By Christian Berthelsen

After the Federal Reserve pledged to crack down on banks engaged

in the lucrative business of commodities trading, most big Wall

Street firms got out.

Macquarie Group Ltd. took the opposite approach.

Australia's largest investment bank has been buying and selling

increasing amounts of oil, natural gas and fuel in the U.S., taking

advantage of the opening as its competitors backed away.

It now is North America's third-largest trader of physical gas,

trailing only industry giants BP PLC and Royal Dutch Shell PLC,

according to industry publications Platts and Natural Gas

Intelligence.

Macquarie investment funds own and manage electric utilities in

Seattle and Pittsburgh, a gas distributor in Hawaii, a merchant

power-generation company in Rhode Island and petroleum storage

tanks along the U.S. Gulf Coast. It imports Canadian oil into the

U.S. by pipeline and in January imported 200,000 barrels of crude

by tanker from the Republic of Congo, U.S. records show.

It all has been possible because the Federal Reserve doesn't

consider Macquarie's U.S. unit a bank. By avoiding certain

activities like taking customer deposits, the Sydney-based firm,

with more than half of its $147 billion in assets in the Americas,

is instead classified as a representative office of a foreign

company.

"There's no question Macquarie has taken advantage of" that

classification, said James Newsome, a former chairman of the U.S.

Commodity Futures Trading Commission whose firm, Delta Strategy

Group, represents banks in dealings with regulators. "The fact

they're not registered as a bank-holding company in the U.S. gives

them the ability to stay active in these markets."

Macquarie officials say the firm doesn't have to be treated as a

bank in the U.S. because it doesn't have a banking license, has no

access to Fed funding and doesn't take deposits.

Big banks jumped into commodities trading in the 1980s, buying

up pipelines, metals warehouses and power plants to trade barrels

of oil, megawatts of electricity and ingots of aluminum. Morgan

Stanley, Goldman Sachs Group Inc. and J.P. Morgan Chase & Co.

became the heavyweights of a group known as the Wall Street

refiners.

The banks presided over an unprecedented commodity boom during

the 2000s. But the business slumped in recent years after a steep

and broad-based commodities-market decline and waning investor

interest.

Regulators and Congress began examining bank activities in the

commodity markets in 2013. They feared damage to the financial

system if a calamity occurred, and worried that the trading

information gave the firms unfair advantages.

In 2014 testimony before a U.S. Senate committee, Fed governor

Daniel Tarullo said the central bank planned to unveil strict new

limits on bank activity in commodity markets in early 2015.

While that hasn't happened, the Fed still is considering what

rules to introduce, people familiar with the matter say.

The threat of new regulation was enough to deter most banks.

Deutsche Bank AG, Credit Suisse Group AG, Morgan Stanley and J.P.

Morgan all closed or curtailed commodity operations. Commodity

revenue at the top 12 global investment banks has declined by

two-thirds since 2008, according to London research-consultancy

Coalition.

Macquarie was founded in 1969 to provide investment-banking and

merger-advisory services in Australia. It obtained its Australian

banking license in 1985.

Macquarie became a U.S. representative office in 2005. Its

global commodities revenue hit $960 million in its most recent

reporting year through March, up 75% since its reporting year ended

March 2013.

While it doesn't break out its U.S. results, nearly half the

firm's commodity- and financial-market revenue comes from the

Americas.

Macquarie's expanding presence in raw-materials markets also has

helped it boost business in parts of the company that handle more

traditional banking activities, particularly for U.S. companies in

the oil, gas and energy industries.

The firm's ranking in U.S. energy-stock underwriting jumped to

12th in 2015 from 29th in 2009, managing six deals with a value of

$471 million, according to Dealogic. And though representative

offices are prohibited from making loans, Macquarie has become a

provider to the U.S. energy industry of a particular kind of

high-risk credit, extending $3 billion in leveraged loans in the

past five years. It has done so by building relationships with U.S.

companies and having foreign offices handle the closing on the loan

agreements, which is allowed under U.S. law.

While trading for clients and with the firm's own balance sheet

has been profitable for Macquarie, it isn't without risk.

Commodities markets are volatile and can lead to sharp losses for

financial traders who suddenly find the market moving against

them.

It also exposes traders to the sort of perils that may be

unfamiliar to banks, from pipeline explosions to hazardous spills

when transporting oil. In addition to disrupting the business, such

incidents can lead to costly lawsuits.

Corrections & Amplifications

Australian bank Macquarie Group Ltd. has $147 billion in assets.

A previous version of this article incorrectly stated the bank's

assets are $350 billion. Macquarie isn't one of the largest

providers of leveraged loans to the U.S. energy industry. The

article incorrectly said it was. Macquarie investment funds own and

manage utilities and other energy assets in the U.S. The story

incorrectly stated the bank owned these assets. (June 9, 2016)

Write to Christian Berthelsen at

christian.berthelsen@wsj.com

(END) Dow Jones Newswires

June 09, 2016 15:33 ET (19:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

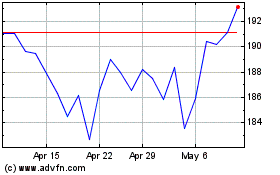

Macquarie (ASX:MQG)

Historical Stock Chart

From Mar 2024 to Apr 2024

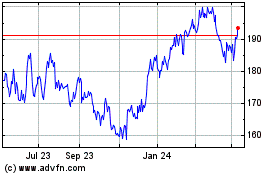

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2023 to Apr 2024