NZ Dollar Retreats As RBNZ Signals Rate Cut

22 September 2016 - 11:12AM

RTTF2

The New Zealand Dollar weakened against the other major

currencies in the Asian session on Thursday, as the Reserve Bank of

New Zealand's statement hinted that further easing is closer on the

horizon than previously expected, after maintaining its Official

Cash Rate at the record low.

The Reserve Bank of New Zealand kept its Official Cash Rate at

the record low of 2.00 percent. The decision was in line with

expectations after the central bank trimmed its benchmark by 25

basis points in August after holding fire for two straight

months.

The RBNZ added that further easing may be appropriate, depending

on the results of forthcoming economic data.

"Monetary policy will continue to be accommodative. Our current

projections and assumptions indicate that further policy easing

will be required to ensure that future inflation settles near the

middle of the target range. We will continue to watch closely the

emerging economic data," RBNZ Governor Graeme Wheeler said.

Meanwhile, the Asian stock markets traded higher after the

Federal Reserve kept interest rates unchanged and hinted at a rate

hike before the end of the year.

Wednesday, the NZ dollar showed mixed trading against its major

rivals. While the kiwi rose against the U.S. dollar and the euro,

it fell against the yen and the Australian dollar.

In the Asian trading, the NZ dollar fell to nearly a 4-week low

of 73.38 against the yen and more than a 2-week low of 1.0405

against the Australian dollar, from the recent lows of 73.87 and

1.0333, respectively. If the kiwi extends its downtrend, it is

likely to find support around 71.00 against the yen and 1.05

against the aussie.

Against the kiwi, the greenback dropped to 0.7316 from nearly a

2-week high of 0.7369. The kiwi may test support near the 0.70

region.

The kiwi edged down to 1.5285 against the euro, from a recent

high of 1.5187. On the downside, 1.55 is seen as the next support

level for the kiwi.

Looking ahead, European Central Bank releases its economic

bulletin in Frantfurt at 4:00 am ET. Bank of England Financial

Policy Committee statement is due to be published at 4:30 am

ET.

In the New York session, U.S. weekly jobless claims for the week

ended September 17, U.S. existing homes sales data for August, U.S.

FHFA house price index for July, U.S. leading indicators for August

as well as Eurozone consumer confidence index for September are

slated for release.

At 9:00 am ET, European Central Bank President Mario Draghi,

Vice Presidents Valdis Dombrovskis and Vitor Constancio are

expected to speak at the European Systemic Risk Board annual

conference in Frankfurt.

At 9:30 am ET, Bank of England Deputy Governor Jon Cunliffe is

expected to participate in a panel discussion at the European

Systemic Risk Board in Frankfurt.

At 1:00 pm ET, Bank of England Governor Mark Carney will deliver

a presentation titled "Arthur Burns memorial lecture," in Berlin.

At the same time, BOE MPC Member Kristin Forbes will deliver a

speech at Imperial College in London.

The Japanese market is closed in observance of Autumnal Equinox

day holiday.

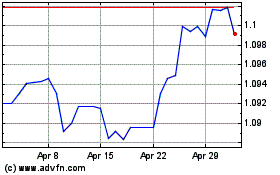

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

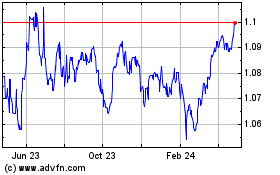

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024