Copper Surges On China Growth, Mine Closure

11 February 2017 - 3:21AM

Dow Jones News

By Katherine Dunn

Copper prices jumped to the highest in over a year on Friday

amid signs of Chinese growth, a strike at the world's largest

copper mine and talk of tax cuts in the U.S.

Futures for March delivery were recently up 4.2% at $2.7655 a

pound on the Comex division of the New York Mercantile Exchange,

trading at the highest level since May 2015. Prices are on track

for the biggest one-day gain since September 2015.

"There's lots of things people can take as positive for [copper]

for the time being," said Liz Grant at Sucden Financial Limited in

London.

Economic data from China released on Friday showed that both

total export and import figures for January were far higher than

expected. Exports jumped 7.9% in January from a year earlier, while

imports rose 16.7% on year, jumping 3.1% from December. China is

the world's largest consumer of copper and base metals.

Friday was also the second day of a union strike at the

Escondida mine in northern Chile, which is owned by BHP Billiton

Ltd. The mine produces roughly 5% of the world's total copper

supply. On Friday, the mine said it won't be able to fulfill

contracts for copper deliveries or shipments, according to a BHP

spokesperson.

"The last couple of days the market's been quite strong on the

back of the strike in Chile," said Ms. Grant. Copper is up more

than 5% so far this week.

Meanwhile, markets were broadly higher on Friday after comments

by President Donald Trump on Thursday that a plan to lower business

taxes was "ahead of schedule." Mr. Trump said Congress would

receive an outline of the plan by the end of the month.

"There's still a lot of optimism about the pro-growth politics

in the U.S.," said Nitesh Shah, commodities strategist at ETF

Securities in London. Expectations of those policies, paired with

strong Chinese speculative demand, helped the copper market rally

sharply late last year.

The details of the policy are still scant, Mr. Shah added, and

have to be weighed against the impact of more trade barriers on the

market.

"It hasn't sunk in just how damaging protectionism will be," he

said.

Stephanie Yang contributed to this article

Write to Katherine Dunn at Katherine.Dunn@wsj.com

(END) Dow Jones Newswires

February 10, 2017 11:06 ET (16:06 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

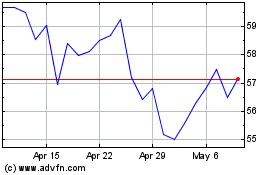

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

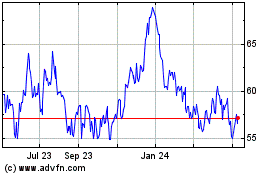

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024