Australia's Economic Growth Accelerates on Strong Exports

01 June 2016 - 5:40PM

Dow Jones News

SYDNEY—Australia's economy grew at its fastest pace in 3½ years

in the first quarter, outpacing other advanced economies even as it

added more uncertainty to the outlook for interest rates.

Gross domestic product grew 1.1% in the first quarter from the

fourth quarter and 3.1% from a year earlier, a government report

showed Wednesday. Economists surveyed by The Wall Street Journal

had expected 0.9% growth from the previous quarter and a 3.0%

year-over-year rise.

With a month to go before a federal election, Treasurer Scott

Morrison embraced the news, saying the data confirm that a

transition in the economy away from mining was evident.

"[Australia's growth is] faster than the United Kingdom, the

United States, the eurozone. It's more than twice the growth we're

seeing in Canada, faster than Singapore, faster than New Zealand

and now even faster than South Korea," he said.

Economists say higher export volumes of iron and liquefied

natural gas are supporting growth, helping to offset lower

commodities prices as a decadelong mining boom comes to an end.

"The mining investment boom is paying dividends and the lower

Australian dollar is boosting services, thereby fostering a

rebalancing of the Australian economy," said Andrew Hanlan, a

senior economist at Westpac.

In addition, unemployment has fallen to a 2½ -year low, helping

to lift consumer spending.

Michael Canturi, 35, the owner of Dahlias Cafe, an eatery in

Campbelltown, a suburb on the outskirts of Sydney, said he invested

300,000 Australian dollars (US$216,960) recently to expand his

small business.

But not all retailers are experiencing the same growth, Mr.

Canturi said, though those in hospitality tend to do better as more

consumers find room in their budgets to eat out.

Australia is also experiencing strong residential housing

construction, led by a boom in apartments, while a lower Australian

dollar is lifting services exports, leading to strong growth in

industries like tourism, health care and education.

Still, falling mining investment is likely to be a drag on

growth for the next year at least, economists say.

Some economists say that the stellar growth is based mostly on

exports, leaving the country exposed to global shocks, while income

growth has been constrained as commodities prices remain weak.

Gareth Aird, an economist at the Commonwealth Bank, said the

circumstances now facing the economy, which include surging growth

and the slowest pace of wage growth in 30 years, were

"bizarre."

The Reserve Bank of Australia cut interest rates on May 3 to a

record low of 1.75% after the economy slid into deflation in the

first quarter. Economists had widely forecast further cuts before

the GDP report; some continue to expect more cuts over the next

year.

The Australian dollar rallied after the release of the

economic-growth data, as bets on a further interest-rate cut were

pushed back into next year.

Jasmin Argyrou, a senior-investment manager at Aberdeen Asset

Management, said there was a growing disconnect between Australia's

economic activity and inflation, which remains below the central

bank's comfort level.

"Against this solid economic backdrop, monetary easing will be

very gradual and it could be a long time between cash rate cuts,"

she said.

Write to James Glynn at james.glynn@wsj.com

(END) Dow Jones Newswires

June 01, 2016 03:25 ET (07:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

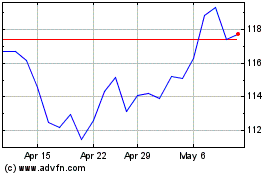

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Apr 2023 to Apr 2024