European Stocks Snap Winning Streak

05 October 2016 - 7:30PM

Dow Jones News

European stocks paused a winning streak on Wednesday after

concerns about higher U.S. interest rates sent Wall Street to a

lower close.

The Stoxx Europe 600 fell 1% in the early minutes of trading

after six consecutive days of gains. Every sector was in the red,

with mining companies the worst performers despite a modest rebound

in gold and oil prices.

London's FTSE 100 Index, which closed at its highest level since

2015 on Tuesday, inched down 0.3%.

In currencies, the British pound declined to as low as $1.2685

on Wednesday after touching a 31-year-low in the previous session.

The dollar was otherwise slightly softer, with the WSJ Dollar Index

down 0.1%.

U.S. stocks, bonds and gold prices had dropped on Tuesday while

the dollar strengthened as investors sold shares of steady

dividend-payers on signals the Federal Reserve expects to raise

rates by the end of the year.

Shares in Asia mostly ended higher, catching up with gains in

Europe in the previous session, except Australia's S&P ASX 200

where mining companies took a hit from gold's biggest daily drop

since June on Tuesday.

Yields on 10-year German government bonds were at minus 0.56%,

holding onto most of Tuesday's steep climb triggered by a report

from Bloomberg News that policy makers at the European Central Bank

reached an informal consensus to wind down bond buying gradually

when the bank decides to end the purchases program. The ECB

subsequently denied the governing council had discussed the

subject.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

October 05, 2016 04:15 ET (08:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

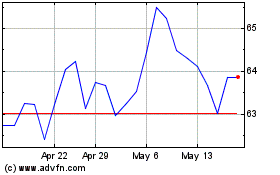

ASX (ASX:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

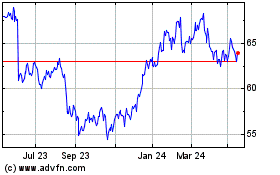

ASX (ASX:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024

Real-Time news about ASX Limited (Australian Stock Exchange): 0 recent articles

More Asx Fpo News Articles