BHP Billiton Returns to Profit, Raises Dividend

21 February 2017 - 5:12PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Mining giant BHP Billiton Ltd. (BHP.AU) swung back to

profit in its fiscal first half, reflecting higher commodity

prices, continued cost cutting, and the absence of large writedowns

that had ravaged its bottom line a year earlier.

The improvement prompted the world's No. 1 miner by market value

to more than double its dividend, after only a year ago scrapping a

pledge to keep its payout steady or rising because of weak

markets.

Global miners have been benefiting from an upswing in commodity

prices that's enabled them to rebuild their balance sheets

following a deep multiyear downturn. Iron ore almost doubled in

value in 2016, and prices for natural resources including coal and

crude oil also rose.

BHP on Tuesday reported a net profit of US$3.20 billion for the

six months through December, which compared to a loss of US$5.67

billion in the same period a year earlier. The year-ago result was

linked to multiyear lows in commodity prices and roughly US$6

billion in one-off charges--mainly write downs against U.S. energy

assets.

Underlying profit increased to US$3.24 billion, from US$412

million a year earlier, it said. That prompted an increase in the

BHP's half-year payout to 40 U.S. cents a share, from 16 cents this

time last year. The miner earlier promised to offer shareholders at

least 50% of underlying profits each fiscal half.

"We are confident in the long-term outlook for our commodities,

particularly oil, with markets expected to rebalance in the

near-term, and copper where we expect a deficit to emerge in the

early 2020s," said Chief Executive Andrew Mackenzie. BHP recorded

its worst-ever annual loss last fiscal year.

Despite the upswing in world commodity markets, BHP said it

remains focused on improving the efficiency of its operations and

paying down debt, after building up a large pile of borrowings in

recent years as the company expanded sites churning out commodities

including iron ore and petroleum.

The miner said net debt fell 23% to US$20.06 billion at the end

of 2016. It said it is on track to meet a target for US$1.8 billion

in productivity gains this fiscal year, excluding any impact from

industrial action at its Escondida copper mine in Chile.

Last month the company reported mixed production results for the

period. It recorded a 7% decline in copper output, mostly linked to

disruptions to its remote Olympic Dam mine in South Australia

state. Petroleum production fell 15% after BHP deferred the

development of some onshore U.S. fields.

Still, output from its vast iron-ore operations-BHP is the

world's No. 3 iron ore exporter-was up 4% as the company increased

production from its newest iron-ore mine, Jimblebar, in Western

Australia.

BHP said substantial progress was being made on social and

environmental remediation programs at its Samarco iron-ore venture

in Brazil following a deadly dam spill in 2015. The collapse of a

dam built at the Samarco mine that it jointly owns with Vale SA

(VALE) released an avalanche of sludge that killed 19 people and

polluted more than 400 miles of rivers.

-Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

February 21, 2017 00:57 ET (05:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

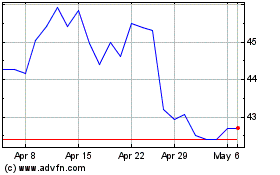

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

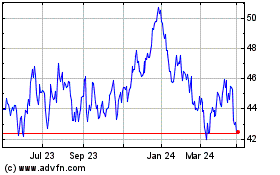

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024