Australian Dollar Climbs Amid Risk Appetite

24 October 2016 - 3:19PM

RTTF2

The Australian dollar advanced against its major rivals in the

Asian session on Monday, as Asian markets advanced, with China

pacing the gains, amid optimism that the Chinese officials will

ramp up infrastructure spending and speed up structural reforms at

state-owned enterprises.

China's most elite Communist Party cadres - the country's top

decision-makers - are gathering in Beijing this week for a four-day

meeting in the run-up to a major party leadership reshuffle next

year.

The sixth plenum that kicked off today focus primarily on "key

issues concerning the comprehensive and strict management of the

Party," the future of Chinese President Xi Jinping's hallmark

anti-corruption campaign.

Investors brace for a wave of earnings and manufacturing reports

from the U.S. this week for further clues on the direction of

global monetary policy.

Key U.S. economic data this week include consumer confidence,

new home sales, durable goods orders and third quarter GDP, which

could shed more clues on the health of the economy.

The currency has been trading lower against most major rivals on

Friday amid risk aversion, as ECB President Mario Draghi refrained

from saying anything on QE extension and Fed voting member William

Dudley reiterated that a rate hike is on the cards by the end of

2016.

The aussie spiked up to more than a 2-year high of 1.0178

against the loonie, from its previous low of 1.0133. Continuation

of the aussie's uptrend may lead it to a resistance around the 1.03

zone.

The aussie bounced off to 0.7634 against the greenback and

1.4256 against the euro, reversing from its early lows of 0.7591

and 1.4318, respectively. The next possible resistance for the

aussie is seen around 0.78 against the greenback and 1.40 against

the euro.

The aussie came off from an early low of 78.88 against the yen,

edging higher to 79.22. The aussie is seen finding resistance

around the 82.00 mark.

Survey figures from IHS Markit showed Japan's manufacturing

activity expanded at the fastest pace in nine months in

October.

The Nikkei Flash Manufacturing Purchasing Managers' Index, or

PMI, rose to 51.7 in October from 50.4 in September.

The aussie climbed to 1.0648 against the kiwi, off its previous

low of 1.0613. Further uptrend may take the aussie to a resistance

around the 1.08 region.

Looking ahead, Canada wholesale sales for August are set for

release at 8:30 am ET.

At 9:00 am ET, the Federal Reserve Bank of New York President

William Dudley will deliver opening remarks at the Federal Bank of

New York Annual Conference.

Subsequently, Federal Reserve Bank of St. Louis President James

Bullard speaks about the economy and monetary policy at the

Association for University Business and Economic Research in

Arkansas.

Markit's U.S. flash manufacturing PMI for October will be out at

9:45 am ET.

The Swiss National Bank Chairman Thomas Jordan speaks about

monetary policy with negative interest rates at the University of

Basel at 12:15 pm ET.

The Bank of Canada Governor Stephen Poloz, will testify along

with Senior Deputy Governor Carolyn Wilkins before the House of

Commons Standing Committee on Finance in Ottawa at 3:30 pm ET.

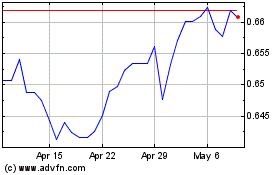

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024