By Justin Baer and Christina Rexrode

James Dimon's message to the markets: If no one else wants to

buy bank stocks, I will.

J.P. Morgan Chase & Co.'s chairman and chief executive on

Thursday bought 500,000 of his firm's shares, according to a

regulatory filing, trying to deliver a jolt of confidence to

investors as a monthlong slide in bank stocks threatened to become

an avalanche.

J.P. Morgan shares fell 4.4% on Thursday, then jumped after The

Wall Street Journal reported Mr. Dimon's purchase after the close

of trading. Mr. Dimon paid about $26.6 million for the shares, at

prices ranging from $53.14 to $53.30 each.

Shares in the nation's biggest bank by assets have dropped

nearly 20% this year, and some of its peers have seen even bigger

declines. Bank of America Corp., for example, tumbled 6.8% on

Thursday, its biggest one-day slide in more than three years. In

the first six weeks of this year, the Charlotte, N.C., bank has

given up nearly three years of gains, falling 34%.

Bank shares overall have been among the worst performers in

2016, their declines about twice as steep as those of the Dow Jones

Industrial Average and S&P 500.

Investors are fretting over slowing economic growth, falling

energy prices and the possibility that interest rates will drop

further. All of the factors are expected to take their toll on bank

earnings.

Meanwhile, bank executives have projected an aura of serenity,

blaming outside forces and working to control what they can. On

fourth-quarter earnings calls in January and at a Credit Suisse

forum in Miami this week, they reminded investors that markets can

be irrational--and that they are well capitalized enough to be in

good shape to handle a slowdown.

Mr. Dimon's move, though, is arguably the biggest statement yet

from a bank executive that the selloff is overdone.

"Jamie Dimon stepped up to the plate," said Mike Mayo, an

analyst with CLSA. "It's a big number. It's either a financial

catastrophe, or this is an epic buying opportunity."

During the selloff, few other bank executives have bought shares

of their firms. Citigroup CEO Michael Corbat and Chairman Michael

O'Neill are exceptions, each buying 25,000 Citigroup shares in

January, at about $41 a share, according to regulatory filings, at

a cost of about $1 million each. Citigroup Chief Financial Officer

John Gerspach bought about $500,000 worth of Citigroup shares this

week, the bank disclosed Thursday.

A Citigroup spokesman said the actions speak for themselves. The

bank's shares are down 32% this year.

Analysts on Thursday again struggled to explain the sharp drop

in bank shares, given that the firms are far better capitalized

than they were when they entered the financial crisis, with

regulators forcing them to hold more cash and get rid of some of

their riskier businesses. U.S. banks also don't face many of the

structural problems that are evident in their European peers.

"Sometimes the market just panics," said David Hilder, an

analyst at Drexel Hamilton.

Stock prices are still far above their lows of previous panics,

including the financial crisis of 2008-2009 and the 2011 eurozone

panic. Credit-default swaps, which work like insurance policies

when companies default on bonds and loans, have spiked this year

but aren't close to the highs of 2011.

One other difference compared to years past isn't so positive

for the banks: Middle Eastern sovereign-wealth funds, which propped

up flailing banks with big investments during the financial crisis,

aren't in a position to be saviors again. Plunging oil prices have

strapped their largess.

Charles Peabody, an analyst at Portales Partners, attributes

some of the recent drop in bank stocks to sovereign wealth- funds

selling off their shares.

"It has nothing to do with the fundamentals of the banks," Mr.

Peabody said of Thursday's decline.

The plunge in bank stocks comes at a bad time of year for

bankers and traders: Some stock awards they received in the past

few years, which are now vesting, will be worth far less than when

they were issued.

Mr. Mayo said he met with Mr. Dimon along with some other

investors at J.P. Morgan's headquarters in midtown Manhattan

earlier this week, and the CEO seemed "extremely relaxed."

The bank CEO assured his visitors that the economy was fine,

consumers were still strong and activity levels were still good,

Mr. Mayo said. When Mr. Mayo asked Mr. Dimon if he was planning to

buy J.P. Morgan stock, the CEO didn't tip his hand but called the

selloff a "financial market event that's not likely to impact the

real economy," Mr. Mayo said.

Including Mr. Dimon's purchase on Thursday, his J.P. Morgan

holdings are worth $357.7 million.

Mr. Dimon's purchase might be big enough to soothe market's

jangled nerves, said Mr. Mayo, adding that "bank stock investors

are shell-shocked right now."

(END) Dow Jones Newswires

February 11, 2016 19:38 ET (00:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

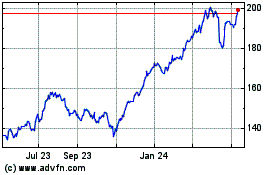

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

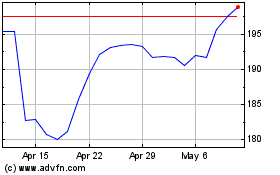

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024