Visa Details Stake in Payments Startup Square--3rd Update

13 February 2016 - 7:04AM

Dow Jones News

By Telis Demos and Chelsey Dulaney

Square Inc. shares rallied Friday after Visa Inc. revealed the

size of its investment in the mobile-payments startup.

The disclosure of the stake late Thursday, raised questions

about Visa's plans with Square. Square, founded and run by Twitter

Inc. Chief Executive Jack Dorsey, previously announced Visa's

investment when it was private in April 2011 but didn't reveal

terms.

Visa hasn't bought or sold Square shares since its original

investment, a Visa spokeswoman said in an email.

In the regulatory filing Thursday, Foster City, Calif.-based

Visa said it owns about 4.19 million of Square's Class B shares,

which don't trade publicly. But the company has the option to

convert those shares to about 3.52 million Class A shares, which

would give it a 9.99% stake in the publicly-traded share class.

Investors typically only convert such Class B when they're

selling.

Visa's filing was a statement of an existing position, known as

a "13G," which are due to be filed by next week. Other early Square

investors including venture firm Sequoia Capital and J.P. Morgan

Chase & Co. also have recently made similar filings.

Despite potentially owning nearly 10% of Square's publicly

traded shares, Visa's stake only represents about 1% of Square's

overall share base. The exact figures of Visa's stake weren't

disclosed at the time of Square's IPO.

Square shares hit a high of $9.84 in morning trading Friday in

New York, up 13% and a return above its IPO price of $9 per share.

By mid-afternoon, the stock had given up some of those gains,

rising 4.6% to $9.01. Visa shares added 2.7% to $70.29.

Shares of San Francisco-based Square have been volatile

following its initial post-IPO surge, as the market tries to figure

out how to value the company, which blends elements of a financial

services firm and a technology firm. Similar fintech companies,

such as LendingClub Corp., also have been whipsawed in trading

since their IPOs.

The November IPO of Square, was well below where it was valued

privately. In first-day trading the stock jumped 45% to over $13.

This year, it has fallen 30% and has traded below its IPO price,

due in part to concerns about the sustainability of the company's

growth and global market turmoil.

Square got its start with a small piece of plastic that plugs

into smartphones and lets anyone accept payment via credit or debit

cards. Visa first invested in Square in 2011 because it saw the

company as a way to help covert small businesses that only accepted

cash to accepting credit cards through Square's devices, the

companies said at the time.

Should Visa convert its Class B shares of Square into Class A

stock, the company would become Square's second-largest holder of

Class A shares behind mutual-fund giant Capital Research and

Management Co., which has a 12% stake in Square, according to

FactSet data.

Visa hasn't historically acquired companies like Square, which

can act as agents to bring merchants onto the networks of Visa,

MasterCard Inc., and other card networks. Still, in a note on

Friday, BTIG stock analysts said that the Visa disclosure this week

"served as a vote of confidence" in Square's business and "a

reminder of [Square's] attractiveness as an acquisition target" as

big technology firms build out their electronic payments

capabilities.

Visa, meanwhile, has focused more on digital efforts lately as

consumers increasingly migrate to electronic payments. The company

has launched Visa Digital Solutions, an initiative geared toward

secure payments using mobile devices. It also has supported Apple

Inc.'s Apple Pay service.

Greg Bensinger contributed to this article.

Write to Telis Demos at telis.demos@wsj.com and Chelsey Dulaney

at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

February 12, 2016 14:49 ET (19:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

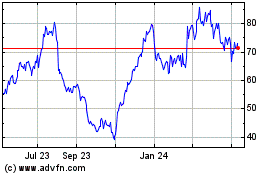

Block (NYSE:SQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

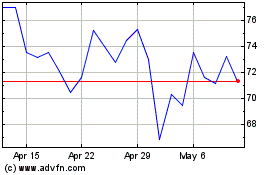

Block (NYSE:SQ)

Historical Stock Chart

From Apr 2023 to Apr 2024