Sainsbury's Confirms Offer for Home Retail

19 March 2016 - 6:10AM

Dow Jones News

LONDON—U.K. grocer J Sainsbury PLC confirmed a £ 1.4 billion ($2

billion) offer for Argos owner Home Retail Group PLC, after South

African retailer Steinhoff International Holdings NV pulled out of

the race for the company.

The Sainsbury offer is worth 173.2 pence a share, comprising

0.321 Sainsbury's shares, 55 pence in cash and a special

dividend.

Sainsbury and Home Retail had previously agreed the terms of the

deal, but South African retailer Steinhoff International Holdings

NV came in with an offer worth 175 pence a share.

But Steinhoff Friday pulled out of the race, saying it has no

plans to make on offer for Home Retail.

Sainsbury's confirmation of its offer came less than half an

hour before a deadline set by the U.K. Takeover Panel for it and

Steinhoff to make their intentions known.

Sainsbury's said it hasn't yet received Home Retail's

recommendation for the offer. Home Retail said following

Sainsbury's announcement that "Sainsbury's has stated its wish to

obtain the recommendation of the Board of Home Retail Group for its

offer, and the Board of Home Retail Group looks forward to working

with Sainsbury's towards such recommendation." It didn't

specifically say whether it would recommend the offer.

Sainsbury also said that it now believes its acquisition of Home

Retail will result in savings of £ 160 million, up from a previous

estimate of £ 120 million.

Home Retail is now focused on its catalog-based retailer Argos,

which sells furniture, electronics and many other items. It

completed the sale of furniture and home products retailer Homebase

to Australian diversified retailer Wesfarmers Ltd. for £ 340

million on Feb. 27. It plans to return £ 200 million of the money

to shareholders.

Earlier this week, Sainsbury reported a 0.1% rise in

like-for-like fourth-quarter retail sales, excluding fuel, but said

it is confident it would continue to outperform its nearest rivals,

underscoring the competitiveness of the U.K.'s food-retailing

sector.

Also, last week Home Retail reported slowing losses at Argos and

backed the recently lowered fiscal 2016 guidance. The firm said

comparable sales at Argos for the year ended Feb. 27 are down 2.6%.

This compares with a fall of 2.8% for the 44 weeks ended Jan. 2,

and sales in the last eight weeks of the year down just 1.1%.

It said it expects full-year benchmark pretax profit to be £ 93

million, compared with guidance given in January for the bottom end

of the £ 92 million to £ 118 million range.

Separately, Steinhoff International said Friday that it has

agreed to buy London-listed, France-focused consumer electronics

retailer Darty PLC for £ 673 million.

Write to Ian Walker at ian.walker@wsj.com and Rory Gallivan at

rory.gallivan@wsj.com

(END) Dow Jones Newswires

March 18, 2016 14:55 ET (18:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

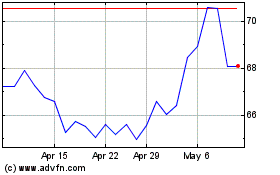

Wesfarmers (ASX:WES)

Historical Stock Chart

From Mar 2024 to Apr 2024

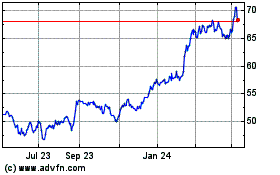

Wesfarmers (ASX:WES)

Historical Stock Chart

From Apr 2023 to Apr 2024