Euro Mixed After Eurozone Inflation, Gross Domestic Product Reports

29 July 2016 - 4:00PM

RTTF2

The euro turned in mixed against its major counterparts in early

European deals on Friday, after the release of mixed economic data

from Eurozone, which showed a pick up in consumer price inflation

in July, whereas the economic growth slowed in the second

quarter.

Flash estimate from Eurostat showed that Eurozone economic

growth eased in the second quarter.

Gross domestic product climbed 0.3 percent from the first

quarter, when it grew 0.6 percent. The rate came in line with

expectations.

On a yearly basis, economic growth eased marginally to 1.6

percent from 1.7 percent. It was expected to grow 1.5 percent.

Separate data showed that Eurozone consumer prices increased for

the second straight month in July.

Consumer prices climbed 0.2 percent year-on-year, following a

0.1 percent rise in June. Prices were expected to rise again by 0.1

percent.

Core inflation that excludes energy, food, alcohol and tobacco

held steady at 0.9 percent in July. Economists had forecast

inflation to slow to 0.8 percent.

European markets are higher, with the banks pacing the gains

amid upbeat earnings results.

The currency was lower against most major opponents in Asian

deals, amid rising risk aversion, as the Bank of Japan expanded

purchases of exchange-traded funds but left its policy rate

unchanged, falling short of investors' expectations.

The euro held steady against the Japanese yen, after touching

more than a 2-week low of 113.92 in Asian deals. This may be

compared to a 2-day high of 116.87 set at 11:30 pm ET. The pair was

valued 116.58 when it finished Thursday's trading.

The Bank of Japan raised the target for exchange-traded fund

purchases, while holding its interest rate.

The bank will increase the purchases of exchange-traded funds so

that their outstanding amount will rise at an annual pace of about

JPY 6 trillion.

The single currency strengthened to 1.1103 per greenback,

following a decline to 1.1072 at 11:30 pm ET. The euro is seen

finding resistance around the 1.12 mark.

The euro fell to a 3-day low of 1.0840 against the Swiss franc,

compared to 1.0864 hit late New York Thursday. On the downside, the

euro may possibly locate support around the 1.07 level.

Survey results by the think tank KOF showed that its economic

barometer unexpectedly rose for a second straight month in July to

its highest level in four months, signaling sustained favorable

prospects.

The KOF Economic Barometer rose to 102.7 from 102.6 in June,

which was revised from 102.4. Economists were looking for a lower

score of 101.4.

Bouncing off from an early low of 0.8388 against the Sterling,

the euro edged up to 0.8439. The euro is likely to find resistance

around the 0.86 zone.

Data from the Bank of England showed that U.K. mortgage

approvals declined to a one-year low in June.

The number of mortgages approved in June fell to 64,766 in June

from 66,722 in May. This was the lowest since May 2015, when

approvals totaled 64,174. It was forecast to drop to 65,500 in

June.

Looking ahead, Canada industrial product price index for June

and GDP data for May, as well as the U.S. advanced GDP data for the

second quarter, Chicago manufacturing survey results for July and

University of Michigan's final consumer sentiment for July are to

be released in the New York session.

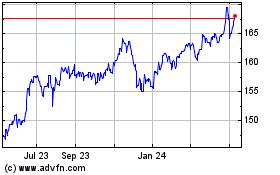

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

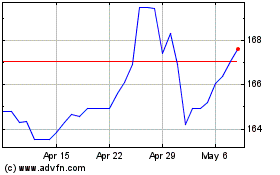

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024