Australia Shares End Higher, Lifted by Resources Stocks

01 March 2016 - 5:23PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Overnight gains in commodity prices helped

buoy Australian resources stocks and the broader market

Tuesday.

In another day of choppy trading, the S&P/ASX 200 finished

41.4 points, or 0.9%, higher at 4922.3. It was the first

substantial move in the index in the last four sessions.

The push higher was led by gains in energy and mining stocks,

with additional support from banks, which are heavily weighted.

Oil prices advanced Monday on signs that U.S. drilling activity

is hitting new lows, while copper prices shook off losses and

turned positive in the last half hour of the day's trading session.

Gold rose to its highest level in nearly three weeks in Asia

trading Tuesday, boosted by weak U.S. economic data and news that

China cut reserve-requirement ratios for banks.

After declining the past four sessions after reporting a

first-half loss and sharply reduced dividend, BHP Billiton

recovered with a jump of 3%. Rio Tinto rose 2.7%, while fellow

iron-ore producer Fortescue Metals Group gained 6.4%. Newcrest

Mining was 4.5% higher.

Among energy stocks, Woodside Petroleum and Oil Search each

added 1.8% and Santos and Oil Search each climbed 3.6%.

The big four banks were all higher for the day, led by a 3%

increase in Australia & New Zealand Banking Group. Westpac

added 2.5%, National Australia Bank was 2% higher and Commonwealth

Bank of Australia was up 1.8%. All four have seen heavy selling for

much of 2016.

"The compelling yields on offer in Aussie banks look to have

finally brought buyers back to the markets, and ANZ was gaining the

most on their compelling historically low valuation," Angus

Nicholson, a market analyst at IG in Melbourne, said.

For the day, 2.8 billion shares were traded worth 6.4 billion

Australian dollars (US$4.57 billion), Commonwealth Securities

said.

The market largely brushed aside the Reserve Bank of Australia's

decision to leave its key cash rate unchanged at a 2% for a ninth

consecutive policy meeting, even as it left the door open to

cutting further if the economy slows later in the year. The

government's statistics office is scheduled to release

fourth-quarter economic growth data on Wednesday.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

March 01, 2016 01:08 ET (06:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

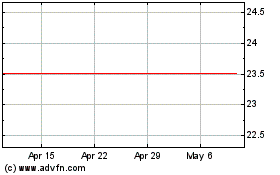

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

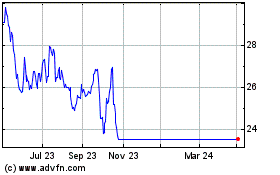

Newcrest Mining (ASX:NCM)

Historical Stock Chart

From Apr 2023 to Apr 2024