Asian Shares Rise on U.S. Gains and Higher Commodities Prices

30 August 2016 - 3:20PM

Dow Jones News

Asia's share markets were broadly higher on Tuesday, lifted by

overnight gains on Wall Street and rising commodities prices,

though volatility in the yen capped the Nikkei's gains.

Australia's S&P/ASX 200 was trading up 0.5%, while

Singapore's Strait Times Index gained 0.2%, and Malaysia's FTSE

Bursa Malaysia Index added 0.1%, after oil and metal prices

rebounded from recent losses.

Brent, the global crude-oil benchmark, was up 16 U.S. cents at

$49.34 a barrel in Asian trading, while copper prices rose 0.6% to

$4,642 a metric ton, supporting shares of commodities-related

companies.

In Australia, Rio Tinto Ltd. gained 0.9% and Oil Search Ltd. was

up 1.3%, while in Japan, Sumitomo Metal Mining Co. rose 2.5% and

Japan Petroleum Exploration Co. added 1.6%.

Elsewhere in the region, Hong Kong's Hang Seng Index rose 0.7%,

the Shanghai Composite Index was flat and Korea's Kospi was up

0.6%. The gains were boosted by strength in U.S. markets on Monday,

with the Dow Jones Industrial Average ending up 0.6%.

Meanwhile, Japanese stocks were initially under pressure from a

stronger yen, which makes the nation's exports more expensive.

The Nikkei Stock Average opened lower amid a bout of yen

strengthening against the U.S. dollar, but the index recovered

slightly, and was last flat at 16,739.93 points, as the yen later

fell 0.2% against the dollar.

"It is a currency story," said Angus Nicholson, a market analyst

at IG Markets Ltd. "It must be a total pain to invest in Japanese

stocks at the moment when the sole driver and focus for the market

is just the exchange rate."

A trio of mixed economic data from Japan on Tuesday also weighed

on equities investors there, with analysts expecting positive

consumer spending to continue.

Retail sales in Japan fell by the smallest margin in five months

in July, a possible indication that consumers may becoming less

cautious about spending despite slow wage growth and uncertainty

over the global economy. Meanwhile, the nation's unemployment rate

fell to 3.0% in July from 3.1% in the previous month, its lowest

reading since May 1995.

However, Japanese household spending fell again in July despite

continued improvement in the labor market, underlining the

conflicting signs of progress in Prime Minister Shinzo Abe's

efforts to generate sustained growth.

One of the Nikkei's winners was the financial sector, with bank

stocks gaining on the prospect of higher U.S. interest rates, which

could help lenders boost margins. Shishei Bank Ltd rose 1.3% and

Mitsubishi UFJ Financial Group gained 1.1%.

In Hong Kong, shares of major Chinese lenders also rose, ahead

of the release of first-half earnings by Industrial and Commercial

Bank of China Ltd. and Bank of China Ltd. after markets close on

Tuesday. ICBC was last up 0.8%, while Bank of China was trading

0.9% higher.

Analysts expect market trading in Asia to remain volatile ahead

of the release of U.S. jobs data late Friday.

"In light of strong jobs reports over the last two months, the

likelihood of an impending rate hike has substantially increased,"

wrote Margaret Yang, a market analyst at CMC Markets PLC. in a

note.

"The market's focus has now turned to nonfarm payrolls this

Friday, which is set to be a key determinant of the Fed's rate-hike

decision in September," she said.

Takashi Nakamichi, Kosaku Narioka, Kenan Machado and Mitsuru Obe

contributed to the article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

August 30, 2016 01:05 ET (05:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

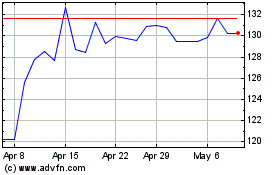

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

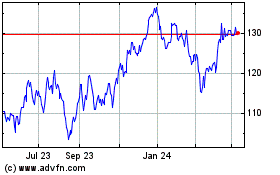

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024