Insurance Australia First-half Profit Slips

22 February 2017 - 9:15AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Insurance Australia Group Ltd. (IAG.AU),

the Australian general insurer that counts Warren Buffett as a

shareholder, saw its first-half profit slip as it was squeezed by

natural-disaster claim costs and insurance earnings declined.

The weaker half year came despite improved investment income

thanks to a stronger equity market and a better-than-expected rise

in the insurer's gross written premium, due largely to rate

increases to counter higher claim costs in some parts of its

personal lines in Australia and New Zealand and improved commercial

pricing.

The company said it now expected its full-year gross written

premium growth would be in the low single digits.

Insurance Australia's net profit fell 4.3% to 446 million

Australian dollars (US$342.8 million) in the six months through

December from A$466 million a year earlier. That was as revenue for

the period eased by less than 1%, to A$8.18 billion from A$8.24

billion.

The company's insurance profit declined 6.4% to A$571 million,

although gross written premium grew to A$5.8 billion from A$5.5

billion.

Chief Executive Peter Harmer said the period reflected a sound

result from the company's core businesses in Australia and New

Zealand and further signs that commercial pricing had passed the

bottom of the cycle.

Yet, while the company's operations in India moved into profit

over the half year, that was more than offset by increased

competition and claims pressure in Thailand and Malaysia, Mr.

Harmer said.

In mid-2015, Mr. Buffett's Berkshire Hathaway Inc. agreed to a

strategic partnership with Insurance Australia, buying an initial

3.7% stake for A$500 million as part of a 10-year deal that

fast-tracked Berkshire's expansion in the region and promised to

lower IAG's capital needs. Under the partnership, Berkshire

receives 20% of Insurance Australia's gross written premiums and

pays 20% of the insurer's claims.

The company in January finalized its natural-disaster

reinsurance program for calendar 2017, keeping gross cover steady

at up to A$7 billion. Its natural-disaster claim costs exceeded the

allowance it had set for first-half of the fiscal year by A$80

million.

The company said it had received more than 13,000 claims to date

for damages during a hailstorm that struck northern Sydney this

month, but it expected that would be within its current allowance

and available reinsurance cover.

Insurance Australia plans to keep its interim dividend steady at

13 Australian cents a share, although this time last year it also

offer a special payout of 10 cents.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 21, 2017 17:00 ET (22:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

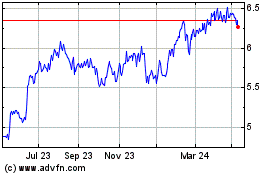

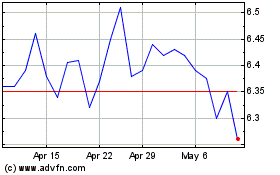

Insurance Australia (ASX:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Insurance Australia (ASX:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024