Glaxo Swings to Loss on Write-Down But Core Earnings, Revenue Beat Expectations -- Update

27 July 2016 - 10:47PM

Dow Jones News

By Denise Roland

GlaxoSmithKline PLC posted a loss in the second quarter,

reflecting a GBP1.8 billion ($2.36 billion) write-down related to

the increased value of liabilities following the sharp drop in the

value of the pound triggered by Britain's vote to leave the

European Union.

At the same time, the company cheered investors by beating

market expectations for core earnings and revenue, sending shares

up 1.5%. Glaxo also narrowed its full-year guidance to the upper

end of earlier estimates. It now expects core earnings per share to

increase 11-12% in 2016, compared with 10-12% previously.

Core operating profit, a measure that strips out one-time losses

and gains, increased 36% to GBP1.8 billion, as revenue climbed 11%

to GBP6.5 billion, beating analyst forecasts of GBP6.3 billion.

Glaxo reports in pounds but makes most of its revenue outside

the U.K., meaning its reported revenue benefited from the sharp

drop in the value of the pound following the Brexit vote, a

currency move that also increased the value of Glaxo's liabilities.

Adjusting for currency, core operating profit climbed 15% and

revenue rose 4%.

The pharmaceutical giant posted a net loss of GBP435 million for

the three months to June 30, compared with GBP149 million net

profit reported a year earlier.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

July 27, 2016 08:32 ET (12:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

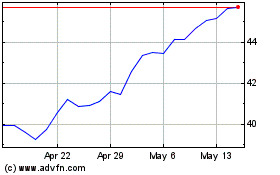

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

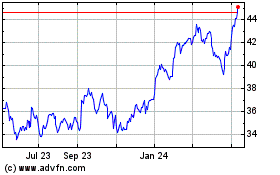

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024