State Street Offers New Tool to Gauge Environmental, Other Social Risks

27 March 2017 - 12:19AM

Dow Jones News

By Justin Baer

Asset managers, pensions and endowments will soon be able to

screen their investments more easily for environmental, social and

governance risks.

The development is thanks to State Street Corp., which is

launching a new set of analytical tools aimed at capitalizing on

the appetite for responsible investing. Many firms have made

similar strides to help investors tackle ESG exposure, but few can

harness as much data as State Street, whose custody business

safeguards $29 trillion.

The custody unit gives State Street a window into clients'

entire portfolios, allowing them to offer ways to analyze reams of

data on those holdings. That core custody business has produced

steady, if underwhelming, profit margins, compelling State Street

to hunt for new ways to tap into the data and potentially

undiscovered investment ideas buried within.

At the same time, interest in so-called environmental, social

and governance investing is surging. More investors are looking to

ensure their holdings more closely reflect their values on

everything from workforce diversity to limits on their carbon

footprint. The overall market for ESG investments has swelled to

$40 trillion in U.S. assets under management last year, up 33%

since 2014, according to the Forum for Sustainable and Responsible

Investment.

"We have the root data, everything about the company itself,"

said Lou Maiuri, head of State Street's analytics and markets

businesses. "We sit on 12% to 15% of the world's assets."

To help in its effort, the Boston-based bank has held

discussions with more than 15 research firms, including MSCI Inc.,

Sustainalytics and TruValue Labs, to license their data. State

Street plans to add those companies' research and ESG ratings

alongside its existing risk-management and analytics systems for

some 300 clients.

The plans follow efforts by State Street's money-management

division, State Street Global Advisors, to add several

exchange-traded funds and other offerings that invest in assets

that screen stocks for environmental and social-justice criteria.

The money manager said earlier this month it would push companies

to put more women on their boards, a campaign punctuated by the

placement the "Fearless Girl" statue near Wall Street's bronze

bull.

State Street formed its Global Exchange business in 2013 to

showcase the bank's analytics.

Some of the division's recent offerings include a private-equity

index based on the data produced by its clients, and a

quantitative-investment tool, called MediaStats, that tracks

patterns in consumer behavior and media coverage.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

March 26, 2017 09:04 ET (13:04 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

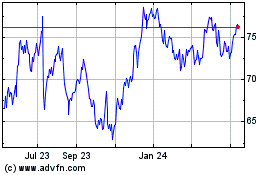

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

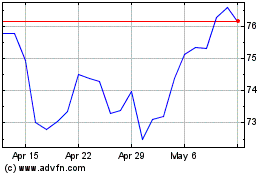

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024