U.S. Retail Sales Rose in January (and December) -- 2nd Update

13 February 2016 - 6:12AM

Dow Jones News

By Harriet Torry

U.S. consumers boosted their spending during the year's first

month, and finished 2015 on a stronger note than first thought, the

latest sign of low unemployment and cheap gasoline outweighing

concerns about market turmoil.

Sales at retail stores and restaurants rose 0.2% in January from

the prior month, the Commerce Department said Friday. December's

retail sales were revised higher, to 0.2% growth from an initially

reported 0.1% drop.

With December's revision, January marked the fourth consecutive

month of higher retail sales and showed how American households

remain relatively strong despite headwinds from global stock-market

volatility in the early weeks of 2016.

"Despite the ongoing turmoil in global financial markets,

consumer spending still managed to get off to a firm start" to the

first quarter, said Richard Moody, chief economist at Regions

Financial Corp.

Spending by consumers drives two-thirds of U.S. economic output,

and household outlays have helped the economy grow in recent

quarters despite a strong dollar and weak overseas growth, which

have burdened U.S. exporters.

Consumers continued to spend less at gas stations thanks to

lower fuel prices. But a core measure of retail sales excluding

autos and gasoline posted a 0.4% increase. Americans stepped up

spending across several major categories, including vehicles,

groceries and building materials. Compared with a year earlier,

sales grew 3.4%.

The impact of a major snowstorm in the Northeast in January was

less than feared, economists said. Sales at bars and restaurants

posted their biggest decline in two years in January, falling 0.5%

during the month. But sales at food and beverage stores rose 0.5%.

A measure of spending that includes online shopping grew 1.6%, the

most in nearly a year.

Wages rose and unemployment fell in the first month of the year,

the Labor Department said last week, providing a strong foundation

for spending growth.

While consumers appeared undeterred by the volatility in

January, a sentiment reading out Friday indicated shoppers may be

growing more nervous this month. The University of Michigan's

preliminary February sentiment index dropped to 90.7 from 92.0 in

January, which the surveyors attributed to a less favorable outlook

for the economy this year.

That could point to caution in the months ahead, economists

warned. Given financial-market uncertainty, growth in consumer

outlays will remain contingent on the job market remaining strong

and wages growing further.

"Looking at recent growth in overall consumer income there does

appear to be some buildup in spending potential--assuming recent

capital market volatility doesn't scare consumers into saving a

little more," said Steve Blitz, chief economist at ITG Investment

Research.

Companies have also warned about the impact of market jitters on

shoppers recently. Beverage giants Coca-Cola Co. and PepsiCo Inc.

both reported higher profit and raised prices in the fourth

quarter, but warned of challenges ahead due to the uncertain global

economy.

Pepsi Chief Executive Indra Nooyi cautioned the U.S. recovery

was "delicate" during an earnings call, and said she has "never

seen this combination of sustained headwinds across most economies,

combined with high volatility across global financial markets"

during her years in business.

Other indicators point to hurdles for the U.S. economy that

could crimp consumer outlays. Factory activity shrank in January

for the fourth straight month, and prices for imported goods fell

1.1%--signs that a slumping global economy, strong dollar and

plunging oil prices are weighing on U.S. inflation.

Nonetheless, Friday's reading on retail sales suggests consumers

headed into 2016 on a relatively strong footing, welcome news for a

Federal Reserve looking for evidence the U.S. economy is holding

steady amid global uncertainty.

In a speech Friday, Federal Reserve Bank of New York President

William Dudley described households as "in good shape." He said the

key sector "looks much better positioned today than in 2008 to

absorb shocks and continue to contribute to the economic

expansion."

The Federal Reserve closely watches consumer spending data as a

gauge of economic growth. Fed officials pointed to solid consumer

spending as a factor in their decision to raise interest rates in

December for the first time in nearly a decade.

Write to Harriet Torry at harriet.torry@wsj.com

(END) Dow Jones Newswires

February 12, 2016 13:57 ET (18:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

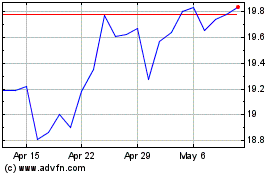

Regions Financial (NYSE:RF)

Historical Stock Chart

From Mar 2024 to Apr 2024

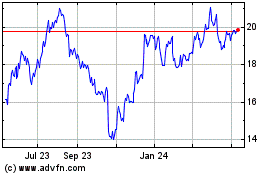

Regions Financial (NYSE:RF)

Historical Stock Chart

From Apr 2023 to Apr 2024