T. Rowe Price Profit Rises 18% -- Update

28 October 2016 - 4:34AM

Dow Jones News

By Sarah Krouse

Giant money manager T. Rowe Price Group Inc. reported better

earnings and mutual fund performance during the third quarter. Yet

clients still pulled some money from the firm's actively managed

stock funds.

The opposing trends reinforce the predicament facing T. Rowe

Price and other active managers as they experience pressure from

index-tracking rivals. Those typically lower-cost funds continue to

attract new money at the expense of funds that make specific

bets.

"What's within our control is to continue to deliver alpha after

fees and hope that over time it carries the day," Chief Executive

William Stromberg said in an interview.

The Baltimore manager said Thursday its third-quarter earnings

rose 18% as investment advisory fees and assets under management

increased. Gains in global stock and fixed-income markets helped

boost assets to $812.9 billion at the end of September compared

with $725.5 billion a year earlier.

The firm also said 84% of its mutual funds outperformed their

Lipper averages on a total return basis over three years at the end

of September, up from 78% at the same time last year. Over five

years 82% of those funds outperformed, up from 77% at the same time

a year earlier.

Despite that improved performance clients still pulled a net

$200 million from the firm during the quarter. Most of that came

out of U.S. equity funds. T. Rowe did attract new money to its

fixed-income mutual funds, international stock funds and other

accounts.

Mr. Stromberg said in a press release that "passive headwinds"

and strategies that are closed to new investors because they have

reached maximum capacity had a "significant impact" on U.S. equity

flows.

The firm's leaders are still discussing whether to proceed with

actively managed exchange-traded funds that must disclose their

portfolio holdings daily or to wait for a potential green light

from the Securities and Exchange Commission to launch so-called

nontransparent actively managed ETFs that don't disclose their

holdings each day.

T. Rowe Price reported a third-quarter profit of $327.8 million,

or $1.28 a share, up from $277.1 million, or $1.06 a share, a year

earlier.

Revenue increased 4.2% to $1.09 billion. Investment advisory

fees grew 5.2% to $970.5 million.

Mr. Stromberg said investment advisory fees during the period

were helped by the firm's investment performance and products

outside the U.S. that typically charge higher fees.

Analysts polled by Thomson Reuters expected a per-share profit

of $1.18 and revenue of $1.08 billion.

Write to Sarah Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

October 27, 2016 13:19 ET (17:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

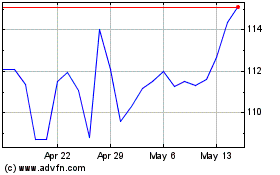

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Apr 2023 to Apr 2024