Software maker considers a takeover of social media firm as

growth efforts sputter

By Dana Mattioli and Yoree Koh

Twitter Inc. may be contemplating a future in the hands of an

acquirer after a yearslong effort to sharpen its focus and ignite

user growth has fallen short.

Salesforce.com Inc. is considering a takeover of the social

media company, according to people familiar with the matter. The

exploration is in early stages, one of the people said, and might

not lead to a deal.

Shares of Twitter rose 21% to $22.62 on Friday after CNBC

reported talks of a possible sale. Before Friday, the stock had

fallen 30% over the past year and its market value was about $13

billion. Its all-time high of $40.7 billion came in December

2013.

Salesforce Chief Executive Marc Benioff has been a voracious

acquirer, and the company has indicated an interest in challenging

its business-software competitors by devouring startups in such

areas as e-commerce and artificial intelligence.

The sales talks shift the conversation around Twitter from

constant business turmoil to the strategic and financial value it

could bring to any number of Silicon Valley giants.

Twitter is approaching the three-year anniversary of its flashy

IPO, when its stock shot up 73% as investors crowned the company a

social media star rivaling Alphabet Inc.'s Google and Facebook Inc.

for advertising dollars. Twitter had become a household name,

building a powerful communication tool that gives voice to ordinary

citizens and celebrities alike.

Since that debut, a series of management upheavals, product

delays and muddled business strategies have complicated Twitter's

effort to capture the world's mobile users and wring revenue out of

them.

Last year, Twitter brought back Jack Dorsey as its chief

executive after some investors lost confidence in former CEO Dick

Costolo's ability to spark growth in the business. Mr. Dorsey's

return was hailed by some employees and investors who believed

Twitter needed its founding architect to right the company.

But even the self-assured Mr. Dorsey, who splits his time as CEO

of payments company Square Inc., has in recent months grown

increasingly stressed about the difficulty of fixing Twitter amid a

march of negative press reports, according to people close to

him.

Mr. Dorsey has sought to reinvigorate Twitter's ad business

around video and revive user growth by making the short-messaging

service he invented easier to use and by getting rid of rules that

some find confusing.

Those efforts haven't translated into meaningful user or revenue

growth. Twitter's second-quarter revenue rose 20% to $602 million,

its smallest gain and eighth-straight period of declining growth.

Total monthly users grew just 1% to 313 million.

Meanwhile, other social and messaging apps such as Facebook,

Instagram and Snapchat Inc. have gained favor with advertisers and

wooed smartphone users at a faster clip. Twitter's share of global

digital-ad spending stands at just 1.2%, according to

eMarketer.

Twitter's struggles, alongside a deal-friendly climate in

Silicon Valley, have raised questions around the firm's future as

an independent public company.

Twitter's audience is still sizable for most companies

interested in expanding their social media offerings, especially as

people spend more of their time on smartphones.

Public figures, from Kim Kardashian to Pope Francis, have ardent

followings in the millions and outsize cultural influence on

Twitter, as seen during the presidential election season each time

Donald Trump sends a tweet.

Twitter also has a small but promising data-licensing business

that lets companies mine the billions of tweets flowing through the

service each day for information. That group's revenue totaled $67

million in the second quarter, up 35% from a year ago.

Many big brands like Anheuser-Busch InBev NV ADR and Ford Motor

Co. are still eager to advertise on Twitter, especially now that

the company is creating ways for people to watch live events free.

Last week, Twitter introduced its first live stream of a National

Football League game, and on Monday it plans to broadcast Bloomberg

TV's feed of the presidential debate. Executives hope the push into

live-streaming will attract the more premium ad dollars that come

with video ads.

"I think [a Twitter acquisition] would be a way for a media or

technology company to have immediate access to a sizable platform,"

said Nomura analyst Anthony diClemente. "That's a big means of

distribution of media and social content and in some ways the

strategic value of Twitter is in the eyes of the beholder."

Twitter would in some ways be an odd fit for Salesforce, which

is focused on providing software services to businesses.

Mr. Benioff has signaled more big deals are coming and expressed

his frustration after losing out to Microsoft Corp. in the

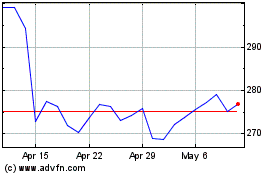

acquisition of LinkedIn Corp. On Friday, Salesforce shares fell

5.6% to $70.39.

Like LinkedIn, Twitter could bring Salesforce reams of data to

create recommendations and insights for its corporate customers.

Salesforce already has a partnership with Twitter to feed social

media data into Salesforce's analytics systems to give its

customers insights on things like how their customers are talking

about their products and brands.

That alliance, started in 2012, provides Salesforce access to

the full fire hose of public tweets on Twitter, giving Salesforce

insight into the value of that information for its products.

--Rachael King contributed to this article.

Write to Dana Mattioli at dana.mattioli@wsj.com and Yoree Koh at

yoree.koh@wsj.com

(END) Dow Jones Newswires

September 24, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

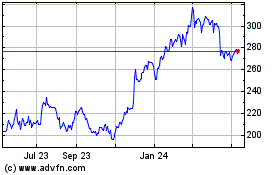

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024