By Max Colchester and Jenny Strasburg in London and Deborah Ball in Milan

European regulators gave most banks a clean bill of health in

"stress tests" despite the Continent's sluggish growth and low

interest rates, saying only a clutch of lenders would struggle to

ride out a hypothetical severe economic downturn.

The European Banking Authority released results Friday of its

latest stress test showing how much capital, or cushion against

losses, banks would have left on their balance sheets in an adverse

economic scenario. The tests come after European banks climbed out

of the 2010 eurozone crisis but have continued to grapple with low

profits, bad loans and, sometimes, management problems and

turnover, all of which have translated into struggling stock

prices.

Struggling Italian lender Banca Monte dei Paschi di Siena SpA

was at the bottom of the pack of 51 banks assessed, underscoring

investor sentiment that the bank is a worrisome vulnerability in

the country's system and needs to raise substantial funds.

Other major banks that suffered sizable hits to their capital

buffers included UniCredit SpA, Barclays PLC and Deutsche Bank

AG.

Hours before the results were made public, the board of Monte

dei Paschi unveiled a plan to unload nonperforming loans and raise

up to EUR5 billion ($5.54 billion) in capital. Because the

Siena-based bank was expected to be the worst performer in the

test, its management was eager to come up with a plan to head off a

crisis of confidence following release of the results.

The bank said the tests didn't take into consideration its new

plan to raise capital and unload sour loans.

The European Central Bank said the exam used a less severe

scenario than the toughest one used in stress tests for U.S. banks

in June, in which 31 out of 33 U.S. lenders, including big firms

such as Bank of America Corp. and Citigroup Inc., passed. In

addition, the European Union tests didn't include struggling Greek

and Portuguese banks this year, which could help account for the

relatively rosy results despite Europe's woes. Such lenders are

being privately tested by regulators, and the results won't be made

public.

In addition, the banking authority's toughest economic scenario

didn't factor in negative interest rates or the effects of a U.K.

pullout from the EU. Regulators said the scenarios tested were

gloomier than most of the predicted impact from the Brexit

vote.

Unlike in previous European stress tests, regulators didn't

include a pass or fail result for each bank related to a specific

capital amount. Instead, the EBA has left it up to investors and

regulators to interpret the results.

Broadly, investors were looking for banks to maintain at least a

5.5% ratio of top-quality capital in the test scenario, analysts

said.

Of the "systemically important" European banks, Italy's

UniCredit fared the worst, with a ratio of 7.1%. U.K. bank Barclays

had a capital ratio of 7.3%.

Deutsche Bank had a 7.8% capital level, better than some

analysts had expected. Investors had been concerned that the German

lender could face an ill-timed capital crunch. The results show

that Germany's largest lender by assets must continue to cut costs

and reduce risky assets to boost its buffer against losses.

Deutsche Bank Chief Executive John Cryan said the test showed

the bank is "well equipped for tough times" and on track to reach

capital goals in its turnaround plan.

UniCredit said it would take the results into consideration as

it develops its new strategic plan.

Some analysts said they had expected Barclays to meet a higher

capital ratio threshold of 7.5%.

Such an expectation potentially raises pressure on the bank to

bolster its balance sheet. It said was focused on a separate Bank

of England stress test expected later this year.

Swiss banks UBS Group AG and Credit Suisse Group AG aren't part

of the eurozone and weren't included in the stress tests.

Generally, the test was a glimmer of good news for U.K. banks,

whose share prices have been depressed following the country's vote

to exit the EU in late June.

"The results demonstrate that the extensive banking reforms

since the financial crisis are working," said Anthony Browne, chief

executive of the BBA British banking group.

Monte dei Paschi's capital buffer, which was calculated before

the bank unveiled its overhaul plan on Friday, was totally wiped

out by the test scenario. Its poor results underscore the

importance of carrying out its new plan, which includes unloading

EUR9.2 billion in net nonperforming loans to Atlante, a fund

orchestrated by the government and financed by Italian banks,

insurers and pension funds. The plans still needs regulatory

approval.

Ireland's Allied Irish Banks PLC also came in under the 5.5%

bar, with a capital ratio of 4.3%. All the other banks came in at

over the 5.5% hurdle.

Individual countries' regulators will use the numbers to

calculate each bank's capital requirement later in the year.

Underperforming banks could be guided to hold more capital, but

authorities are unlikely to widely force banks to raise more funds.

Alternatively, banks could face tougher "qualitative measures" such

as improving risk controls.

Write to Max Colchester at max.colchester@wsj.com, Jenny

Strasburg at jenny.strasburg@wsj.com and Deborah Ball at

deborah.ball@wsj.com

(END) Dow Jones Newswires

July 29, 2016 19:08 ET (23:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

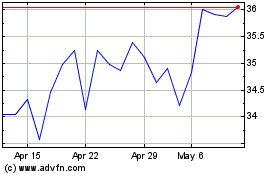

Unicredit (BIT:UCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unicredit (BIT:UCG)

Historical Stock Chart

From Apr 2023 to Apr 2024