By Anne Steele

Macy's Inc. said revenue will continue to decline this year as

it works on ways to improve sales and draw in more customers who

are increasingly using the internet to plan and make their

purchases.

During the December quarter, sales at Macy's stores open at

least a year fell 2.1%, not as bad as the 2.9% decline in the

year-ago fourth quarter and the 2.2% decrease analysts expected.

Still, it marked the eighth straight quarterly decline.

Earnings, meanwhile, came in better than Wall Street estimates,

and Macy's shares edged 0.8% higher midday to $32.55. Still, they

are down by one-fourth in the past three months.

Foot traffic continues to dwindle at brick-and-mortar retailers

as more shoppers are shifting more sales online.

Last month, Macy's said it would slash more than 10,000 jobs and

detailed plans to close dozens of stores after another holiday

season of weak sales, providing more evidence that department

stores have lost their once-central place in American

retailing.

Chief Executive Terry Lundgren, on his last investor call at the

helm, said 2016 "frankly wasn't the year we expected nor hoped

for."

However, the department store made significant progress on key

initiatives "that are starting to bear fruit," including improved

digital platforms, the rollout of a new approach to fine jewelry

and women's shoes, an increase in exclusive merchandise and the

refinement of the clearance and off-price strategy.

"We also took a big step forward in rightsizing our physical

footprint and restructuring our entire organization," said Mr.

Lundgren.

The company, which closed 66 stores during fiscal 2016 and plans

to close another 34, said it received $673 million in cash from

real-estate transactions last year and continues to explore options

for its properties, including redeveloping some as hotels or

condos.

Macy's expects sales in fiscal 2017 to be down between 3.2% and

4.3% -- less severe than the 4.4% decline analysts polled by

Thomson Reuters have forecast. Adjusted earnings are expected

between $2.90 to $3.15 a share, bracketing the average analyst

estimate for $3.05 a share.

Karen Hoguet, Macy's finance chief, said guidance "reflects the

desire to test and learn before we roll out initiatives nationally"

and the department store anticipates "little to no sales

improvement" meanwhile.

Over all for the fourth quarter, Macy's earned $475 million, or

$1.54 a share, down from $544 million, or $1.73 a share, a year

earlier.

Excluding impairments, store closings, settlement charges and

other costs, per-share profit fell to $2.02 from $2.09.

Sales slipped 4% to $8.52 billion.

Analysts, polled by Thomson Reuters, predicted $1.96 in earnings

per share and $8.62 billion in revenue.

Gross margin expanded to 38.3% from 37.4%.

Ms. Hoguet said in-store sales continued to be below what the

company expected.

"Clearly customers are choosing to purchase less in-store and

more through digital means," she said.

Macy's management said in the earnings report and on the call

that changes need to be more dramatic and made faster. But

executives also emphasized 2017 would be a year for testing new

concepts before rolling them out nationally. That includes new

merchandise and entertainment options, enhanced technology, updated

marketing and a simplified pricing structure.

Ms. Hoguet said Macy's is testing strategies to move away from

coupon reliance, but added "we all know making dramatic changes in

coupons is not good."

Mr. Lundgren pointed to more-organized customers entering stores

with mobile devices and making their decisions before they leave

their homes or cars.

"They've already done their homework and searches for what they

want to buy and where they want to buy it," he said. "They're

visiting fewer stores once they get to the mall -- we have to be

top of mind in that search process for them and make sure we match

up well."

Earlier this month, The Wall Street Journal reported Canada's

Hudson's Bay Co. has approached Macy's about a takeover, as the

biggest U.S. department-store chain grapples with disappointing

results and restive shareholders. There was no mention of any

discussions in Tuesday's report.

Hudson's Bay is an acquisition-hungry owner of marquee names in

retail including Lord & Taylor department stores and Saks Fifth

Avenue. While its market value is dwarfed by that of Macy's,

Hudson's Bay could raise equity and debt against its real-estate

portfolio, which could be worth $14 billion, according to people

familiar with the matter.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 21, 2017 13:16 ET (18:16 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

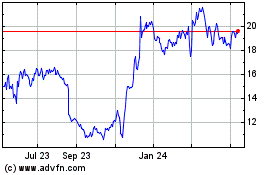

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

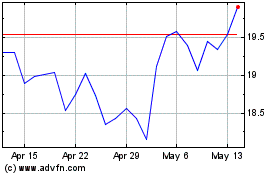

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024