NZ Dollar Rises Amid Rising Risk Appetite

20 October 2016 - 1:11PM

RTTF2

The New Zealand dollar strengthened against the other major

currencies in the Asian session on Thursday amid rising risk

appetite, following the positive lead overnight from Wall Street

and the surge in crude oil prices. However, gains are modest as

investors preferred to stay on the sidelines after the third and

final U.S. presidential debate ended.

Wednesday, the NZ dollar showed mixed trading against its major

rivals. While the kiwi rose against the U.S. dollar, the yen and

the euro, it held steady against the Australian dollar.

In the Asian trading, the NZ dollar rose to more than a 2-week

high of 0.7266 against the U.S. dollar, a 6-week high of 1.5102

against the euro and nearly a 6-week high of 75.27 against the yen,

from yesterday's closing quotes of 0.7229, 1.5169 and 74.77,

respectively. If the kiwi extends its uptrend, it is likely to find

resistance around 0.73 against the greenback, 1.50 against the euro

and 76.00 against the yen.

Against the Australian dollar, the kiwi advanced to a 10-day

high of 1.0597 from an early 2-day low of 1.0695. The kiwi is

likely to find resistance around the 1.04 area. Data from the

Australian Bureau of Statistics showed that the unemployment rate

in Australia was a seasonally adjusted 5.6 percent in September.

That was beneath forecasts for 5.7 percent, which would have been

unchanged from the previous month following a revision from 5.6

percent.

The Australian economy lost 9,800 jobs last month, well shy of

expectations for an increase of 15,000, following the loss of 8,600

jobs in August.

Looking ahead, Eurozone current account data for August and U.K.

retail sales data for September are slated for release later in the

day.

The European Central bank will announce its interest rate

decision at 7:45 am ET. The bank is forecast to keep its refi rate

at zero percent and the deposit rate at -0.4 percent.

Following the announcement, European Central Bank President

Mario Draghi will hold the customary post-meeting press

conference.

In the New York session, U.S. weekly jobless claims for the week

ended October 15, U.S. existing home sales data and leading

indicators for September and U.S. Philly Fed manufacturing index

for October are set to be published.

At 8:00 am ET, Bank of England Deputy Governor Nemat Shafik is

expected to participate in a panel discussion about reform in the

financial services industry at the Federal Bank of New York's

conference.

At 8:30 am ET, Federal Reserve Bank of New York President

William Dudley is scheduled to give welcome remarks at a conference

entitled "Reforming Culture and Behavior in the Financial Services

Industry: Expanding the Dialogue", in New York.

European Union leaders summit is due to be held in Brussels,

later in the day.

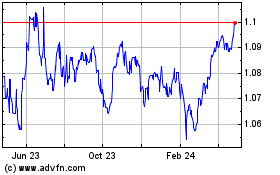

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Mar 2024 to Apr 2024

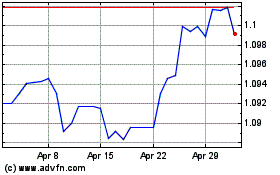

AUD vs NZD (FX:AUDNZD)

Forex Chart

From Apr 2023 to Apr 2024