Euro Strengthens After Upbeat German Economic Sentiment Index

11 April 2017 - 7:00PM

RTTF2

The euro climbed against its major counterparts in the European

session on Tuesday, as German investor confidence rose for a second

straight month to its highest level in more than one-and-a-half

years in April, adding to the recent run of strong data pointing to

robust economic growth.

Survey results from the Mannheim-based think tank ZEW showed

that the economic sentiment indicator climbed to 19.5 from 12.8 in

March, sailing past the 14.8 economists had predicted.

The current situation index rose to 80.1 from 77.3 in March. The

reading is now at its highest level since July 2011. Economists had

forecast a modest improvement to 77.5.

The single currency was also underpinned by dollar weakness

across the board, as investors focused on geopolitical tensions in

the Middle East and North Korea.

While North Korea warned that it was ready for "war" to defend

the invasion of U.S. Navy strike group to the Korean Peninsula, the

White House kept open the possibility of additional strikes on

Syria if the situation deteriorates again.

Investors shrugged off downbeat Eurozone industrial production

data in February.

Data from Eurostat showed that Eurozone industrial output

dropped 0.3 percent month-over-month in February, reversing a 0.3

percent rise in January, which was revised down from 0.9

percent.

The currency was trading in a negative territory in the Asian

session.

The euro advanced to a 4-day high of 1.0697 against the Swiss

franc, off its early 1-1/2-month low of 1.0668. The next possible

resistance for the euro-franc pair is seen around the 1.09

mark.

The euro climbed to a 4-day high of 1.0620 against the

greenback, following a decline to 1.0579 at 3:15 am ET. the euro is

seen finding resistance around the 1.08 region.

Bouncing off from early nearly 4-month low of 116.88 against the

yen, the euro rose back to 117.46. On the upside, 119.00 is likely

as the next resistance level for the euro.

The euro recovered to 1.4152 against the aussie and 1.4152

against the loonie, from its early low of 1.4095 and a 1-1/2-month

low of 1.4090, respectively. The next possible resistance levels

for the euro are seen around 1.43 against the aussie and 1.43

against the loonie.

The 19-nation currency hit a 4-day high of 1.5293 against the

kiwi, off early weekly low of 1.5204. Further uptrend may take the

euro to a resistance around the 1.54 region.

Following a 5-day decline to 0.8517 against the pound at 11:15

pm ET, the euro bounced off to 0.8548. The euro is likely to

challenge resistance around the 0.87 mark.

Data from the Office for National Statistics showed that UK

inflation remained stable at the highest level since September

2013.

Inflation held steady at 2.3 percent in March, in line with

expectations. This was the highest rate since September 2013.

Looking ahead, Minneapolis Fed President Neel Kashkari is

expected to speak at the Minnesota Business Partnership, in

Minneapolis at 1:45 pm ET.

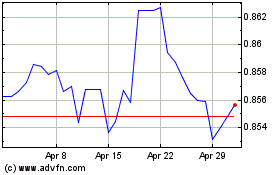

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

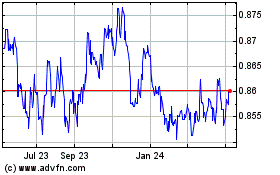

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024