Dollar Higher After Upward Revision To U.S. GDP, Positive Jobless Claims Data

29 September 2016 - 7:43PM

RTTF2

The U.S. dollar firmed against its major counterparts in early

New York deals on Thursday, as the U.S. economy expanded more than

previously estimated in the second quarter and first-time claims

for U.S. unemployment benefits rose less than expected in the week

ended September 24, boosting Fed rate hike bets later this

year.

Data from the Commerce Department showed that the U.S. GDP

increased more than previously estimated in the second quarter,

primarily reflecting upward revisions to non-residential fixed

investment.

The Commerce Department said second quarter GDP climbed by 1.4

percent compared to the previously reported 1.1 percent increase.

Economists had expected the pace of GDP growth to be upwardly

revised to 1.3 percent.

According to a report released by the Labor Department,

first-time claims for U.S. unemployment benefits rose by less than

expected in the week ended September 24th.

The report said initial jobless claims edged up to 254,000, an

increase of 3,000 from the previous week's revised level of

251,000.

Economists had expected jobless claims to climb to 260,000.

The data came a day after Yellen's testimony before the

Congress, suggesting the likelihood for an interest rate hike by

the end of year.

"If we allow the economy to overheat, we could be faced with

having to raise interest rates more rapidly than we would want

which could conceivably jeopardize that good state of affairs that

we have come close to achieving," Yellen told lawmakers.

The greenback has been trading in a positive territory against

its major rivals, except the Swiss franc, in the European

session.

Extending early rally, the greenback appreciated by 1.1 percent

to an 8-day high of 101.82 against the Japanese yen. The greenback

is seen finding resistance around the 103.00 mark.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's retail sales declined 1.1 percent on month in

August.

That missed forecasts for a decline of 0.8 percent following the

upwardly revised 1.5 percent increase in July. The greenback

climbed to 1.1197 against the euro, up by 0.3 percent from a low of

1.1236 hit at 12:00 am ET. On the upside, 1.00 is possibly seen as

the next resistance level for the greenback.

Survey data from the European Commission showed that Eurozone

economic sentiment rebounded strongly in September to its highest

level thus far this year from a five-month low in the previous

month.

The economic sentiment index climbed to 104.9 from 103.5 in

August. Economists had forecast an unchanged reading.

The greenback was trading in a positive territory against the

pound with the pair trading at 1.3007, off its early 6-day low of

1.3057. The next possible resistance for the greenback may be found

around the 1.28 region.

Data from the Bank of England showed that U.K. mortgage

approvals declined in August to the lowest since late 2014.

The number of mortgages approved in August dropped to 60,058

from 60,925 in July. This was the lowest since November 2014, when

mortgages totaled 59,392. The level was expected to fall to 60,200

in August.

The greenback reversed from its recent 2-day low of 0.9689

against the Swiss franc, rising back to 0.9713. Further upward move

may see the greenback challenging resistance around the 0.98

area.

The greenback that rebounded from an early Asian session's

3-week low of 0.7710 against the aussie held steady in subsequent

deals, trading at 0.7665. At yesterday's close, the pair was worth

0.7692.

The greenback held steady against the kiwi, after reaching as

high as 0.7255 at 7:00 am ET. The kiwi-greenback pair finished

Wednesday's deals at 0.7284.

On the flip side, the greenback stayed weaker against the

loonie, as the latter was supported by the surprise announcement by

the OPEC agreeing to curb output in November. The greenback has set

a 6-day low of 1.3048 against the loonie at 8:30 pm ET.

The U.S. pending home sales data for August is due at 10:00 am

ET.

At the same time, Federal Reserve Governor Jerome Powell will

deliver a speech titled "Trends in Community Bank Performance Over

the Past 20 Years" at the Community Banking Research and Policy

Conference, in St. Louis.

At the same time, European Central Bank President Mario Draghi

and Vice President Vitor Constancio are expected to speak at the

First ECB Annual Research Conference in Frankfurt.

At 2:00 pm ET, Federal Reserve Bank of Minneapolis President

Neel Kashkari participates in Town Hall on economic development in

Rapid City and surrounding areas, in South Dakota.

At 4:00 pm ET, Federal Reserve Chair Janet Yellen is expected to

speak at the Minority Bankers Forum in Kansas City, via

satellite.

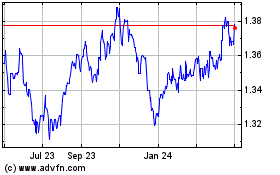

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

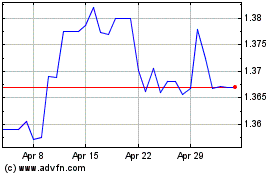

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024