Adidas Boss Is Bold -- WSJ

09 March 2017 - 7:02PM

Dow Jones News

New chief executive expects sales, profit to climb faster than

under his predecessor

By Sara Germano and Natascha Divac

Adidas AG's new chief executive promised to increase sales and

boost profits faster than his predecessor, saying the German

athletic-gear giant could overcome challenges elsewhere in the

sporting-goods industry.

Kasper Rorsted, who took over in October, said in an interview

Wednesday that the improved profitability would come from selling

more full-priced products and improvements to the supply chain, as

well as foreign-exchange benefits.

Mr. Rorsted said Adidas is working to bring products to market

in-season in order to mitigate inventory losses, and pointed to the

development of new factories at production partner BASF SE, which

makes the Boost material used in some of Adidas' most popular

sneakers.

"Boost is one where we left a lot of money on the table," he

said of recent results, adding that sneakers that contain the

white, spongy-looking material like the NMD, the Ultra Boost, and

others have been consistently sold out because of an inability to

keep up with demand. Adidas has already established a new factory

in Germany and is planning to open another in Atlanta this year to

help speed its own product production.

The company on Wednesday raised its sales forecast to increase

at a currency-neutral rate between 10% and 12% a year on average

through 2020. Previously, it targeted an increase at a

high-single-digit rate. Net income from continuing operations is

projected to rise between 20% and 22% a year on average in the

period, up from a previous forecast of around 15%.

Adidas is in the midst of an overhaul focused on shedding

underperforming operations and beefing up results in the important

U.S. market, where it competes with Nike Inc. and Under Armour Inc.

The American sporting-goods industry has seen a broad contraction

over the last year, with bankruptcies and liquidations at several

retailers as manufacturers have worked to drive more direct

sales.

Dick's Sporting Goods Inc., one of the largest U.S.-based

chains, said Tuesday it would shed a fifth of brands it carries as

it expands distribution of major vendors' products, including those

of Adidas.

The sports apparel and footwear industry has grappled with a

shift in consumer taste away from performance wear toward casual,

fashion-forward looks. Such changes are evident at Adidas, where

sales of lifestyle-oriented products rose 45% for the year, while

performance products rose 13%.

Mr. Rorsted cautioned that the performance business accounts for

about 70% of Adidas brand sales, and that the division between

performance and fashion products is blurring.

Adidas's net loss in the three months ended December narrowed to

EUR10 million (about $10.5 million) from a EUR44 million loss a

year earlier. Sales increased to EUR4.69 billion from EUR4.17

billion, boosted by growth in its running category.

Adidas said it would continue to sharpen its focus on the Adidas

and Reebok brands and whittle away at noncore operations. The

company is now seeking a buyer for its ice-hockey brand CCM Hockey,

and said the sales process for the golf brands TaylorMade, Adams

Golf and Ashworth, is on track.

Write to Sara Germano at sara.germano@wsj.com and Natascha Divac

at natascha.divac@wsj.com

(END) Dow Jones Newswires

March 09, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

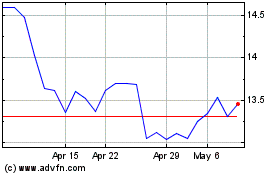

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Mar 2024 to Apr 2024

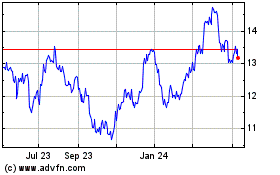

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2023 to Apr 2024