AMP Profit Lifted by Continued Wealth Management Growth

18 February 2016 - 8:30AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--AMP Ltd. (AMP.AU) said Thursday its profit

rose 10% last year, driven by continued growth in its wealth

management business and an expansion of its international

investment management operation.

Net profit rose to 972 million Australian dollars (US$691.3

million) in 2015 from A$884 million the year before, the financial

services firm said.

Underlying profit--which strips out one-time costs and the

impact of some investment-market volatility, and is used by the

company to determine its dividend--was 7% higher at A$1.12 billion,

in line with the A$1.11 billion median of six broker forecasts

compiled by The Wall Street Journal.

The company's board plans to pay a final dividend of A$0.14 a

share, up 4% on a year ago, for a full-year payout of A$0.28.

Chief Executive Craig Meller said it was a good performance

against a backdrop of challenging markets in the second half of the

year, momentum maintained across its Australian wealth management

and AMP Capital divisions.

The company said earnings from its Australian wealth management

operations rose 10% to A$410 million for the year, driven by 10%

growth in assets under management. However, operating earnings for

its Australian wealth protection business eased 1.6% to A$185

million, it said.

AMP Capital recorded a 20% jump in operating earnings and

improved net cashflows, boosted by a rise of more than A$2 billion

in funds managed on behalf of international institutional clients

to A$6.8 billion, the company said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 17, 2016 16:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

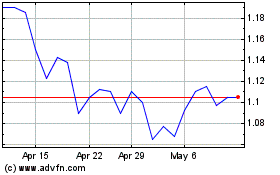

AMP (ASX:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

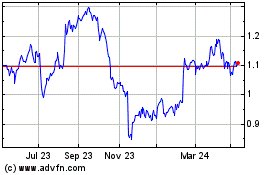

AMP (ASX:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024