Rolls-Royce Cuts Dividend as Full-Year Profit Falls -- 2nd Update

12 February 2016 - 8:13PM

Dow Jones News

By Robert Wall

LONDON-- Rolls-Royce Holdings PLC on Friday slashed its

full-year dividend 39%, the first cut in its shareholder payment

since 1992, though investors embraced the lack of further bad news

sending shares higher.

Rolls-Royce proposed a full-year dividend of 14.1 pence, down

from 23.1 pence in the prior year. The final payment to

shareholders was cut 50% to 7.1 pence from 14.1 pence. It marks

only the second dividend cut for the company since it was

privatized in 1987. The dividend payout for the first half of this

year will also be halved.

"We need to sustain a healthy balance sheet to ensure we have

the financial flexibility to maintain a strong investment grade

credit rating," Chief Executive Warren East said. He acknowledged

the need for a "healthy" dividend and pledged to "review the

payment so that it will be rebuilt over time to an appropriate

level." An upward adjustment could come with the review of the 2016

final payment "subject to short-term cash needs."

Rolls-Royce, which makes engines for Boeing Co. and Airbus Group

SE long-range jetliners, has seen demand soften for some of its

most profitable products. The sharp drop in oil prices also has hit

earnings at its marine and power systems operations.

Some investors worried the company would require a rights issue

to shore up its balance sheet and further cut its financial outlook

after a series of profit warnings in the past two years.

Rolls-Royce management allayed those concerns.

Chief Financial Officer David Smith said the company had boosted

its cash and liquidity position. "We don't need to look at a rights

issue," he said.

The company also left its guidance unchanged after warning in

November that profit this year would face a GBP650 million ($942

million) headwind. Sales this year will be "marginally lower" this

year on a constant currency basis, it said. The further

deterioration in the oil markets since the company last issued

guidance hasn't changed already depressed prospects for the

business, Mr. East said.

Investors reacted positively, sending shares up more than 12% in

early London trading, the most since 2008.

Still, earnings are expected to remain depressed for the near

future after the company's closely watched underlying profit before

tax, which excludes changes in the value of currency hedges, fell

to GBP1.4 billion ($2 billion) last year, following an 8% retreat

in 2014. Underlying sales declined 1% to GBP13.4 billion.

"Despite steady market conditions for most of our businesses it

will be a challenging year as we start to transition products and

sustain investment in Civil Aerospace and tackle weak offshore

markets in Marine, " Mr. East said.

Mr. East took the top job at Rolls-Royce in July. Since then, he

has issued two profit warnings and announced further job cuts,

including the departure of two of the company's top executives.

Shares in Rolls-Royce have tumbled about 40% since he joined.

Rolls-Royce has embarked on a restructuring program, seeking to

generate GBP150 million to GBP200 million in annual savings from

2017, which includes pruning management and other changes. Mr. East

said about half those savings have been identified, including the

departure of about 50 of 200 top managers.

The company on Friday said it would take an exceptional

restructuring charge of GBP75 million to GBP100 million in 2016 to

pay for those measures. Mr. Smith said a low charge is expected in

the future to pay for the remainder of the program.

Rolls-Royce faces investor pressure to act. U.S. activist

investor ValueAct Capital Management LP has become Rolls-Royce's

largest shareholder and is seeking a board seat, adding pressure on

management to turn around the company's prospects.

Neil Woodford, a highly regarded British investment fund manager

who held Rolls-Royce stock for almost a decade, last year said he

lacked confidence in the engine maker's near-term prospects as he

announced his CF Woodford Equity Income Fund and the Woodford

Patient Capital Trust fund had sold their shares.

Mr. East said Friday that the company was continuing its review

of how to restructure the business. That includes an assessment of

potential portfolio changes, first signaled last year, though the

company has said it isn't exploring major disposals.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 12, 2016 03:58 ET (08:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

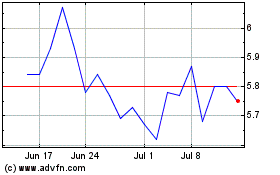

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

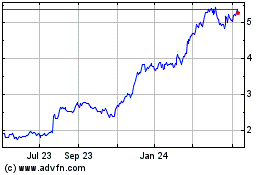

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Apr 2023 to Apr 2024