Marathon Oil Agrees To Buy PayRock Energy -- WSJ

21 June 2016 - 5:06PM

Dow Jones News

By Erin Ailworth and Austen Hufford

Marathon Oil Corp. said Monday that it would buy PayRock Energy

Holdings LLC for $888 million.

The acquisition adds to Marathon's position in an area of

Oklahoma known as the Stack, where oil producers are finding they

can still make money when crude trades at $45 a barrel.

Lee Tillman, Marathon's chief executive, said the 61,000 net

surface acres his company is getting are located in one of the best

shale oil reservoirs in the U.S., and will be a top competitor for

investment when crude prices improve.

"The asset quality is exceptional," he told investors on a

conference call. "We certainly see that next incremental dollar of

capital, as prices get more constructive, flowing into

Oklahoma."

Marathon shares, which have fallen 49% in the last 12 months,

rose 10.3% to $14.52 in midday trade.

Marathon isn't the only company that has been beefing up its

presence and activity in the Stack, which stands for Sooner Trend,

Anadarko Basin, Canadian and Kingfisher counties. Wells there are

generating between 10% and 30% returns based on an oil price around

$45 a barrel, operators have said.

Newfield Exploration Co. recently paid $470 million to

Chesapeake Energy Corp. for more than 40,000 acres that complement

its existing position in the Stack.

PayRock's oil-and-gas acreage, which currently produces 9,000

net barrels of oil equivalent every day, boosts Marathon's holdings

in that section of Oklahoma to more than 200,000 acres. Marathon

said capital spending on the acquired assets would fit within its

already announced $1.4 billion budget. The company hopes to put at

least 4 drilling rigs to work in the Stack next year.

"The last five PayRock wells have each been drilled and

completed for under $4 million," said Wade Hutchings, a regional

vice president at Marathon.

Marathon has cut its production, slashed spending and sold off

more than $1 billion worth of stock to shore up its finances. The

company recently said it was selling off oil-and-gas acreage not

considered core to its operations so it could focus on lower risk,

higher-return U.S. fields.

Marathon executives on Monday credited those sales with

strengthening the balance sheet enough to make the PayRock

acquisition, and said they didn't see a need to issue new shares to

complete the deal.

The Payrock purchase is expected to close in the third quarter,

pending customary closing conditions.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 21, 2016 02:51 ET (06:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

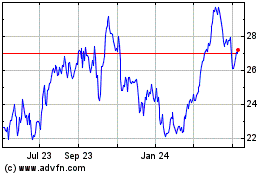

Marathon Oil (NYSE:MRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

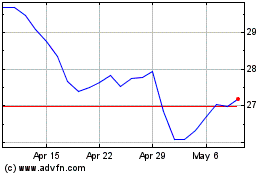

Marathon Oil (NYSE:MRO)

Historical Stock Chart

From Apr 2023 to Apr 2024