDA are not calculated in the same manner by all companies, they are not necessarily comparable to other similarly titled measures used by other companies. EBITDA and Adjusted EBITDA have their limitations as an analytical tool, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. |

| | | | | | | | | | | | | | |

(9) We operate in two reportable segments; Refining and Logistics. Our operations that are not included in the Refining and Logistics segments are included in Corporate. As of December 31, 2015, the Refining segment includes the operations of our oil refineries and related facilities in Delaware City, Delaware, Paulsboro, New Jersey, Toledo, Ohio and New Orleans, Louisiana. The Logistics segment includes the operations of PBF Logistics LP ("PBFX"), a growth-oriented master limited partnership which owns and operates logistics assets, currently consisting of the Delaware City Rail Terminal, the Toledo Truck Terminal, the DCR West Rack, the Toledo Storage Facility and the Delaware City Products Pipeline and Truck Rack. The Logistics segment's results include financial information of the predecessor of PBFX for periods presented prior to May 13, 2014, and the financial information of PBFX for periods beginning on or after May 14, 2014, the completion date of the PBFX initial public offering ("PBFX Offering"). Prior to the PBFX Offering, the DCR West Rack acquisition, the Toledo Storage Facility acquisition and the Delaware City Products Pipeline and Truck Rack acquisition, PBFX's assets were operated within the refining operations of PBF Energy's Delaware City and Toledo refineries. The assets did not generate third party or intra-entity revenue, other than certain intra-entity revenue recognized by the Delaware City Products Pipeline and Truck Rack, and were not considered to be a separate reportable segment. All intercompany transactions are eliminated in our consolidated financial statements and are included in Eliminations, as applicable. |

|

(10) As reported by Platts. |

|

(11) Gross refining margin and gross refining margin per barrel of throughput are non-GAAP measures because they exclude operating expenses, refinery depreciation and amortization and gross margin of PBFX. Gross refining margin per barrel is gross refining margin, divided by total crude and feedstocks throughput. We believe they are important measures of operating performance and they provide useful information to investors because gross refining margin per barrel is a better metric comparison to the industry refining margin benchmarks shown in the Market Indicators Tables, as the industry benchmarks do not include a charge for refinery operating expenses and depreciation. Other companies in our industry may not calculate gross refining margin and gross refining margin per barrel in the same manner. |

|

(12) Represents refinery operating expenses, excluding depreciation and amortization, divided by total crude oil and feedstocks throughput. |

| | | | | | | | | | | | | | |

(13) We define heavy crude oil as crude oil with an American Petroleum Institute (API) gravity less than 24 degrees. We define medium crude oil as crude oil with an API gravity between 24 and 35 degrees. We define light crude oil as crude oil with an API gravity higher than 35 degrees. |

|

(14) Includes activity for the Chalmette refinery subsequent to its acquisition on November 1, 2015. |

| | | | | | | | | | | | | | |

(15) The Company recorded pre-tax adjustments related to the change in the tax receivable agreement liability of $18.2 million and $3.0 million for the years ended December 31, 2015 and 2014, respectively, and $20.4 million and $0.0 million for the three months ended December 31, 2015 and 2014, respectively. Income taxes related to the change in the tax receivable agreement liability were recalculated using the Company's statutory corporate tax rate of approximately 39.6% and 40.2%, respectively, for the 2015 and 2014 periods presented. |

(16)The Refining segment includes capital expenditures of $565.3 million for the acquisition of the Chalmette refinery on November 1, 2015. |

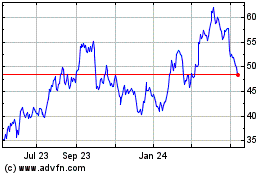

PBF Energy (NYSE:PBF)

Historical Stock Chart

From Mar 2024 to Apr 2024

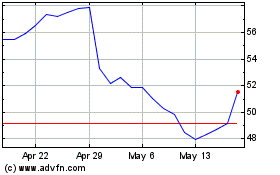

PBF Energy (NYSE:PBF)

Historical Stock Chart

From Apr 2023 to Apr 2024