With Eyes on OPEC, Oil Prices Rebound Slightly

30 November 2016 - 4:30PM

Dow Jones News

Crude futures rebounded in Asia, though sentiment remains

bearish that the Organization of the Petroleum Exporting Countries

will deliver an agreement later today on production cuts.

An OPEC deal would be aimed at cutting into a global oversupply

of oil that has severely depressed prices since 2014. A proposal

would have the group cut production by more than a million barrels

a day, which represents about 1% of the global oil supply.

Goldman Sachs says if OPEC reaches an accord on production,

prices could rise to the low-$50-a-barrel range. If no deal is

reached, oil prices could plunge below $40 a barrel.

On the New York Mercantile Exchange, light, sweet crude futures

for delivery in January recently traded at $45.51 a barrel, up

$0.28 in the Globex electronic session. January Brent crude on

London's ICE Futures exchange rose $0.44 to $46.82 a barrel.

In the past year, OPEC leaders have tried several times to agree

on production curbs, but these attempts have failed. In April, de

facto OPEC leader Saudi Arabia refused take part in a deal after it

insisted that all members agree on production cuts, which didn't

happen. The kingdom is likely to make the same demand this time

around.

Tension between Iran and Saudi Arabia has been a sticking point

leading up to today's summit in Vienna. Even though Iran has

relaxed its position by agreeing to hold production levels steady—a

step back from a previous demand to keep pumping—it remains to be

seen whether Saudi Arabia will be satisfied.

"The fact that geopolitical rivals, Saudi Arabia and Iran,

appear to have problems resolving their differences on the

allocation of any cartel-wide production cuts seems to be the major

stumbling block to any agreement," said Barnabas Gan, an economist

at OCBC bank in Singapore.

Iraq, OPEC's second largest producer after Saudi Arabia, also

wants to be excluded from a deal, saying it would only go as far as

capping production at present levels. Iraq says it needs the oil

revenue to fund its war against Islamic State.

The Iraqi and Iranian proposals are being circulated in a

briefing paper among OPEC members ahead of the meeting, The Wall

Street Journal reported.

"This apparent stalemate has seen investors take an increasingly

bearish view on oil prices," said ANZ Research. ANZ added that

despite the squabbling, OPEC is under growing pressure to deliver a

deal to protect its relevance.

Saudi Arabia has much more to lose if oil prices remain low and

the kingdom's finances have been strained by the glut.

"In order for the deal to happen, Saudi Arabia must be the one

to make most of the concessions," said Vyanne Lai, an energy

analyst at National Australia Bank.

Write to Jenny W. Hsu at jenny.hsu@wsj.com

(END) Dow Jones Newswires

November 30, 2016 00:15 ET (05:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

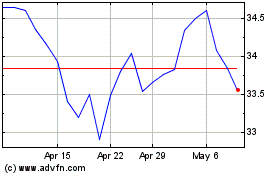

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Apr 2023 to Apr 2024