Eli Lilly Working to Cut Costs

25 April 2017 - 10:28PM

Dow Jones News

By Austen Hufford

Eli Lilly & Co. on Tuesday reported higher revenue but swung

to a loss and cut its profit forecast due to charges related to

cost-cutting efforts.

The company said it was working reduce its cost structure but

that severance expenses would eat into unadjusted profit in the

year. In the first quarter, Lilly took a $213.9 million charge for

severance-related items as well as for Novartis integration

costs.

It now expects to earn $2.60 to $2.70 per share in 2017,

compared with the $2.69 to $2.79 it expected previously. Still, the

company reaffirmed its revenue and adjusted earnings per share

guidance.

Manufacturing efficiencies helped lift Lilly's gross margin to

74.6% from 72.8% in the first quarter last year.

Volume growth was helped by diabetes treatment Trulicity,

skin-drug Taltz and other new drugs. Cancer treatment drug Alimta

and antipsychotic medication Zyprexa hurt volumes in the quarter.

Sales of blockbuster erectile-dysfunction drug Cialis fell 7% to

$533.6 million, hurt by decreased demand.

In all, global volumes rose 8% in the quarter, which were

partially offset by a 1% hit on unfavorable exchange rates.

Sales of Humalog, one of Lilly's biggest products by revenue,

grew 17% to $708.4 million driven by a prior U.S. quarter having

higher discounts and by increased demand in the most recent

quarter. Sales in its animal-health division, which Lilly bought

from Novartis AG for about $5.4 billion in 2014, grew 2% to $769.4

million. In January, Eli Lilly closed on its acquisition of

Boehringer Ingelheim Vetmedica Inc.'s U.S. pet vaccines portfolio

for $885 million in a move to grow its animal unit.

During the quarter, the company also bought CoLucid

Pharmaceuticals Inc., adding a potential near-term launch to its

late-stage drug pipeline with lasmiditan for acute migraines, but

also taking a $857.6 million charge. The deal helped swing the

company to a loss.

In all for the first quarter, Lilly reported a loss of $110.8

million, or 10 cents a share, compared with a profit of $440.1

million, or 41 cents a share, a year prior. Excluding certain

items, earnings per share was 98 cents.

Revenue rose 7.5% to $5.23 billion.

Analysts projected 96 cents in adjusted per-share profit on

$5.22 billion in sales.

This month, the U.S. Food and Drug Administration didn't approve

Eli Lilly and Incyte Corp.'s new drug application for a rheumatoid

arthritis treatment that some analysts estimate could generate more

than $2 billion in annual sales. The FDA asked for more clinical

data to determine the most appropriate doses and clarify safety

concerns for baricitinib, a once-daily oral medication for the

treatment of moderate-to-severe rheumatoid arthritis.

On Monday, Lilly also reported positive news from a clinical

trial of an experimental breast cancer, saying abemaciclib, when

added to an older type of breast-cancer treatment, improved

measures of survival and tumor shrinkage in trial patients.

Shares of Lilly, up 11% over the past three months, were

inactive in premarket trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 25, 2017 08:13 ET (12:13 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

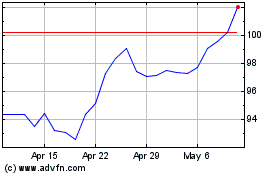

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

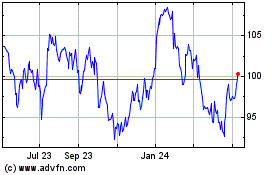

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024