By Alexandra Berzon and Peter Grant

President Donald Trump's company receives tens of millions of

dollars a year from Vornado Realty Trust, which relies on the

federal government for a significant portion of its revenue and is

vying for new work from Mr. Trump's administration.

Mr. Trump and Vornado's founder and chairman, Steven Roth, have

forged a yearslong relationship, with Mr. Trump's family company a

minority owner of two skyscrapers controlled by Vornado. Messrs.

Trump and Roth are friends, and Mr. Trump said in January that he

had appointed Mr. Roth as co-chairman of a council charged with

overseeing the president's potential $1 trillion

infrastructure-spending plan.

Mr. Trump has said that while he is in the White House, he won't

personally be involved in his real-estate business, which is being

run by his sons. He has rejected calls to sell his assets or put

them in a blind trust, and he remains the assets' owner.

Two of the most valuable real-estate assets in Mr. Trump's

company, the Trump Organization, are 30% stakes in a pair of office

buildings controlled by Vornado.

The Trump Organization's stake in 1290 Sixth Avenue in Manhattan

is worth $428.9 million, according to an analysis for The Wall

Street Journal by a financial-services firm that provided the data

on the condition it not be named. The 43-story skyscraper generates

about $14.7 million in annual cash flow for Mr. Trump's company,

according to the analysis.

The Trump Organization also owns 30% of 555 California Street in

San Francisco, with Vornado holding the other 70%. The Trump stake

is worth $322.6 million, the analysis shows. That 52-story

building, previously named the Bank of America Center, produces an

estimated $8 million in annual cash flow for Mr. Trump's company,

according to the analysis.

The amount of money the Trump Organization gets annually from

its Vornado partnerships isn't affected by how much government

business Vornado gets. But the Trump administration's decisions

could benefit -- or hurt -- Vornado's bottom line. And at the same

time, Vornado decides how much Mr. Trump's company -- the

properties' only other owner -- receives from the partnership each

year, according to people familiar with the matter.

Vornado has full control of both buildings' finances. It is up

to Vornado to decide how much of their incomes are held for capital

upgrades and other long-term expenses and how much of the income is

profit. Of that bottom-line figure, Vornado has to distribute 30%

annually to Mr. Trump's company, the people said.

The Trump Organization declined to comment and the Trump

administration didn't respond to requests for comment for this

article.

Messrs. Roth and Trump haven't reached new deals in recent

years, the people said. Mr. Roth on Tuesday was circumspect about

his relationship with President Trump when discussing the

infrastructure council on a conference call with analysts to

discuss Vornado's earnings. "I know President Trump. I've known him

for a very long time. We have had dealings together," he said.

Mr. Roth also said he was "honored" to be named to the council

and pointed out that he wasn't "in any way an employee of the

government."

Vornado also had a business relationship with Jared Kushner, the

president's son-in-law and now a senior White House aide. In 2011,

Vornado bought a 49.5% stake in the mixed-use tower at 666 Fifth

Avenue in Manhattan from Kushner Cos., where Mr. Kushner at the

time was chief executive. The next year, Vornado purchased retail

space in the building for $710 million.

Mr. Kushner resigned from his family company and is selling some

of his sizable portfolio to family members and taking other steps

to avoid conflicts of interest, according to people familiar with

the matter.

Vornado, meanwhile, has much riding on its relationships with

the federal government.

The company, a major owner of buildings in Washington and other

U.S. cities, counts the U.S. government as its largest tenant.

Vornado reported that the U.S. government represented around 6% of

its annual lease revenue in the third quarter of 2016, or around

$140 million.

Vornado is among the developers bidding to build a new Federal

Bureau of Investigation headquarters in Washington's suburbs, a $2

billion project, the Washington Post has reported. The selection

process will be run by the U.S. General Services Administration, or

GSA, part of the executive branch. Vornado has declined to comment

on this report.

People familiar with the GSA process say it has protocols in

place to prevent influence or favoritism. The bureaucratic process

means that the bidding and leasing process can take years.

"It creates a big distance between people who have immediate

political interests and the actual ability to execute them," said

Dan Tangherlini, a former GSA administrator. The GSA didn't respond

to a request for comment.

Vornado also is involved in a high-profile New York project

dependent on federal funds. Last fall, a team of Vornado, Related

Cos. and Skanska AB was named under New York Gov. Andrew Cuomo's

administration, to create a $1.6 billion train hall and retail

space in the James A. Farley Building in Manhattan, currently the

home of a post office facility. A portion of the funds is expected

to come from the federal government, Mr. Cuomo has said, but all of

the commitments haven't been made.

If the project goes ahead, it would give Vornado a boost because

the company is the largest office building owner in the surrounding

area. On an earnings call in August, when asked about the James A.

Farley project, Mr. Roth called the area the "big kahuna" for

Vornado.

The Washington region is Vornado's second-largest market after

New York. In 2016, Washington made up around 21% of the company's

$2.5 billion in revenue, according to company financial

documents.

In recent years, Vornado has been on the losing end of federal

decision-making. The Department of Defense pulled out of 2.4

million square feet of Vornado office space and moved to military

bases as part of a plan first initiated by the George W. Bush

administration to relocate military offices.

Mr. Roth in 2013 estimated that the Pentagon's office

relocations cost Vornado $70 million in earnings a year. Government

vacancies, he said on an investor conference call that year, are

"the eye of the storm for our company."

At the end of 2016, the company gave a massive Virginia complex

once used primarily as Department of Defense offices over to

debtholders after that property struggled to maintain occupancy

amid the military realignment. That caused revenue in the fourth

quarter from government leases to drop significantly, according to

analysts. Vornado reported that in the fourth quarter of 2016 its

revenue from the government declined to 3.8% of its total

revenue.

Over the next four years, Vornado is set to negotiate renewals

on 28 expiring leases with the federal government, according to

people familiar with the company.

Vornado is planning a spinoff of its Washington office buildings

and apartments, the company has said. The transaction, slated for

completion by the second quarter of 2017, would combine Vornado's

holdings in the region with those of JBG Cos., a Washington

landlord. The merger would create a landlord named JBG Smith with

12.6 million square feet of office space and more than 4,400

apartments in the area. Vornado shareholders will own a 74% stake

in the merged company. Mr. Roth will be its nonexecutive

chairman.

Write to Alexandra Berzon at alexandra.berzon@wsj.com and Peter

Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

February 18, 2017 17:31 ET (22:31 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

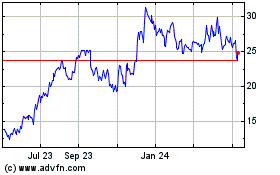

Vornado Realty (NYSE:VNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

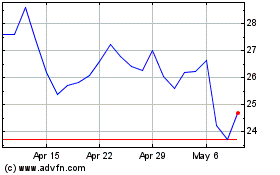

Vornado Realty (NYSE:VNO)

Historical Stock Chart

From Apr 2023 to Apr 2024