Betting Company Rejects Buyout Bid -- WSJ

27 December 2016 - 7:02PM

Dow Jones News

Tatts turns down takeover offer from group including KKR, still

favors rival deal

By Robb M. Stewart

MELBOURNE, Australia -- Tatts Group Ltd. rejected a takeover

offer from a group of investors that includes private-equity firm

KKR & Co. and Australian bank Macquarie Group Ltd., and said it

continues to back a planned merger with rival Tabcorp Holdings

Ltd.

The wagering and lotteries company said Friday it wouldn't allow

the Pacific Consortium to go through its books or engage in

discussions over the group's buyout offer of as much as 7.34

billion Australian dollars, or roughly US$5.3 billion.

A spokesman for the consortium said the group was reviewing its

position, as well as a "material profit downgrade" by Tatts.

In its written statement Friday, Tatts said earnings before

interest, tax, depreciation and amortization were expected to fall

14% year-to-year for the lotteries business to about A$153 million

because of unfavorable jackpots.

The Pacific Consortium earlier this month offered A$3.40 a share

for Tatts's lottery business, plus shares that it valued at between

A$1 and A$1.60 in the wagering operations that it plans to float or

sell. Under Tabcorp's offer, Tatts shareholders would receive 0.80

Tabcorp share and 42.5 Australian cents in cash for each share held

in Tatts, which implied a value of A$4.34 a share.

Tatts said it concluded the consortium's unsolicited, indicative

and conditional offer was inferior to the deal with Tabcorp.

The value the consortium ascribed to its lottery business was

inadequate, Tatts said, adding that the consortium's offer was

based on assumptions that were either incorrect or inconsistent

with its own current expectations.

KKR, Australian pension fund First State Superannuation Scheme

and Morgan Stanley, as an adviser and manager to North Haven

Infrastructure Partners II LP, each have 30% stakes in the

consortium and Macquarie the remaining 10%.

Last month, Tabcorp bought a roughly 10% equity stake in Tatts,

which holds several lottery licenses in Australia and owns

over-the-counter betting shops.

Australia's gambling industry has attracted attention from

overseas in recent years, and betting activity in Tabcorp's retail

locations has fallen as a result of the heightened competition.

Companies such as Ladbrokes Coral Group PLC and William Hill PLC

have opened online betting platforms in the country.

Tatts said the estimated A$1-a-share trading price for the

wagering and gaming business that the consortium could list was too

high, and the amount of debt that the offer suggests for the

business could hurt the trading price.

The company also said that its current net debt was about A$1.2

billion, while the consortium's proposal assumed debt of no greater

than A$1.04 billion. And unlike the assumption in the offer, it

said there was no certainty its lottery license in southern

Victoria state would be renewed or if it would be on the same

terms, with the outcome of the process not expected before

June.

Tatts said that even if the consortium updated its assumptions,

with no changes to important terms and conditions, the board would

still reach the conclusion the offer wasn't superior to the planned

Tabcorp deal.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 27, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

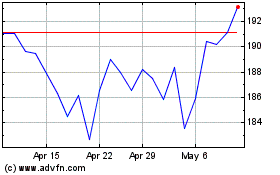

Macquarie (ASX:MQG)

Historical Stock Chart

From Mar 2024 to Apr 2024

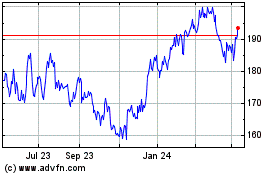

Macquarie (ASX:MQG)

Historical Stock Chart

From Apr 2023 to Apr 2024