UniCredit in Talks to Sell Pioneer Investment Unit to Amundi

06 December 2016 - 3:20AM

Dow Jones News

UniCredit SpA has entered exclusive talks with Amundi SA about

the sale of Pioneer Investments, in a deal that could deliver the

Italian bank a special dividend of up to €800 million ($853

million) in addition to the sale proceeds, a person familiar with

the matter said.

The Italian lender could sell the asset-management company—part

of a strategic plan to bolster its capital base to meet strict, new

regulations—for between €3.2 billion and €3.5 billion, the person

said.

UniCredit could also receive a special dividend of €500 million

to €800 million from Pioneer before the deal, the person added. The

terms could still change.

Spokeswomen for UniCredit, Amundi and French bank Credit

Agricole SA, which owns a 75% stake in Amundi, declined to comment

on details of the possible deal.

Pioneer manages assets worth €225.8 billion across America,

Europe, the Middle East and Asia, according to its website.

UniCredit is due to announce details of its plan to shore up its

capital base on Dec. 13. Proposals may include a share sale worth

about €13 billion, along with asset sales and cost cuts, according

to people familiar with the matter.

But investors are fretting the government crisis in Italy, after

voters on Sunday rejected proposed constitutional changes in a

referendum, may complicate the bank's plans.

Since the beginning of the year Italian lenders have been

battered by investor anxiety about the robustness of the country's

banking system, which is struggling with bad loans and low

profitability. The jitters have been compounded by fears the "no"

vote in the referendum could unleash market instability. Italian

banking stocks have fallen more than 50% since the start of the

year, while European banks overall have fallen 10% over the same

period.

UniCredit has sold a 30% stake in FinecoBank SpA and a 10% stake

in Bank Pekao SA since the end of the second quarter. This has

helped raise its common equity tier 1 ratio with fully applied

Basel 3 rules—a commonly used measure of a bank's financial

health—to 10.82%, from 10.33% at the end of the second quarter.

Mediobanca SpA is advising Amundi on the Pioneer deal, while

J.P. Morgan Chase & Co. and Morgan Stanley are advising

UniCredit.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com, Inti

Landauro at inti.landauro@wsj.com and Giovanni Legorano at

giovanni.legorano@wsj.com

(END) Dow Jones Newswires

December 05, 2016 11:05 ET (16:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

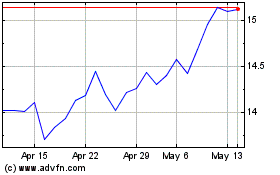

Finecobank (BIT:FBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

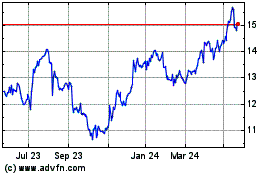

Finecobank (BIT:FBK)

Historical Stock Chart

From Apr 2023 to Apr 2024